USDT usage for money laundering surges in East and Southeast Asia: UN report

The report shows that the stablecoin is used mainly through the Tron blockchain, and its usage is growing through schemes referred to as ‘motorcades.’

Share this article

On January 15, the United Nations Office on Drugs and Crime (UNODC) published a report highlighting the role of casinos, junkets, and crypto in the underground banking and money laundering infrastructure across East and Southeast Asia. According to UNODC, Tether USD (USDT) is the most used crypto to wash money related to illicit activities.

According to the study, these elements have rapidly proliferated, paralleling a spike in cross-border criminal activities. Jeremy Douglas, the UNODC Regional Representative for Southeast Asia and the Pacific, emphasized the technological revolution in underground banking, driven by the need for faster, anonymized transactions and the mingling of illicit funds.

“The illicit economy’s expansion has necessitated a digitized approach, utilizing casinos and cryptocurrencies, thereby supercharging the criminal business landscape, particularly in the Mekong region,” Douglas stated.

The report, titled ‘Casinos, Money Laundering, Underground Banking, and Transnational Organized Crime in East and Southeast Asia: A Hidden, Accelerating Threat,’ explores the interconnection between illegal online casinos, e-junkets, and crypto exchanges.

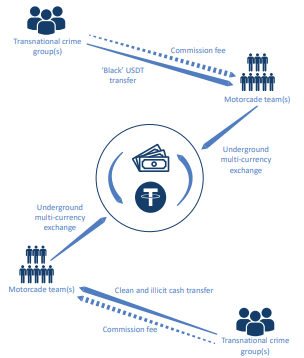

The document also highlights how Tether USD (USDT) is used to route money “through multiple bank or cryptocurrency exchange accounts for a percentage of the total laundered and transferred funds.” Those services are called ‘motorcades’ and can be found on social media platforms, namely Facebook and TikTok, or Telegram channels. It also states that the Tron network is the main blockchain used for USDT transactions related to illicit activities.

In a post published within one of the Telegram channels used for motorcade groups and used as an example by the report, administrators share a call requesting a large amount of Singapore dollars (SGD) in exchange for USDT at the rate of SGD 1.32.

“I will provide USDT, you will provide Singaporean white capital transfer…one transaction, one return, large quantity,” says the post. In another instance, a user from the group claims that he’s a representative of ‘Second Sister’s Pawnshop’, and advertises exchanging USDT for ‘pure white capital’ at a high rate, even mentioning their “strong business reputation.”

Law enforcement and financial intelligence authorities in East and Southeast Asia have also reported USDT among the most popular cryptocurrencies used by organized crime groups, demonstrated by a surging volume of cyberfraud, money laundering, and underground banking-related cases.

The UNODC report mentioned a report from data company Bitrade published on November 2023, which shares that over 17 billion USDT were connected to “underground currency exchanges, illegal commodity trades, unlawful collection and payment processes, and various criminal activities” between September 2022 and September 2023.

Moreover, the study also points to several money laundering networks responsible for moving illicit Tether funds being closed in 2023, mentioning an operation conducted by Singaporean authorities that recovered $737 million in cash and crypto in August 2023.

The report was developed through the analysis of criminal indictments, case records, court filings, and consultations with authorities, and provides detailed insights into the mechanics and drivers of underground banking in the region.

Douglas further notes that organized crime groups are exploiting vulnerabilities, with casinos and crypto assets being the least resistant pathways. Operations against syndicates in countries like Cambodia and the Philippines have led to a displacement of criminal infrastructure to areas perceived as having lax enforcement.

The UNODC’s analysis identifies over 340 licensed and unlicensed land-based casinos operating in Southeast Asia as of early 2022, most of which have transitioned online, offering live-dealer streaming and proxy betting services. The formal online gambling market is projected to grow to over $205 billion by 2030, with the Asia Pacific region expecting the largest market growth.

Share this article