Tether reports almost $3 billion in quarterly profits boosted by Bitcoin and gold

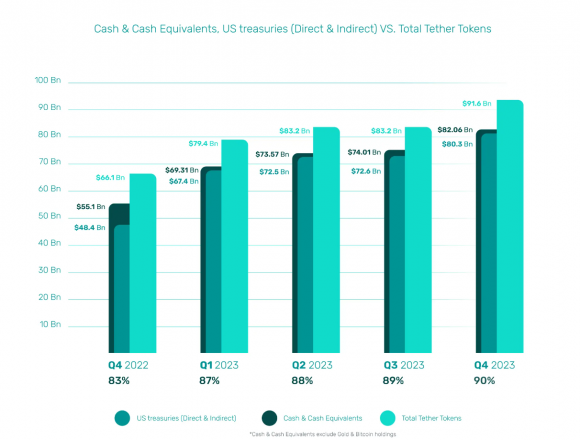

The company holds over $97 billion in consolidated assets, with 90% used as USDT backing.

Share this article

Tether Holdings Limited revealed a “record-breaking” quarterly net profit of $2.85 billion in 2023’s Q4 today. In its “Consolidated Reserves Report”, conducted by independent auditing firm BDO, the company’s quarter earnings reveal that approximately $1 billion of the net operating profits stemmed from interest on US Treasuries, with the remainder largely attributable to the appreciation of its gold and Bitcoin reserves.

The report also shows that Tether holds over $97 billion in consolidated assets, such as US Treasuries, Reverse Repo, Money Market Funds, Bitcoin, and gold. The amount of cash and cash equivalents represents 90% of the company’s assets and is used to back the issuance of Tether USD (USDT) fully.

“Tether’s Q4 attestation underscores our commitment to transparency, stability, and responsible financial management. Achieving the highest percentage of reserves in Cash and Cash Equivalents reflects our dedication to liquidity and stability”, comments Paolo Ardoino, CEO of Tether.

Notably, the company’s excess reserves surged by $2.2 billion to a total of $5.4 billion, marking an all-time high. For the entirety of 2023, Tether’s net profit reached $6.2 billion, with about $4 billion derived from net operating profits related to, and the remaining from other asset classes.

An additional $640 million was strategically invested in various projects, including mining, AI infrastructure, and peer-to-peer telecommunications, under a new segregated venture capital umbrella to ensure these ventures do not impact the token reserves. Ardoino says that those investments can be seen as Tether’s “commitment to a more sustainable and inclusive financial future”.

Moreover, the report also informs the coverage of all $4.8 billion in secured loans, thus addressing any risk these loans might pose to token reserves. This move was in direct response to past concerns expressed by the Tether community regarding this aspect of the company’s portfolio.

Share this article