Zcash Signals Local Top, Will Bitcoin Follow?

Zcash surged nearly 60% over the past month, and data suggests that it could have hit an exhaustion point in its uptrend.

Key Takeaways

- Zcash's social volume is reaching levels that have previously indicated local tops.

- Different technical indexes add credence to this outlook signaling that a correction is underway.

- If validated, the high correlation between ZEC and some of the top cryptocurrencies could spell trouble for the rest of the market.

Share this article

On-chain and technical metrics suggest that Zcash, a privacy-centric cryptocurrency, reached a local top, which could have severe implications for the rest of the crypto market.

ZEC’s Social Volume Skyrockets

Zcash is up nearly 13 percent over the past 24 hours. The privacy token rose from hovering around $29.7 to recently hitting a high of $47.6.

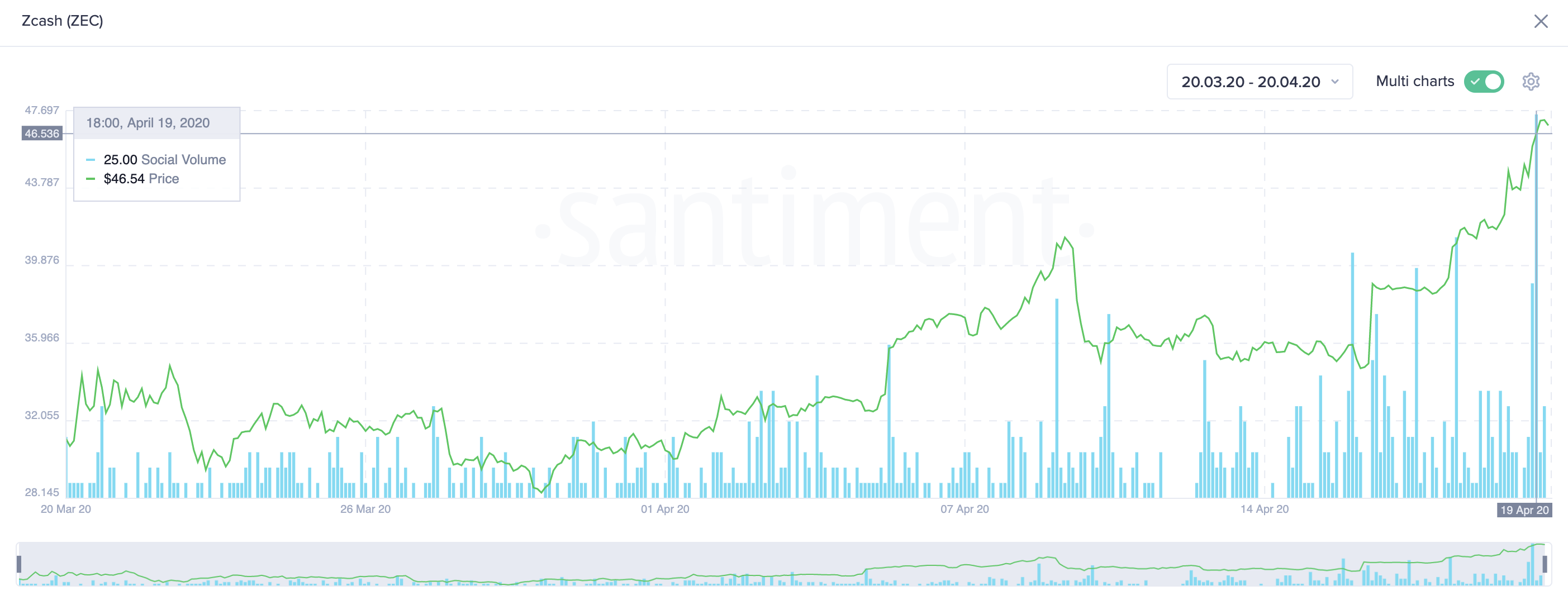

Now, this price level could represent a local top, according to Santiment.

The behavior analytics firm explained that ZEC’s social volume spiked to a month high of 25 in the last few hours. This short-term signal is usually indicative of profit-taking opportunities unless the metric continues at these high levels in the following days.

Coincidentally, multiple technical indexes add credence to the bearish outlook.

A Retracement Seems Imminent

The TD sequential indicator, for instance, has been incredibly accurate at predicting local tops.

Over the past month, this technical index presented three different sell signals in the form of green nine candlesticks that were all validated. Following the bearish formations, Zcash fell 20%, 4.7%, and 18%, respectively.

Now, the TD sequential setup is once again providing another bearish signal in the form of a green nine candlestick. Given the strength of the 200-twelve-hour moving average, it is very likely that this signal will be validated.

If so, ZEC could plummet for one to four candlesticks before continuing its uptrend.

Such a downward impulse could see the privacy altcoin drop to the 23.6% or 38.2% Fibonacci retracement levels. These support barriers sit at $40.6 and $36.3, respectively.

Nonetheless, a further increase in demand could help avoid the pessimistic outlook. For this to happen, Zcash needs to break above its 200-twelve-hour moving average and turn this resistance level into support.

Under such circumstances, combined with another spike in social volume, ZEC could jump to $54 or even $64.

Impact on the Market

Data from BitInfoCharts reveals that Bitcoin and Zcash have a high correlation regime. The flagship cryptocurrency and this privacy-centric altcoin maintain an average correlation coefficient of 0.97, which is considered a strong positive linear relationship.

Under this premise, a slump in ZEC’s price could also see BTC fall, consequently, affecting the rest of the market.

It is worth mentioning that multiple altcoins, such as Ethereum and Litecoin, have also seen their social volume rise to local tops. Meanwhile, the TD sequential indicator is printing the same sell signal across most of the top ten cryptocurrencies.

Although it is too early to tell whether Zcash will lead the market to a steep correction, the different datasets previously explained indicate that traders must be cautious.

Share this article