CeFi vs DeFi: Would You Trust Code or a Company With Your Bitcoin?

DeFi advocates bemoan the human involvement inherent in the more centralized CeFi sector, but it does have some advantages.

There are two distinct branches of blockchain-based open finance. One places user funds in the hands of a centralized corporation, while the other places trust in autonomous code. Both approaches want to unchain people from legacy banking.

What Is Centralized Finance?

Centralized finance, called “CeFi,” allows people to earn interest or get loans on their cryptocurrency by lending or borrowing it through a centralized corporation. These corporations are responsible for the success of their products and the well-being of their clients. Though these firms may be using a new kind of money, there is very little innovation in terms of structure.

More exotic definitions of the term may also include centralized exchanges like Binance and Coinbase, which incidentally offer lending and borrowing services.

When people talk about CeFi, they’re primarily talking about neobanking, a kind of digital bank without any branches. These are fintech firms that are pushing to provide digital and mobile-first financial solutions. In CeFi’s case, the focus is on cryptocurrency.

CeFi is currently dominated by private companies like Crypto.com, Celsius, Cred, BlockFi, and Nexo.

What Is Decentralized Finance?

DeFi allows people to access a variety of financial instruments through smart contracts built mostly on the Ethereum blockchain. Some of the capabilities that DeFi offers include lending and borrowing, flash loans, insurance, derivatives, and permissionless trading.

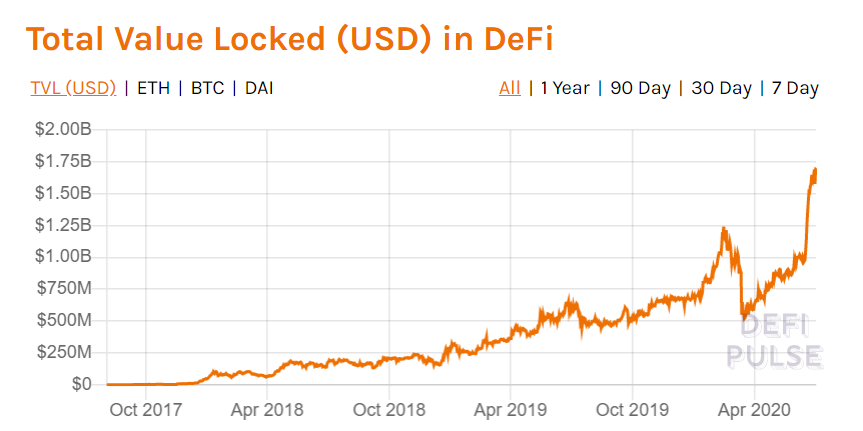

In the crypto industry, DeFi is one of the fastest-growing niches.

In a mere two years, the space has grown from nothing to around $1 billion in value locked, according to DeFi Pulse.

As of early this year, around 2.5% of all Ether was locked in DeFi protocols, according to TokenInsight.

At its core, DeFi is a group of financial products that allow users to transact without relying on a single centralized authority, like a corporation. As a result, users can avoid many of the boundaries and regulations of the traditional financial sector—for better or for worse.

The Primary Difference with DeFi

The most significant difference between DeFi and CeFi is custody of the underlying digital assets.

CeFi platforms hold customer deposits and control the accrual and payment of interest.

DeFi, for the most part, is non-custodial. Users lock their funds in smart contracts to access financial services. No company is holding their coins. Moreover, whether the person is in Zimbabwe or Los Angeles, no one can prevent them from accessing those services.

Terrorists and financiers alike can obtain these services without the need to disclose their identity.

Crypto purists argue that third party custody is anathema to the ethos of cryptocurrency. The “not your keys, not your coins” argument implores people to assume the responsibility of maintaining custody over their crypto assets.

Maker was the first protocol to gain widespread usage, dominating the DeFi landscape until last month.

With the newly released COMP tokens surging in value, Compound recently became the largest DeFi protocol. Synthetix, Balancer, and Aave round out the top five in DeFi.

But CeFi Does Have Its Advantages

For newcomers to crypto, DeFi can be daunting. By using CeFi services, users don’t have to worry about keeping seed phrases safe or managing their wallets. So long as they trust the CeFi platforms they use, crypto-based neobanking is a good entry point for new crypto holders.

For widespread adoption to occur, owning crypto needs to be as secure as traditional banking. Not everyone is comfortable being their own bank.

CeFi players also pay attractive rates of interest, as recently outlined by Crypto Briefing.

Nexo pays up to 11.9% per year. Deposits are secured by BitGo. BlockFi pays close to 10% on some assets (stablecoins). Coinbase and Galaxy Digital back it, and assets are lent to institutional investors.

San Francisco-based Cred also pays up to 10% on deposits, with undercollateralized lending to reputable money managers. BitGo also secures these funds. Its credit card payment app established the #killthebill campaign.

Celsius users earn close to 9% on certain assets, while Crypto.com offers a whopping 12% on 3-month term stablecoin deposits, rising to 18% if paid out in its native CRO tokens.

The Risks

The risks of CeFi are associated with custody. Ultimately, depositors need to trust the companies operating these neobanking services to keep their funds safe. And while their user-friendly interfaces are likely to attract new users to crypto, centralization of any kind is seen by some as a step backward.

The risks of DeFi protocols relate to the movement’s relative newness. High profile failures have resulted in sophisticated attackers walking off with hundreds of thousands of dollars in funds.

Earlier this week, an exploit was used by a hacker to deploy a $23.4 million flash loan to drain a Balancer pool of over half-a-million dollars.

With each exploited vulnerability, the DeFi ecosystem will improve and mature. But millions will be lost in the process. The innovation DeFi protocols have introduced to the market will eventually outweigh the short-term risks users are exposed to.

Both DeFi and CeFi have valid places in the cryptocurrency movement. They offer attractive yields, faster transactions, and infrastructure that promotes more open finance. Both of these visions will improve financial inclusion.

Whether your preference is for DeFi or CeFi, the innovations will almost certainly mean the end of banking as we have come to know it. That is a net positive for everyone.

Disclosure: Crypto.com and Cred are sponsors of Crypto Briefing.

Earn with Nexo

Earn with Nexo