Solana’s DEXes hold their ground after 38% weekly drop in DeFi trading volume

Saber and Raydium DEXes helped mitigate Solana's trading volume loss.

Share this article

Despite a 38% fall in weekly crypto trading volume across all decentralized exchanges (DEXes) on smart contract platforms, Solana’s DEXes maintained their ground, losing only 8.6%, according to data from DefiLlama.

Meanwhile, Optimism endured a loss in total trading volume exceeding 60%, the largest among the top 10 chains by total value locked (TVL). Polygon and Arbitrum also saw drastic losses in volume, both around 50%.

Saber and Raydium were the DEXes behind Solana’s relatively small loss, with 45% and 32% growth in trading volume, respectively.

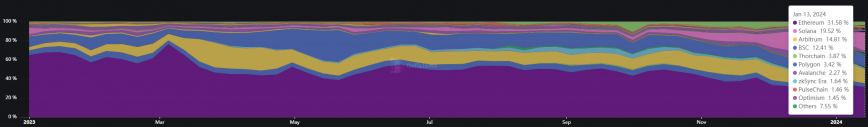

Moreover, Solana is closing in on Ethereum’s lead in decentralized exchanges dominance, as seen in January’s trading volume data. In the first week of the month, Solana came in third place with a little more than 13% dominance, getting outshined by Arbitrum’s 18% and Ethereum’s 34%. However, last week, Solana overtook Arbitrum, climbing to a 19.5% market share, while Ethereum maintained a slightly reduced dominance at 31.5%.

Although it seems like a minor feat by Solana, the gap in dominance for the same period last year was significantly narrower at almost 67%, with Ethereum holding 68% of the decentralized exchange market share, compared to Solana’s share at the time.

This rise in trading volume registered by Solana decentralized exchanges started in October 2023, when its dominance was at 2.4% and gradually went up.

Solana’s peak dominance in weekly trading volume was registered in the third week of December 2023. On that occasion, the chain stood just 0.34% behind Ethereum in volume, which could be considered a technical draw.

However, Solana’s DEXes lost ground in the following weeks, registering a rebound in trading volume between Jan. 13 and 19.

Share this article