STORM ICO Review And Token Analysis

Share this article

What gap exactly could the STORM ICO token fill, that nothing else has yet filled? It seems like a ludicrous question, given the ever-expanding breadth of blockchain offerings. Yet the team appears to have found one – and it’s a big one: the income gap.

The ever-widening chasm between the haves and the have-nots in the western world, particularly the USA, means that micro-tasking has become a genuine economic force. (Examples include filling out paid surveys, rating products, and so on for some kind of incentive).

Amazon’s Mechanical Turk is the most notable and largest micro-tasking service. Companies can use Mturk for all types of services, from audio transcription to human visual identification, to proofreading, and other things which cannot be accurately done by computers but which are not especially high value or high skill tasks.

This is the important differentiator between micro-tasking and freelancing: the former is generalized and requires the same skill-level as a minimum-wage job while the latter requires a specialization. Supply and demand tell you why these tasks are micro in difficulty and reward: if anyone in the world can do it, then those who can accept the least money will get the most reward.

This quick side note, should help to explain the STORM ICO token’s potential value: an interesting thing to note about Mechanical Turk is that they only have two payment options for the micro-task performer: a bank account transfer or an Amazon gift card. People in countries where Amazon cannot engage in banking (every single country besides the US and India, at last check), or people without banking generally, have to accept the Amazon gift card. This is one factor that actually has given rise to Purse.io, Mturk workers wanting to realize the value of their labor exchange their Amazon credit for Bitcoin.

We note that there are plenty of labor markets where people can accept even lower rates than people in the US and India, and we believe that more people would participate in micro-tasking programs if they were able to receive direct monetary value no matter where they were.

We think any effort to do this will likely prosper by degrees.

Today, we have a look at the STORM ICO Token by StormX, an effort to rebrand an existing product called “BitMaker” to “Storm Play.” In a previous iteration, the token was called a “Block.” It was not a very advanced system: users earned blocks and cashed them out for Bitcoin or Ether. But it did quietly amass 250,000 users, as Kyle Torpey writes, who points out that: “BitMaker incentivizes users to engage with other mobile applications, such as freemium games, in an effort to get the user to download the app.”

We analyze from the position that firms like Amazon, Fiverr, Upwork, and others have a great deal of overhead and the fees they subtract from both providers and requesters demonstrate as much.

Decentralized technologies are perfect for mediating interactions between humans in more equitable ways, and we see that this is what StormX is attempting to achieve. As such, we see the opportunity.

The introduction of blockchain to the Storm Play app marks the first step in an evolution toward what StormX envisions as an entire decentralized marketplace for tasks – the “Storm Market.”

The Storm Market will operate similar to the Apple App Store or the Google Play Store in that it will serve as a platform where Storm Makers and Storm Players can create and accept tasks using smart contracts powered by the tokens created by the STORM ICO.

StormX aims to make the Storm Market a platform that operates via a combination of StormX APIs and other proprietary software tools and applications, along with Ethereum-based smart contracts for various types of tasks which will execute using STORM tokens.

How Storm Market/Storm Play Will Work

Storm Play intends to expand the notion currently at work in BitMaker – the primary type of person who uses BitMaker currently is actually just one of six different types of “players” in the Storm system. They are classified as basic “players” who are motivated by rewards. StormX sees several other types of people being served by the new system:

- “Achievers” who may participate in skill-based and educational programs offered by members. We’re not sure what types of applications are in mind for this, but they imagine a specific type of person who “enjoy[s] mastering new skills.”

- “Disruptors” will be white hat hackers and the like, participating in bug bounty programs or similar skilled technical challenges, operated through the Storm Market. They are described in broader terms, of course, because there are other people who will come into this category such as beta testers.

- “Explorers” will perform more creative-type tasks.

- “Socializers” are people who would like to be incentivized to participate in social activities and group-oriented studies, or things of that nature.

- “Philanthropists” – StormX has identified a specific type of person here who’d be willing to give their time to an ideological cause. If one doubts the existence of this market, they only need look to Change.org and the level of engagement that NGO is able to effect.

The other type of participant, of course, is the Storm Maker, or the requestor/client/customer – whichever term you’d like to use in this regard. The Storm Maker creates the tasks for the micro-taskers.

