UPRISE Lost $20M of Client Funds on LUNA Short Bet

The Korean crypto finance platform UPRISE lost nearly all of its clients' money shorting LUNA as it crashed to zero.

Key Takeaways

- UPRISE, a Korean crypto startup running a robo-advisor algorithmic trading platform, reportedly lost $20 million in a short bet on Terra's LUNA during its collapse in May.

- Per a local media report, the firm got liquidated while betting that the price of LUNA would fall as it crashed to zero.

- UPRISE is allegedly considering a compensation plan for its clients.

Share this article

According to a local media report, UPRISE’s “robo-advisor” trading product was liquidated for almost all of the platform’s assets when it went short on Terra’s LUNA on the futures market during the network’s collapse.

UPRISE Liquidated on LUNA Short

As Terra met its demise in May, UPRISE managed to lose nearly all its client funds by going short on LUNA.

According to a Wednesday report from Sedaily, the Korean crypto platform lost around $20 million in client funds, comprising over 99% of the platform’s assets under management. Per the report, the firm’s artificial intelligence-based robo-advisor product, dubbed HEYBIT, suffered a liquidation while betting against the price of LUNA during a period in which the cryptocurrency crashed to almost zero.

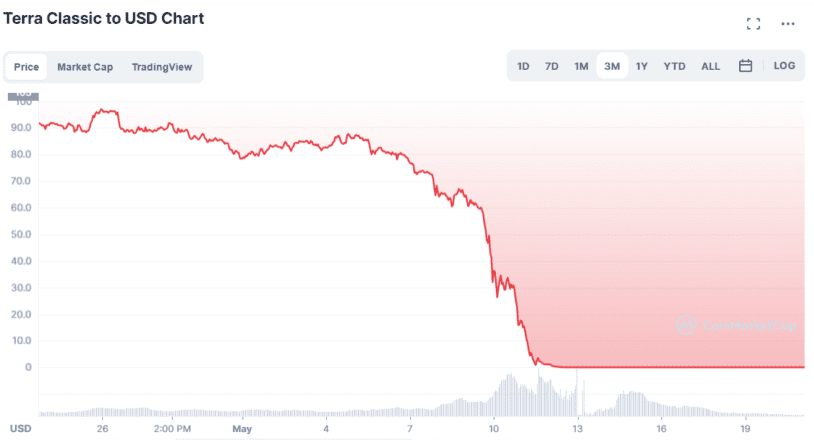

On May 7, Terra’s flagship stablecoin UST depegged from its intended parity with the dollar, sparking a “death spiral” event that caused the price of the protocol’s volatile token, LUNA, to plummet from around $77 to virtually zero in less than a week. As a result, over $40 billion was wiped out from the crypto market, causing a world of hurt for the entire crypto industry and eventually plunging multiple large crypto entities, including Three Arrows Capital, Celsius, Vauld, Babel Finance, CoinFLEX, in severe liquidity and solvency issues.

However, unlike most of the other crypto entities that either got caught by having long exposure to LUNA and UST or by the financial contagion stemming from the collapse, UPRISE went bust by going short—or betting against—the price of LUNA. In financial markets, traders place “long” bets when they believe that the price of the asset will increase in value. Conversely, traders go “short” in anticipation of a downturn.

According to UPRISE, its algorithmic trading product only accepted deposits from professional investors, investment firms, and high-net-worth individuals. The firm also reportedly claims that it had informed its clients of the potential risks involving the platform’s trading strategies prior to losing the funds.

According to an UPRISE official cited in the Sedaily report, the beleaguered startup is considering a compensation plan for clients. “It is true that damage to customer assets has occurred due to unexpected great volatility in the market. We plan to finalize the report on virtual asset business soon,” an official from the firm said.

Disclosure: At the time of writing, the author of this article owned ETH and several other cryptocurrencies.

Share this article