Stacking Sats: The Cheap Bastard’s Guide To Buying More Bitcoin

How would you like to make 5 BTC per year?

Share this article

Stacking sats isn’t nearly as hard as it seems, if you go for the jugular and cut out the things in life you don’t really need. In fact, at current prices this quick guide to hoarding satoshis could put an extra five bitcoins in your digital wallet every year…

Coffee Budget Insanity

Who doesn’t love coffee? Around the world, it’s a favorite method for getting going in the morning.

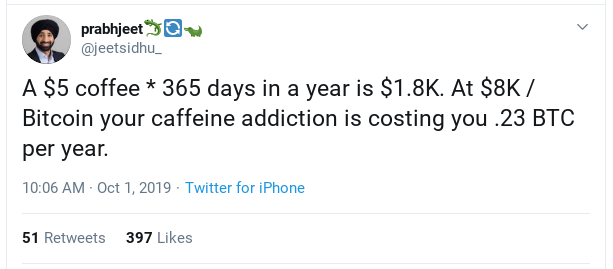

Thing is, your coffee-purchasing habit can put a serious dent in the monthly budget, according to many financial pundits of varying expertise.

It can be especially costly if you buy the Venti mocha double-blended frappuccino with extra whip every day, multiply the price by 365, and arrive somewhere in the neighborhood of a couple thousand dollars spent every year.

Two thousand dollars. That’s like… a quarter of a Bitcoin. Today, anyway. That’s some hard-earned money blown on your daily caffeinated frivolity.

So the question is… would sacrificing your daily dose of caffeine, courtesy of your neighborhood overpriced cafe franchise, be worth it to acquire a nice chunk of BTC every year?

This begs another question worth exploring: What else could you drop from your discretionary budget to eek out a few more bucks and save up satoshis?

It’s time to get cheap. Seriously cheap.

Let’s consider some budgetary cuts that would have little (or no) negative impact on your life.

Average monthly savings from scrapping your expensive coffee habit: $150 or 0.018 BTC.

Smokes And Booze

Smoking and drinking — these are the classic budget-killers. And, it’s generally agreed, they’re terrible for your health.

Depending on where you live and how much you smoke, you might spend around $2,000-$5,000 a year for a daily pack of smokes, and much more if you’re a multi-pack inhaler.

Alcoholic drinks aren’t cheap either, whether bought at the local convenience store or out at the bar. This is no lifestyle for a cheapskate to keep up. How do you expect to stack sats with this sort of spending habit?

Average monthly savings: up to $416 or 0.051 BTC from smoking and about $50 or 0.0062 BTC from drinking.

Neglected Gym Memberships

After cutting out the smoking and drinking, you might be feeling energized. Or bored. Maybe it’s time to use that gym membership card that’s been languishing in your junk drawer.

You could return to the gym and get back into shape, working out consistently, dedicating months of concerted effort… but honestly, is that realistic? It sounds an awful lot like work. Besides, you’ve got that P90X DVD set in the basement somewhere… Or you could just finally hang up that laundry that’s been hanging on your treadmill.

It is, admittedly, a major pain actually going into the gym and pleading your case for the successful cancellation of your membership, but think of the savings that can be dedicated to your new crypto habit instead.

Average monthly savings: $58 or 0.0071 BTC.

Restaurants

Going out to restaurants is crazy expensive compared to eating at home.

The average American household spends a few thousand bucks every year going out to restaurants. Those daily lunch jaunts for fast-food bites that cost around $10 can really add up too, totaling around $2,500 a year just for lousy burgers, limp fries, and watery sodas.

If you’ve really got to get out to the restaurant to achieve that socially-connected feeling, you can still make some minor adjustments to your spending. Phase out expensive drinks, cut down on the appetizers, or scrap desserts.

Restaurants enjoy huge mark-ups on dessert items like ice cream. You can buy a gallon of your favorite frozen dairy concoction — enough to make you sick and then some — for much less at your local grocery store. Warning: your waiter might not like you as much as your former free-spending self.

Smoothies are, in particular, an insanely expensive, but seemingly healthy and therefore apparently worthwhile daily purchase for many Americans. In reality, they’re packed with sugar and cost way more than it would cost to just buy a few bags of frozen fruit and a little juice and throw them together in a blender at home. Just switching to home-made smoothies might pocket you more than a thousand dollars — about an eighth of a Bitcoin today — every year.

Average monthly savings: $250 or 0.031 BTC

Streaming Platforms And Subscriptions

Netflix, Amazon, Hulu, Disney Plus, cable TV… Wait, you still pay for cable TV? Buy a digital antenna for all your over-the-air broadcast television and chop down your streaming subs to your single favorite platform. You’ll be saving well over $100 from this one minor adjustment.

Sure, you might be forced to watch the occasional 280p video on YouTube instead, but you really won’t miss much. I promise.

While you’re at it, check for any other automatically renewing subscriptions on your monthly bank statements that you’ve forgotten about.

Do you really need that iTunes cloud storage that is charging you a few bucks every single month from here to eternity? Ever heard of an SD card? A memory stick? A hard drive? Free cloud storage? Cancel all these silly subs and — voila — you’ve got more moolah for stacking sats on the daily instead.

