The United States of Bitcoin?

Share this article

Blockchain technology may operate on the principles of distribution, transparency, and decentralization, but is its most revolutionary application— cryptocurrency— truly democratizing the financial landscape of the United States of Bitcoin?

Recent data from Google Trends show that search that search interest for “Bitcoin”, the most valuable and widely used cryptocurrency, is most interesting to individuals in Hawaii, Washington, California, New York, and other high-income states.

When compared to a full list of US States ranked by median household income, the difference of interest in Bitcoin between high-income and low-income states becomes apparent— of the top 20 states searching for Bitcoin, 16 are listed in the top 20 wealthiest US states.

It’s clear that there’s an obvious disparity between low and high-income states when it comes to cryptocurrency investing. Hawaii, which boasts the second-highest median household income in the US is the number one state when it comes to interest in Bitcoin. Mississippi, however, is the lowest-ranking US state by both interest in Bitcoin and median household income. The United States of Bitcoin looks remarkably like the United States of The Dollar.

What does this mean for the “democratization of currency” that Bitcoin and other cryptocurrencies promise us? Has cryptocurrency been co-opted into another avenue for wealth to flow into the hands of the financial elite?

Bitcoin Wealth Distribution Mirrors Fiat Distribution

The distribution of Bitcoin interest throughout the United States can be considered to represent a microcosm of the distribution of wealth throughout the entire Bitcoin blockchain. It’s arguable that individuals living in high-income states have access to higher levels of disposable income, as evidenced by a 2015 study performed by the US Bureau of Economic Analysis.

Therefore, it’s arguable that residents of high-income states are more interested in Bitcoin as they possess the means to invest in cryptocurrency at a higher rate than those in low-income states. While this may appear self-evident, the implications of this disparity raise interesting questions.

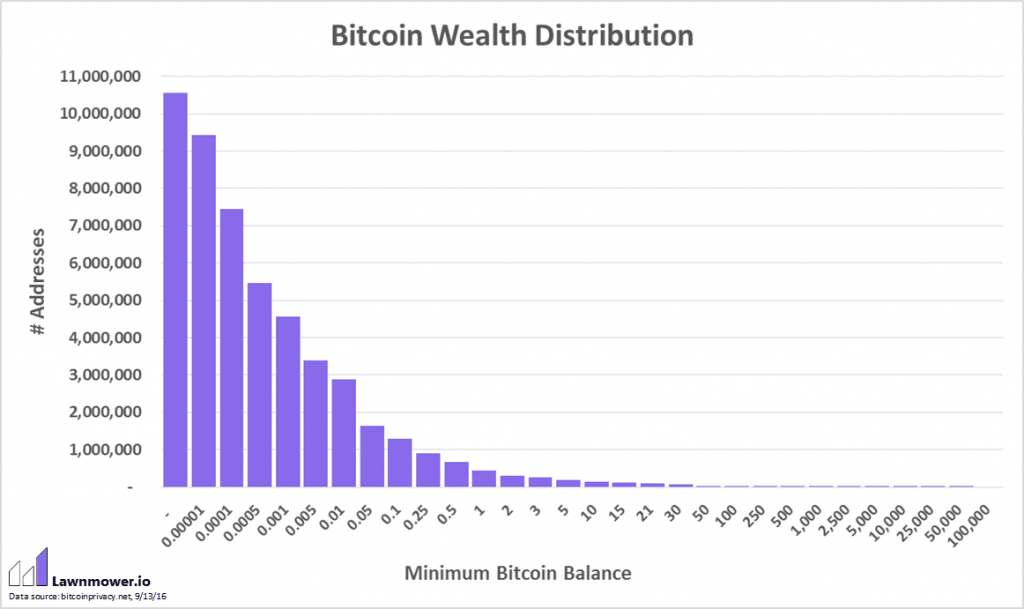

Is this inequality in Bitcoin interest— and therefore ownership— a caused by the stratification of wealth within the incumbent financial paradigm that Bitcoin and other cryptocurrencies seek to dissolve? Or is it rooted in macro-econophysics as an emergent property of financial networks themselves?When assessing the distribution of wealth over the entire Bitcoin blockchain, it’s clear that not every wallet address is created equal. The Bitcoin Rich List, which ranks the size of all Bitcoin wallet addresses, demonstrates that more than 75% of Bitcoin addresses hold less than 0.01 BTC.