As you see in the above infographic, “Storm Players, and Storm Makers are going thru [sic] a journey from beginner to mastery [sic].” This graphic is meant to explain the levels at which tasks will be presented to users. When they first install the application, they won’t have any challenging or difficult tasks. According to the whitepaper, part of the goal here is expanding the network effect overall:

“The mechanics focus on helping Storm Players become advocates of the Storm Market platform. […] An action-loop serves to boost a user’s engagement. Storm Makers can offer different tasks, like QA Testing, for Storm Players. Storm Players track their micro-task progress according to their “Bolts” earned to date, which can best be characterized as the experience points a Storm Player accumulates as he or she completes tasks.”

The Bolts that players earn through doing tasks are what help them rank up. Unsurprisingly, a lot of millennials are likely to go for this sort of system (“millennials want status-based rewards instead of free products”).

Almost 14% of Americans are underemployed, so we do not foresee this application becoming some kind of regionally-dominated system, as Mturk and others have overwhelmingly contributors from a certain few countries.

We think instead that this application will cut across the economic spectrum – even the well-to-do who have more than enough might have fun and make a little money too without gambling, something that up to 40% of Americans don’t do on average.

So… the STORM ICO technology has a purpose.

Market dynamics of the STORM ICO Token

Storm Play has shown significant growth by providing users with a gamified AdTech experience, and StormX sees this gamification model as the foundational point for creating an improved marketplace for all not just advertising, but all sorts of microtasks. As StormX integrates blockchain technology and adds additional features, all players involved in the marketplace benefit.

STORM ICO Token & Bolts

Transactions that take place on the Storm Market will be subject to a 1% fee, paid in tokens. STORM ICO tokens are required for Storm Makers to offer tasks to the 250,000+ BitMaker users.

Bolts are not only useful to users for advancement and exposure to more lucrative tasks – they are also a currency that can purchase advertising for the freelancer, to put themselves front and center in front of Storm Makers. This is similar to the “Boost points” system used at Minds.com.

However, we feel that the following passage from the whitepaper may illustrate a bad decision:

The Ethereum network is limited in terms of scalability allowing for only about 8.5 transactions per second. As a result, StormX plans to build an optimized platform with a hybrid implementation of both blockchain-based and proprietary services in its gamified micro-task marketplace. At launch, only the STORM token will operate on the Ethereum network, and the remaining functionality of the Storm Market – i.e., the Storm Play application – will be offered by StormX as proprietary Storm Market services.

We believe that this move, while pragmatic and likely to help the overall product, could result in a serious product delay. We don’t feel that based on the logic presented here that all options have yet been properly considered.

We carefully note that the whitepaper we reviewed was in “DRAFT” status as of October 12th, 2017.

We further note that they intend for “STORM Tasks” to be layered on the Ethereum network properly at a later date. This would mean the execution of the actual transactions would be happening in a decentralized manner, but we’re not sure how important this is to the user.

Our main concern is that if the new blockchain-like product being built by StormX is not functional enough to secure user funds, it could bring a negative hype swirl out of nowhere if there were even one incident. In general, with security related protocols and problems, we assert that tried and true methods are safer. Nevertheless, at the very least the STORM ICO tokens themselves live on an established, well-mined (secured) blockchain like Ethereum. That there are drawbacks to using the Ethereum network goes without saying, but we believe that over time these drawbacks are being sufficiently handled by Ethereum’s developers.

So, to summarize: STORM will survive by taking a 1% cut of transactions on the network. This is an incredibly attractive price for all potential participants, who are currently paying anywhere from 10-40%.

We therefore think that user adoption will be the least of STORM’s problems.