Average monthly savings: From $29 to more than $100, depending on whether or not you have cable TV. That’s anywhere from 0.0036 to 0.012 BTC.

Cars

Cars are fun. They’re also the worst purchase you will ever make in your life. Brand new cars are even more dumb. You can save a ton of money by going with a used car rather than buying new, or even better, you could take the bus.

Still, by buying a car that is just three years old instead of brand new every time you replace your car, you would save about $130,000 over your lifetime, according to this report.

You’d also never own a new car, which kinda sucks. But still, you’re saving money. Just buy a Lambo when your BTC goes to the moon. Of course, that Lambo is going to depreciate like crazy, what with all the suddenly-rich BTC buyers flooding the market.

Just don’t buy a Fiat with fiat. Neither is very reliable.

Average monthly savings: about $125 or 0.015, depending how long you live and how many used cars you buy.

Name-Brand Clothes And Designer Eyeglasses

That Versace shirt you bought for $200 isn’t really worth anywhere near that much in terms of materials and workmanship. It only fetches such a high price because somebody out there is willing to pay $200 for it, which causes others to stand in admiration — or, conversely, recoil in bafflement — that one would spend such a fortune on a cotton shirt. That’s the free market for you.

Eyeglasses are a whole other scenario. With only a couple major companies, like Luxxotica, controlling the entire industry and thus hiking markups by more than 1000% on those designer spectacles, you might feel like you’re forced to pay a fortune just to be able to see properly.

Fashion can really carve into your satoshi savings. Instead of buying the branded shirt and designer eyeglasses, buy non-branded clothing and choose your eyeglasses from this long list of independent providers, assembled by a helpful Redditor.

Buying from these retailers, you could get ten pair of eyeglasses for the same price as one pair… or buy one pair and stack a pile of satoshis.

Most people buy a new pair of glasses every couple years at a few hundred bucks a pop. In the average American household, that can add up to well over a thousand dollars every year or two, depending on the degree of myopia running through your family’s genes. More regularly, American households spend about $150 on clothing on a monthly basis, so there are plenty of savings to be had here.

Average monthly savings: This one really depends on how bad your family’s vision is and how important keeping up with style is to you and your family. If you can’t see, do you actually need to look good? Hmm.

Savings range anywhere from $100 to $300, or 0.012 to 0.037 BTC.

Credit Card Debt

Carrying a credit card balance is just about the worst thing you can do to your monthly budget. Worse than buying a new car. Unless you bought the new car with your credit card.

You are literally throwing away money when you carry a credit card balance. The average American who carries a balance on their favorite piece of plastic pays between two to four hundred bucks a month, just on interest payments.

Get out that pair of scissors, chop up those credit cards, and switch to using your own money. Use cash and debit cards instead. This act alone will stunt your excessive spending habits.

When you use cash instead of credit, the body reacts to the act of paying with the same receptors as are associated with pain. Essentially, it hurts to spend cash. You will naturally spend less on frivolous items as you feel physical discomfort allowing the cash to leave your hands. To really make it hurt, use singles. (Hint: do not tuck these into the waistband of the waiter you stiffed on dessert.)

Once your budget is under control and you’re not carrying any credit card balances from month to month, use some of that spare cash to start saving up BTC.

Average monthly savings: On interest payments, you will save $200 to $400 a month, or 0.025 to 0.05 BTC. On items you don’t need, but you used to buy anyway, you could potentially save hundreds more.

Phones

Cell phones are expensive. And pretty much everybody arguably needs one nowadays. What you don’t need any more is a landline. Landlines cost an average of $42 per month and serve no purpose other than answering spam calls for free vacations and the latest Windows team virus inspection.

If you really have to have a landline — say you have kids at home who need to call you once in a while or something — get a VOIP phone and stop paying monthly phone bills on the service.

On the topic of cellphones, you don’t need to upgrade your gear every single year. Really. Try to add a year or two of patience to your cell phone purchasing habit and you can save more than a thousand bucks a year just by holding onto older tech a little while longer.

Average monthly savings: Anywhere from $42 to $100 or 0.0052 to 0.012 BTC

Dating

Dating can be pricey. There’s a ton of savings to be found here, from cooking at home, to buying a nice bottle of wine at the nearby store, to just staying in to watch a movie on YouTube instead of going to the theater.

And if your ‘dating’ actually has a specific cost associated with it, well, ahem, that’s a whole other set of savings.

Average monthly savings: $168 or 0.021 BTC

Add Up All Your Savings For Some Sweet BTC

Time to add up all your potential savings. With all the above budget adjustments, you’ll be saving anywhere from $100 to $3,000, or more, depending on how ridiculous your spending habits were before you cut back.

That’s almost half a Bitcoin every month, assuming prices stay somewhere in the same range as they are now. And it doesn’t even account for emerging services such as Lolli, which actually deposit bitcoins into your wallet just for shopping through their service.

Mind you, it may also make you a *miserable* bastard, as well as a cheap one…

If you save five bitcoins a year with this advice, please feel free to donate one of them to the victims of Hurricane Dorian in the Bahamas.

Because bitcoins plus karma equals happy.

Share this article

Trending News