Terra Rallies Despite Crypto Market Downturn

Terra’s native token LUNA appears to have gathered enough liquidity for a significant bullish impulse.

Key Takeaways

- LUNA has rebounded by more than 12% over the past few hours.

- The TD Sequential indicator anticipated the bullish impulse.

- Further buying pressure could push Terra to $90 or higher.

Share this article

Terra’s native token LUNA is leading the crypto market after staging a 12.36% rebound. Technical indicators suggest that it has now breached a critical resistance area, which could indicate further gains are on the horizon.

Terra Rebounds

Terra’s native token LUNA is rebounding swiftly after suffering losses over the past few weeks.

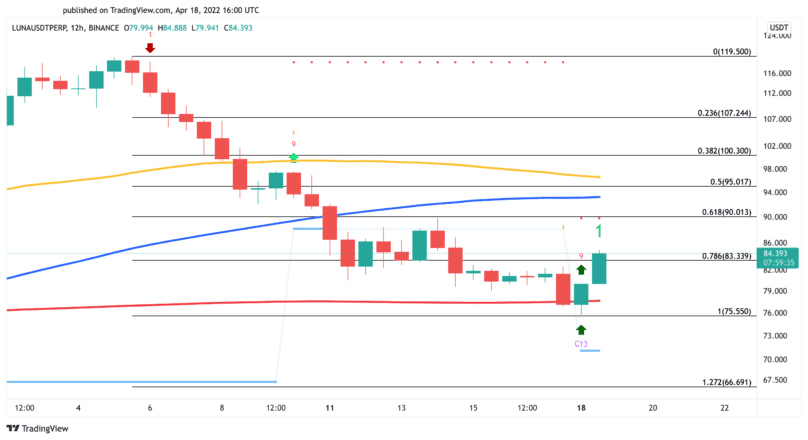

The global cryptocurrency market cap tumbled below $2 trillion early last week, and LUNA is one of several assets that saw sharp losses. The Layer 1 token has seen its price drop by nearly 37% since Apr. 5, going from a high of $119.50 at the beginning of the month to a low of $75.55 early this morning. However, Terra appears to have gained enough liquidity for a significant rebound despite the steep correction.

The Tom DeMark (TD) Sequential Indicator presented a buy signal on LUNA’s 12-hour chart as prices dipped below the 200-hour moving average. The bullish formation developed as a red nine candlestick, which is indicative of a one to four 12-hour candlestick upswing. The optimistic outlook appears to have been validated as Terra broke through the $83 resistance level.

Further buying pressure around the current price levels could push LUNA toward $90. If Terra manages to overcome this hurdle, the gains could extend to $95 or even $100.

It is worth noting that LUNA must continue to trade above its 200-hour moving average at $78 on the 12-hour chart. Breaching such a crucial support area could encourage investors to exit their long positions to cut losses. In such as case, the potential spike in selling pressure could push Terra down to $67.

Disclosure: At the time of writing, the author of this piece owned ETH and BTC.

Share this article