S&P issues warning on USDT's ability to hold peg in latest assessment

S&P highlights risks in Tether's reserve management practices.

Share this article

S&P Global Ratings, a leading financial data analysis firm, recently introduced a stablecoin stability assessment. This assessment rates cryptocurrencies based on their ability to maintain a stable value against fiat currencies, with scores ranging from 1 (indicating strong stability) to 5 (showing weakness).

Gemini Dollar and Circle’s USDC received the highest ratings from S&P, scoring a 2, categorized as “vital.”

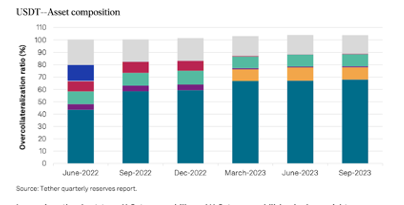

In contrast, Tether’s USDT and other stablecoins like Frax and Dai received a rating of 4, considered “constrained.”’ S&P attributed these lower scores to risky reserve assets and a lack of transparency in management procedures.

This score suggests that USDT may face challenges consistently maintaining its peg to the US dollar.

S&P identified several weaknesses in Tether’s operations, including limited reserve management and risk appetite transparency, an absence of a regulatory framework, no asset segregation to protect against the issuer’s insolvency, and limitations to USDT’s primary redeemability.S&P explicitly stated:

“In our view, the short-term US treasury bills and the US treasury-bill-backed overnight reverse repos (78% of the collateralization ratio) represent low-risk assets. However, the Tether reserve report does not disclose the entities that act as custodians, counterparties, or bank account providers of the assets in reserve.”

Despite these concerns, USDT has demonstrated notable price stability recently, even during significant crypto market volatility events.

Share this article