Solana’s market structure mirrors Bitcoin and Ether, strengthening its bid for US ETF approval

Strong liquidity and mature market dynamics enhance Solana's appeal for institutional investment opportunities.

Solana’s (SOL) market structure shows deep liquidity and strong cross-exchange price correlations, putting it on par with Bitcoin and Ethereum and bolstering Solana’s case for regulatory approval of exchange-traded products (ETPs) in the US, according to a new analysis co-authored by James Overdahl and Craig Lewis, former SEC chief economists.

While US regulators have yet to greenlight a Solana ETP, the approvals of Bitcoin and Ether ETPs signal a maturing crypto market and provide a framework for evaluating other digital assets.

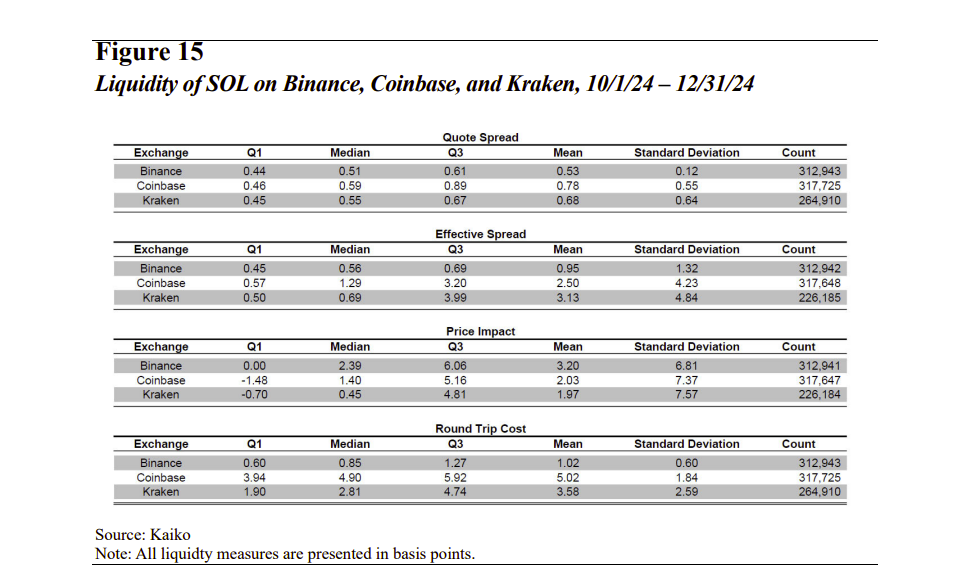

Based on the framework, Overdahl and Lewis offer a detailed look at Solana’s market characteristics, focusing on key factors that regulators consider when assessing whether a crypto asset is suitable for regulated investment products. These include order book liquidity, effective spreads, trade costs, and price correlation.

According to the analysis, while SOL’s order book depth in USD is smaller than BTC and ETH, its liquidity, when considering its smaller market capitalization, is relatively robust.

A larger proportion of SOL’s circulating supply is readily available for trading compared to BTC and ETH. This is a positive sign for SOL’s liquidity and indicates increasing participation and the ability to handle large trades without large price swings.

Furthermore, its effective spreads and trade costs are now comparable to, and in some cases better than, those observed in the Bitcoin and Ethereum markets.

When it comes to the correlation of SOL returns across different exchanges, another indicator of market quality and resistance to manipulation, researchers found a high degree of correlation in SOL prices across Binance, Coinbase, and Kraken.

The correlation is higher at longer intervals than at shorter intervals. This suggests that any temporary price differences that might arise due to order flow or liquidity fluctuations are quickly arbitraged away.

The high correlation and effective arbitrage mechanism make it difficult to manipulate the price of SOL on a single exchange. Manipulators would need to influence the global price of SOL, which is a much more challenging and costly undertaking.

“The persistent high correlations suggest that the arbitrage mechanisms are working effectively. Therefore, to successfully manipulate the price of SOL on any single exchange, one would likely need to influence the global price of SOL. However, doing so would likely impose a high cost [on] the would-be manipulator and therefore provide a strong deterrent,” the analysis notes.

The combination of high liquidity, low transaction costs, and a robust arbitrage mechanism paints a picture of a healthy and well-functioning market, similar to those for Bitcoin and Ethereum.

While regulatory approval is not guaranteed, the findings present a compelling case for Solana. Its strong market performance and comparability to Bitcoin and Ethereum could make it a prime candidate for the next wave of US-listed crypto investment products.

Earn with Nexo

Earn with Nexo