Photo: Grey82

XRP could rocket over 500% and outrank Ethereum by 2028: Standard Chartered

Bitcoin and Avalanche remain the bank's top picks, but there is less confidence in Ethereum.

XRP could surge to $12.5 and overtake Ethereum as the second-largest crypto asset by market cap before Trump’s second term wraps up, according to a new report by Geoffrey Kendrick, Standard Chartered’s global head of digital assets research.

With XRP now trading at $1.9 according to CoinGecko data, reaching $12.5 would represent a surge of over 550%.

“By the end of 2028, we see XRP’s market cap overtaking Ethereum’s,” Kendrick noted.

XRP’s market cap is over $110 billion per CoinGecko, positioning it as the fourth-largest crypto asset. This places it behind Bitcoin, Ether, and Tether. Currently, Ether’s market cap sits at around $183 billion.

XRP’s market cap previously peaked at $190 billion in January, and it has also, at times, surpassed Tether to claim the third-ranking spot.

Kendrick’s forecast is based on several factors, including expected regulatory developments and institutional adoption. According to the analyst, a key positive catalyst for XRP’s price growth is the recent resolution between Ripple and the SEC.

Last month, Ripple CEO Brad Garlinghouse said that the securities regulator had dropped its lawsuit against the blockchain company. Ripple has agreed to pay $50 million as part of the settlement, which does not require the firm to admit to any wrongdoing.

The SEC’s decision reflects a shift in regulatory approach under the current administration. Prior to Ripple, the agency had already withdrawn from several high-profile crypto enforcement cases.

XRP ETFs could attract up to $8 billion in first 12 months if approved

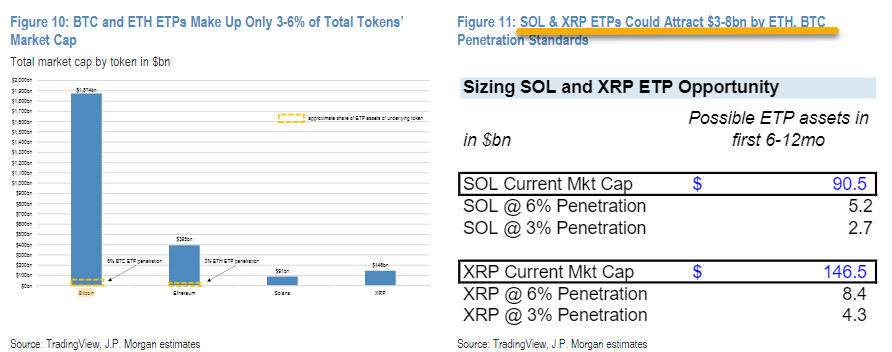

Kendrick also forecasts SEC approval for spot XRP ETFs in the third quarter of 2025, which he estimates could attract $4-8 billion in inflows within the first year. This projection falls in line with JPMorgan’s estimate.

The bank, in its January analysis, also anticipated first-year inflows for potential XRP spot ETFs to be in the range of $4 billion to $8 billion. JPMorgan’s forecast was based on the market penetration rates observed with existing Bitcoin and Ethereum ETFs.

Ripple’s CEO previously predicted XRP ETFs would make their market debut in the second half of 2025.

Regarding XRP’s use case in payments, Kendrick believes its cross-border payment functionality aligns with growing digital asset usage trends, similar to stablecoins, which he notes have seen 50% annual transaction volume growth and are projected to increase tenfold over four years.

Kendrick believes the XRP Ledger (XRPL), XRP’s foundational blockchain, functions as a “payments chain” with a strong trajectory to become a “tokenization chain.”

In support of this view, the analyst compares XRPL to Stellar, a blockchain with comparable architecture that has achieved success in tokenization. Franklin Templeton initially launched its OnChain US Government Money Fund on Stellar.

Kendrick projects XRP to reach $5.5 by year-end, rising to $8 in 2026, and hitting $12.5 in 2028. These projections are based on the assumption that Bitcoin will reach $500,000 within the same timeframe.

Even though the analyst is bullish on XRP, he does not ignore existing challenges the project faces, including a smaller developer ecosystem than its competitors and a low fee model.

Still, he believes that the positive drivers he has outlined could overpower these barriers.

The analyst continues to see strong potential in Bitcoin and Avalanche, but he’s less enthusiastic about Ether, labeling it an “identified loser.”

Earn with Nexo

Earn with Nexo