Tether Can Freeze Your USDT, 39 Addresses Containing Millions Blacklisted

Under the influence of law enforcement, Tether operator Bitfinex blacklisted 39 ETH addresses containing approximately 7.9 million USDT.

Key Takeaways

- Tether started blacklisting addresses in 2017, adding 24 new addresses to the list this year

- The largest blacklisted address contains 4.5 million USDT, with all blacklisted addresses totaling 7.9 million USDT

- Blacklisted addresses are frozen and cannot send or receive USDT and are likely honoring requests from law enforcement

Share this article

Following the first USDC address blacklisting, concerns about increased regulatory scrutiny over stablecoins motivated Ethereum researchers to create tools to track blacklisted addresses across all major stablecoins, including Tether.

Turns out 39 addresses have been banned from using USDT on Ethereum as of now. Made another dashboard to keep track of USDT bans here:https://t.co/uuQd1kW28Y https://t.co/sUAw5hnWur pic.twitter.com/72G7OKNlfI

— PhABC (@PhABCD) July 9, 2020

Tether leads the pack with 39 blacklisted addresses, while the other two share the second spot with only one address each. Most of the blacklisted Tether addresses are empty or contain little in terms of cryptocurrency.

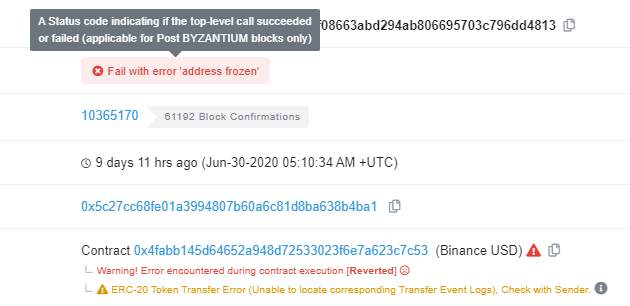

The few addresses that contain USDT add up to 7.9 million USDT, with roughly 6 million of this from addresses frozen in 2020 alone. Once blacklisted, these addresses cannot send or receive USDT. Those who try to initiate a transaction will see a rejection message as follows:

It’s not clear why Bitfinex would blacklist addresses that do not contain any funds, but the exchange is likely answering to requests made by law enforcement. Cryptocurrency exchanges usually collaborate with law enforcement, routinely banning addresses, blacklisting users, and disclosing transaction records.

Bitfinex and Tether have a checkered past. Bitfinex was “hacked” for $72 million in Bitcoin in 2016, pushing these losses onto customers by issuing a token backed by profits from the exchange. Later, it was discovered that Tether did not have one-to-one backing for its stablecoin, clashing with earlier claims.

Now, Bitfinex and Tether are involved in two lawsuits with the New York Attorney General after it “lost” $800 million in customer funds.

The recent discovery of blacklisted addresses runs contrary to Bitcoin’s ethos of financial freedom. Should Tether and other centralized stablecoins get strongarmed by regulators, then using their services will be no safer than using banks.

Share this article