STORM ICO Token Supply

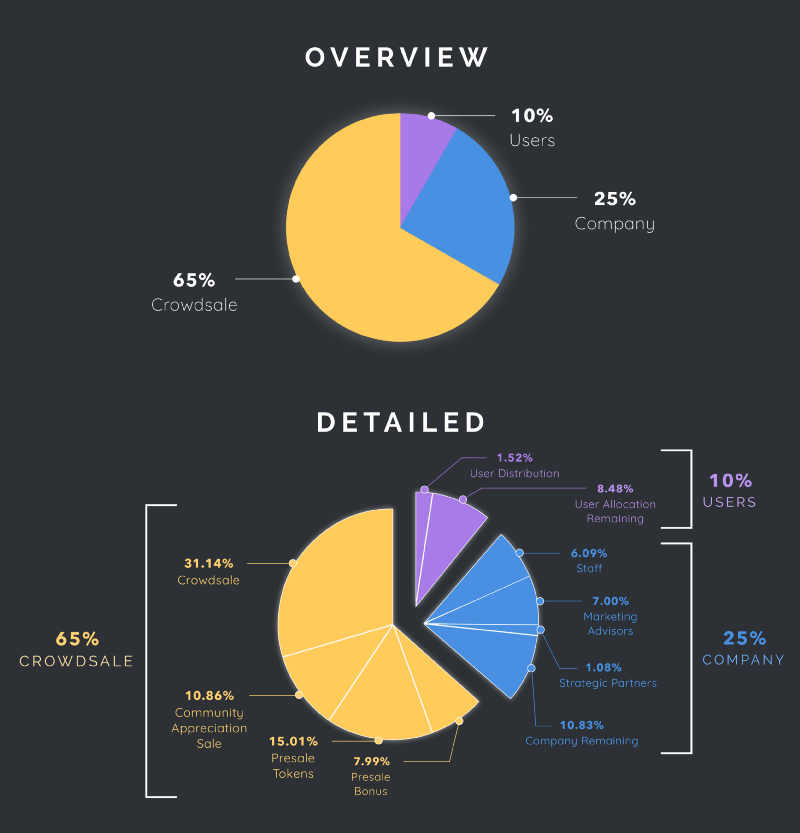

A total 4.2 billion of STORM ICO tokens will be generated.

The new pie chart gives you extra visibility to the token structure. The total amount of tokens for the crowdsale is 4.2 billion, not the previously stated 3.2 billion. The miscount resulted from the the 2.5 billion Company Inventory and the 1 billion Incentivization User Supply buckets being included in the presale tokens.

We are a little concerned about something like the quote here. Where normally a high supply of tokens would concern us, in this case we feel that there is going to be enough demand. Most ICOs with a massive supply like this do not have an existing user base of a quarter million people to consume it.

Private presale bonuses were given to our earliest supporters of the project. The presale bonus given to the early investors is approximately 53%. All of the limited private presale bonus tokens have a 90 day lock.

We also read that a STORM ICO community appreciation sale was conducted between October 7th and October 8th , “to ensure that our earliest community supporters are given the exclusive privilege of this early access period for both registration and token purchases.”

We are not certain, but it seems that of the 4.2 billion tokens that will be generated on October 19th, about 700 million will actually be on the open markets. This does help alleviate price depression concerns.

In many circumstances we worry about the ICO’s ability to actually attract a user base, but we don’t have that problem here and this makes up for a lot of reasons we might otherwise take a pass. At least they aren’t issuing a trillion of the things.

We must now assess the team behind STORM in order to determine how strong we feel on their ability to deliver the product.

STORM Team

StormX has several high-profile associates whose name association alone is valuable due to the viral nature of applications in the Google Play store. What we mean to say is that if any of these advisors appear in the mainstream media to speak about Storm Market, there is a good chance they will have made a great contribution by virtue of that alone.

These advisors/associates include the CEO of Bittrex, Bill Shihara, which implies there will be immediate trading somewhere (at least); Ethereum co-founder Anthony Di Iorio; and even Brian Kelly of CNBC fame.

Collectively, these people represent massive hype as well as business potential. If they play any sort of active advisory role and feel their stake in the STORM ICO is important (clearly they wouldn’t lend their name otherwise), then we have trouble suppressing our enthusiasm for this project.

Learn more about Storm in our TELEGRAM CHAT (https://t.me/CryptoBriefingSupporters)

ICO Review Disclaimer

The team at Crypto Briefing analyzes an initial coin offering (ICO) against ten criteria, as shown above. These criteria are not, however, weighted evenly – our proprietary rating system attributes different degrees of importance to each of the criteria, based on our experience of how directly they can lead to the success of the ICO in question, and its investors.

