Crypto funds see $206 million in weekly outflows led by US Bitcoin ETFs: CoinShares

Investor caution persists as blockchain equities face 11th week of outflows.

Share this article

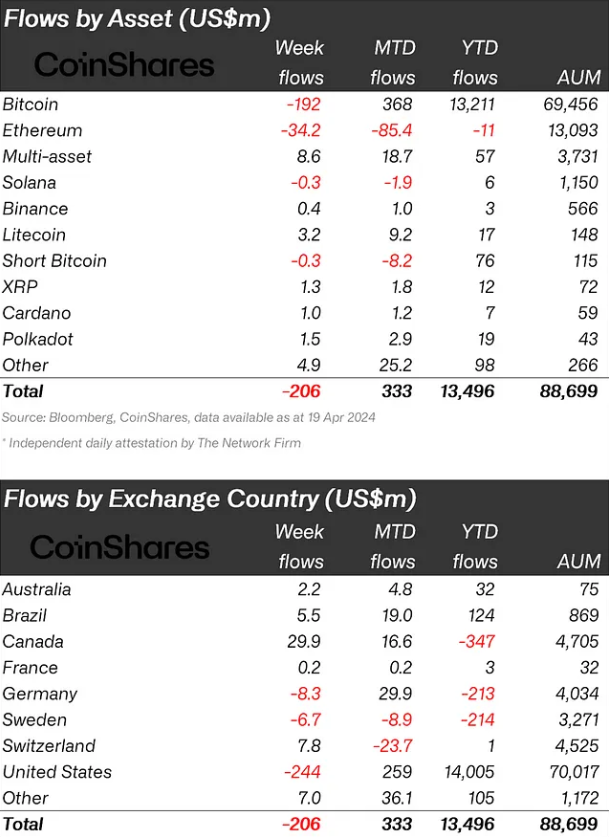

Crypto exchange-traded products (ETP) experienced $206 million in outflows last week and a decrease of $18 billion in trading volume, reveals a report by asset management firm CoinShares. Bitcoin (BTC) products represent 28% of the trading volumes, a drop from 55% a month earlier.

James Butterfill, CoinShares’ head of research, stated that this trend indicates a diminishing interest from ETP and ETF investors, possibly due to the expectation that the Federal Reserve will maintain the current high interest rates for an extended period.

Bitcoin saw outflows of $192 million last week, yet there was little movement to short the crypto, with short Bitcoin products also seeing meager outflows of $300,000. Ethereum continued its trend with $34 million leaving, marking its sixth consecutive week of outflows. On a more positive note, multi-asset products saw $9 million in inflows. Additionally, Litecoin and Chainlink attracted $3.2 million and $1.7 million, respectively.

Regionally, ETFs were primarily responsible for the outflows in the US, with $244 million leaving the market. This shift was concentrated in established ETFs, while newly issued ETFs still attracted capital, albeit at a reduced rate compared to previous weeks. In contrast, Canada and Switzerland experienced inflows of $30 million and $8 million, respectively, and Germany had minor outflows of $8 million.

Blockchain equities faced their 11th consecutive week of outflows, totaling $9 million, as investor concerns persist over the impact of the upcoming halving on mining companies.

Share this article