What Is Bitcoin Cash? Introduction to BCH

Bitcoin Cash is Bitcoin's most notable hard fork and one of its strongest competitors.

Introduction To Bitcoin Cash (BCH)

Bitcoin Cash was created as a “hard fork” of Bitcoin during a schism between developers. Bitcoin depends on a widely distributed network to reach consensus, and that network can divide over time if miners choose to use software created by different development factions.

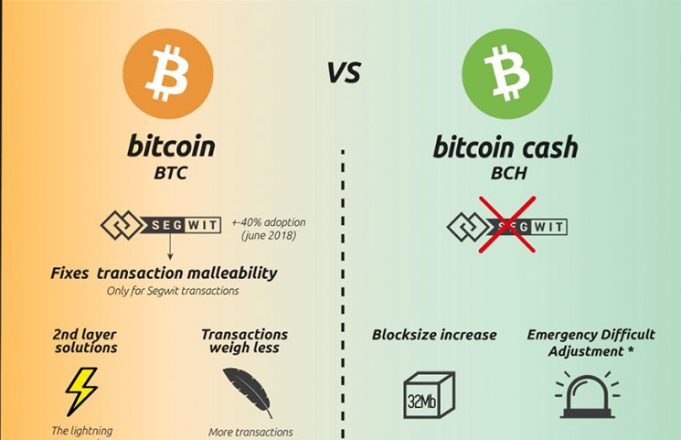

The issue at stake was the introduction of Segwit (BIP-91), which allowed Bitcoin to handle more transactions per block without significantly larger block sizes. However, the Bitcoin Cash community felt block size limits needed to be increased in a more direct way to achieve a greater transaction capacity. SegWit became the straw that broke the camel’s back, and BCH was coined.

Before miners executed the Bitcoin Cash fork at block number 478558 on August 1, 2017, the two blockchains had identical transaction histories (or ledgers). After that, Bitcoin and Bitcoin Cash split into two separate chains.

Bitcoin Cash’s celebrity lineage doesn’t necessarily guarantee success. Nonetheless, Bitcoin Cash is notable for being Bitcoin’s first hard fork, and the project has became a cryptocurrency to be reckoned with in its own right.

Bitcoin Cash Controversies

The Bitcoin Cash and Bitcoin communities remain at odds due to the troubles of brand identity. Bitcoin.com and /r/BTC on Reddit present Bitcoin Cash as equivalent to Bitcoin, arguably misleading investors. Other locations, such as Bitcoincash.org and /r/BitcoinCash, represent Bitcoin Cash more transparently. Meanwhile, Bitcoin.org and /r/Bitcoin represent Bitcoin itself.

Bitcoin Cash also had its own controversial hard fork in November 2018 when Bitcoin SV split away to raise block sizes even further. Bitcoin Cash believes that Bitcoin SV’s extremely large 2GB blocks are unsafe, and that its own 32MB blocks are ideal for now. (It is important to note that these are size limits; BCH blocks are usually under 1 MB despite a 32 MB maximum.)

In 2020, the Bitcoin Cash community began to face more internal divisions. Changes to the coin’s Difficulty Adjustment Algorithm (DAA) are under consideration, which could impact BCH’s mining hashrate. The Chinese mining community is also advocating an Infrastructure Funding Plan (IFP), which could take miner revenue and redistribute it to developers. It’s not clear whether Bitcoin Cash will fork over these issues once again.

Bitcoin Cash Market Performance

Bitcoin Cash has a total supply of 21,000,000 BCH. The peak price of BCH so far has been $4091.70 on December 20, 2017. BCH is the 5th largest cryptocurrency by market cap as of August 2020.

Any user who held Bitcoin at the time of the fork received Bitcoin Cash. This means that it was distributed as an airdrop, and that it did not raise funds as part of an ICO. This means that Bitcoin’s value comes solely from demand among investors, although much of that demand was arguably originally built up by Bitcoin itself.

BCH is mined using Bitcoin’s proof-of-work mining hash function (SHA-256). Like Bitcoin, Bitcoin Cash is decentralized and issues a block reward every 10 minutes. The current block reward as of August 2020 is 6.25 BCH; F2pool suggests that miners using top-of-the line equipment can earn about $6 per day after costs.

BCH can be bought or sold on a variety of crypto exchanges, including Bitcoin.com, Binance, Bitfinex, Bithumb, Bittrex, Coinbase Pro, Gemini, Huobi, Kraken, OKEX, and Poloniex. There are over 500 trading pairs across those exchanges, and BCH can be traded for BTC, ETH, USD, and many other currencies.

Several wallets support Bitcoin Cash, including the Bitcoin.com Wallet, Trezor, Ledger, and more.

Why Cryptocurrencies Fork

What makes cryptocurrency so revolutionary is its decentralized governance. When you get a bank account with Bank of America, for example, it must adhere to rules set by the OCC and FDIC. The Bank of America also makes its own rules (such as setting overdraft fees, deposit minimums, and other account requirements).

There’s not much you can do as an account holder except accept the change or switch banks, but cryptocurrency offers what many believe to be a better way. Holders, miners, and developers of a crypto have a say in the governance of the currency and can disagree on what the new protocol should look like.

If there is enough support for two separate proposals during an upgrade, a “hard fork” results, such as the one that created Bitcoin Cash. (It is also possible to create a fork of Bitcoin outside of a usual upgrade. Litecoin, for example, simply borrowed Bitcoin’s code and launched its own blockchain, meaning that it is a “soft fork.”)

Bitcoin hard forks are great because you get an equal amount of each currency so long as you hold prior to the fork. Savvy investors should keep an eye on potential forks and learn the best time to maximize profits.

Building a Better Bitcoin

Community support and corporate partnerships are key ingredients to any cryptocurrency’s success. Bitcoin Cash isn’t resting on its laurels—the community and team actively pursue partnerships.

BCH is accepted by nearly 2000 companies, and Roger Ver has met with the president of Cyprus to promote BCH as a currency. It has also partnered with Moonpay, Simplex, and Crypto2Cash, as well as investment platforms like Nexo and Cred.

Additionally, community projects like SLP Ledger and Cashscript give Bitcoin Cash developers a way to create custom tokens and smart contracts, just like on Ethereum.

It may just be eating Bitcoin’s crumbs, but Bitcoin is a giant, and its crumbs fed Bitcoin Cash enough to become a legitimate competitor.

Bitcoin Cash Summary

Bitcoin Cash is the first Bitcoin fork, but it’s hardly the last. When the community couldn’t agree on SegWit and block sizes, Bitcoin Cash was created as an alternative to the original cryptocurrency. Its value is driven by several key factors.

- Because it shared a history with Bitcoin until August 2017, Bitcoin Cash benefited in its valuation, which is much less than Bitcoin, but more than most other cryptocurrencies.

- BCH has block sizes much larger than BTC. They’re still mined in the same 10-minute intervals and share many other similarities.

- The price of BCH is heavily reliant upon BTC, but that doesn’t mean its not successful in its own right. It already supports smart contracts and has a custom token platform.

With these pieces in place, Bitcoin Cash is a “dark horse” crypto candidate that could easily surprise anyone. One day it may even take over Bitcoin itself as the king of cryptocurrency.