Crypto Briefing provides general information about cryptocurrency news, ICOs, and blockchain technology. The information on this website (including any websites or files that may be linked or otherwise accessed through this website) is provided solely as general information to the public. We do not give personalized investment advice or other financial advice.

Decentral Media LLC, the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Accordingly, nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any ICO or other transaction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media LLC makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media LLC expressly disclaims any and all responsibility from any loss or damage of any kind whatsoever arising directly or indirectly from reliance on any information on or accessed through this website, any error, omission, or inaccuracy in any such information, or any action or inaction resulting therefrom.

Cryptocurrencies and blockchain are emerging technologies that carry inherent risks of high volatility, and ICOs can be highly speculative and offer few – if any – guarantees. You should never make an investment decision on an ICO or other investment based solely on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional of your choosing if you are seeking investment advice on an ICO or other investment.

See full terms and conditions for more.

Founding Team

This category accounts for the leaders, developers, and advisors.

Poor quality, weak, or inexperienced leadership can doom a project from the outset. Advisors who serve only to pad their own resumes and who have ill-defined roles can be concerning. But great leadership, with relevant industry experience and contacts, can make the difference between a successful and profitable ICO, and a flub.

If you don’t have a team willing and able to build the thing, it won’t matter who is at the helm. Good talent is hard to find. Developer profiles should be scrutinized to ensure that they have a proven history of working in a field where they should be able to succeed.

Product

What is the technology behind this ICO, what product are they creating, and is it new, innovative, different – and needed?

The IOTA project is a spectacular example of engineers run amok. The technology described or in use must be maintainable, achievable, and realistic, otherwise the risk of it never coming into existence is incredibly high.

Token Utility

Tokens which have no actual use case are probably the worst off, although speculation can still make them have some form of value.

The best tokens we review are the ones that have a forced use case – you must have this token to play in some game that you will probably desire to play in. The very best utility tokens are the ones which put the token holder in the position of supplying tokens to businesses who would be able to effectively make use of the platforms in question.

Market

There doesn’t have to be a market in order for an ICO to score well in this category – but if it intends to create one, the argument has to be extremely compelling.

If there is an existing market, questions here involve whether it is ripe for disruption, whether the technology enables something better, cheaper, or faster (for example) than existing solutions, and whether the market is historically amenable to new ideas.

Competition

Most ideas have several implementations. If there are others in the same field, the analyst needs to ensure that the others don’t have obvious advantages over the company in question.

Moreover, this is the place where the analyst should identify any potential weaknesses in the company’s position moving forward. For instance, a fundamental weakness in the STORJ system is that the token is not required for purchasing storage.

Timing

With many ICO ideas, the timing may be too late or too early. It’s important for the analyst to consider how much demand there is for the product in question. While the IPO boom funded a lot of great ideas that eventually did come to fruition, a good analyst would recognize when an idea is too early, too late, or just right.

Progress To Date

Some of the least compelling ICO propositions are those that claim their founders will achieve some far-off goal, sometime in the future, just so long as they have your cash with which to do it.

More interesting (usually) is the ICO that seeks to further some progress along the path to success, and which has a clearly-identified roadmap with achievable and reasonable milestones along the way. Founders who are already partially-invested in their products are generally more invested in their futures.

Community Support & Hype

Having a strong community is one of the fundamental building blocks of any strong blockchain project. It is important that the project demonstrates early on that it is able to generate and build a strong and empowered support base.

The ICO marketplace is becoming more crowded and more competitive. While in the past it was enough to merely announce an offering, today’s successful ICO’s work hard to build awareness and excitement around their offering.

Price & Token Distribution

One of the biggest factors weighing any analysis is price. The lower the price the more there is to gain. But too low of a price may result in an under capitalized project. It is therefore important to evaluate price relative to the individual project, its maturity and the market it is going after.

The total supply of tokens should also be justified by the needs of the project. Issuing a billion tokens for no reason will do nobody any good.

Communication

Communication is key. The success of a project is strongly tied to the project leaders’ ability to communicate their goals and achievements.

Things don’t always go as planned but addressing issues and keeping the community and investors in the loop can make or break a project.

Share this article