Just 22% of all Bitcoin addresses hold between 0.01 and 1 BTC, with just 2.4% of all addresses holding between 1 and 100 BTC. Addresses that hold more than $1 million USD at the current market rate make up just 0.07% of all addresses. Roughly 40% of all Bitcoin is held by just 1,000 addresses.

How does this compare to the distribution of fiat currency wealth, however?

The World Institute for Development Economics Research published a study that demonstrates over 40% of global assets are owned by just 1% of the total global population. This general trend of wealth distribution imbalance is reflected in the US economy, with studies demonstrating that 1% of the US population controlling over 38% of all wealth.

If Bitcoin, and distributed ledger technology as a whole, is intended to decentralize the financial landscape, why does high-level aggregate network behaviour in the Bitcoin blockchain mirror the system it is designed to disrupt?

The Mechanics of Distribution in Emerging Networks

A 2018 by Credit Suisse questioned whether Bitcoin was “Another (digital) asset class for the 1%?” and noted that “Centralisation is also prevalent when examining the ownership of bitcoin. The concentration of wealth at a small group of addresses – be it individuals or exchanges – means that a few key players in the game can have a massive influence on the bitcoin market.”

An early empirical analysis of the Bitcoin transaction network, published in 2013 by a research team in the PLOS One delivers some interesting insights regarding the statistics of capital movement on the Bitcoin blockchain. The study, available here, predated the current influx of cash to the market, but was still able to demonstrate that linear preferential attachment drives the growth of the network— essentially, the rich get richer.

Interestingly, the same preferential attachment driven growth can be demonstrated in another study that assessed the interaction patterns of scientists in collaboration networks. The likelihood of one scientist collaborating with another is a function of their previous collaborations and the number of their previous collaborators— or their social “wealth” within the scientific community.

How is this related to the number of times Hawaiians search for “Bitcoin”, though?

Ultimately, the distribution of wealth across the US economy, the likelihood that scientists will collaborate with each other, or even the frequency of word use in language and the sizes of craters on the moon are all an expression of power-law relations— stochastic processes that are, arguably, a function of reality itself. The distribution of Bitcoin across the blockchain is no exception to this rule.

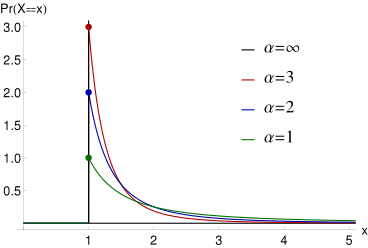

The ubiquity of power-law relations in virtually all complex systems is referred to as the Pareto distribution, named after Italian economist and sociologist Vilfredo Pareto. The Pareto distribution function has been empirically observed to fit a wide range of natural phenomena, and looks like this:

Wealth distribution across the Bitcoin blockchain looks like this— a clear Pareto distribution:

An Inevitable Imbalance Of Wealth?

While blockchain technology may disrupt and decentralize incumbent financial institutions or facilitate the creation of smart economies, it’s not capable of acting as the great equalizer of wealth distribution. Ultimately, imbalance is a natural function of nature.

So are, the cryptocurrency community, all fooling ourselves in thinking that blockchains will usher in a new age of financial equality and transparency?

The underlying philosophy of Bitcoin and other cryptocurrencies will do one thing very well (if allowed to) – it will eliminate the unnecessary third parties (such as banks) that contribute to wealth inequality, and in this way could democratize the way in which money is transferred, stored, used.

But it seems likely that not even Bitcoin can change the actual distribution of wealth. Data plots by Moon Nguyen

Share this article