Stargate Finance Tumbles After Launching Staking Platform

Stargate Finance has taken a downward turn after launching its highly-anticipated staking governance model.

Key Takeaways

- Stargate Finance has launched its staking program.

- The news was met with an increase in selling pressure.

- STG now holds above a critical support level.

Share this article

Stargate Finance launched its highly-anticipated governance model, with which token holders can stake for greater governance weight. Despite the significance of the announcement, STG has suffered over the last 24 hours.

Stargate Finance Hits Vital Support

Stargate Finance has given governing rights to token holders while STG struggles to hold above support.

Stargate Finance’s native token STG has seen its price retrace by more than 17% over the past 24 hours. The sudden bearish impulse came as a surprise to market participants as it appears to correlate with the launch of the project’s most-anticipated staking platform.

The new yield-generating program allows community members to participate in Stargate DAO governance. Users can stake STG tokens to increase their balance of vote-escrowed STG (veSTG), which is the unit of governance voting power. Such a mechanism enables long-term holders greater governance weight and control of the protocol.

Essentially, Stargate Finance aims to achieve full decentralization and autonomy by giving the power to community members to determine protocol development, integrations, tokenomics, and more.

Despite the significance of the new governance model that Stargate Finance has put in place, it appears that traders may have perceived the announcement as a “sell the news” event.

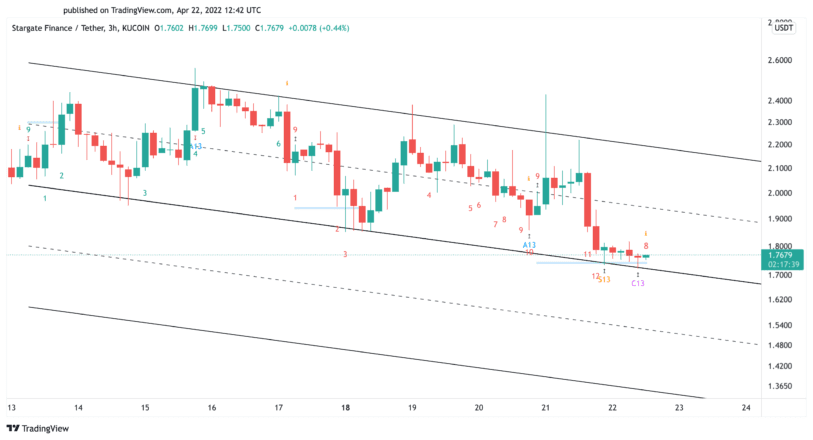

STG lost over 0.35 points in market value after the launch of the staking platform. The downswing saw the token reach a crucial support level at $1.70, which is represented by the lower boundary of a parallel channel that developed in the two-hour chart in mid-April.

Further selling pressure around the current levels could present trouble, as the next important demand zone sits around $1.48.

Still, the Tom DeMark (TD) Sequential indicator suggests that STG could rebound from the channel’s lower trendline.

This technical index is about to present a buy signal in the form of a red nine candlestick on the two-hour chart. If buy orders were to pile up around the current price levels, the token might be able to rebound to the channel’s middle trendline at $1.90 or even the upper boundary at $2.10.

Disclosure: At the time of writing, the author of this piece owned ETH and BTC.

Share this article