Zcash Surges 25%, Get Ready for a Nosedive

Zcash managed to surge this week thanks to support from two privacy-compliance firms. But, with its momentum exhausted, ZEC looks ready to drop.

Key Takeaways

- Zcash rose over 25% in the past week after two crypto forensics and compliance platforms added support for ZEC

- The sudden upswing was accompanied by a spike the number of social interactions around this cryptocurrency

- The increased levels of attention, however, may spell trouble for ZEC’s short-term price action

Share this article

After making 25% gains this past week, Zcash could suffer a nosedive when bullish social media chatter around the project subsides.

Zcash Holders Grow Optimistic

Zcash has been on a roll over the past week, rising by more than 25%. The sudden upswing seems to have been triggered after Chainalysis and Elliptic announced support for this privacy-centric token in their compliance products. Following the announcement, ZEC went from trading at a low of $54 to recently hit a high $64.

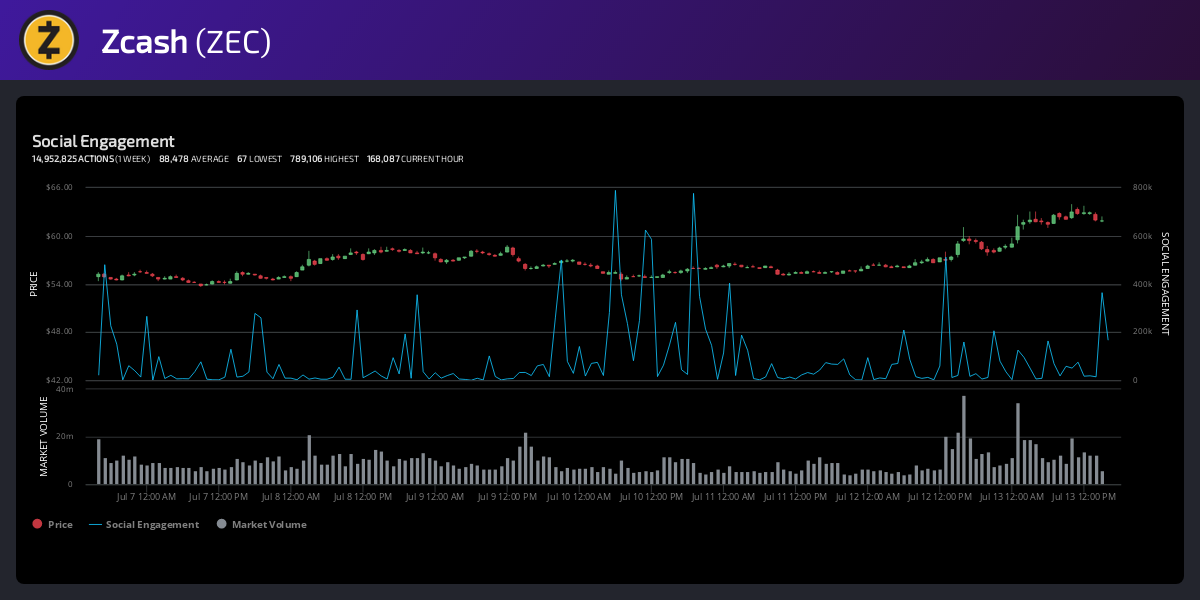

Data from LunarCRUSH reveals Zcash’s social engagement activity has been picking up since the news broke. Spikes in the project’s fundamental metrics seem to be manifesting itself into higher prices.

The first significant spike in ZEC’s social engagement metrics occurred on July 6, with over 1.65 million engagements on that day alone. However, the social activity around the altcoin skyrocketed three days later, registering over 4 million engagements.

More importantly, roughly 62% of all the social interactions have been bullish about Zcash over the last seven days. These include favorites, likes, comments, replies, retweets, quotes, and shares, to name a few.

The increasing ZEC-related mentions across different social media networks can be considered a highly concerning sign for this token’s short-term price action. Usually, when market participants pay increased attention to a given cryptocurrency because of an ongoing pump, it leads to a steep correction.

A Bearish Impulse Is Underway

The TD sequential indicator adds credence to the bearish outlook. This technical index recently presented a sell signal in the form of a green nine candlestick on ZEC’s 4-hour chart. The bearish formation estimates a one to four candlesticks correction or the beginning of a new downward countdown.

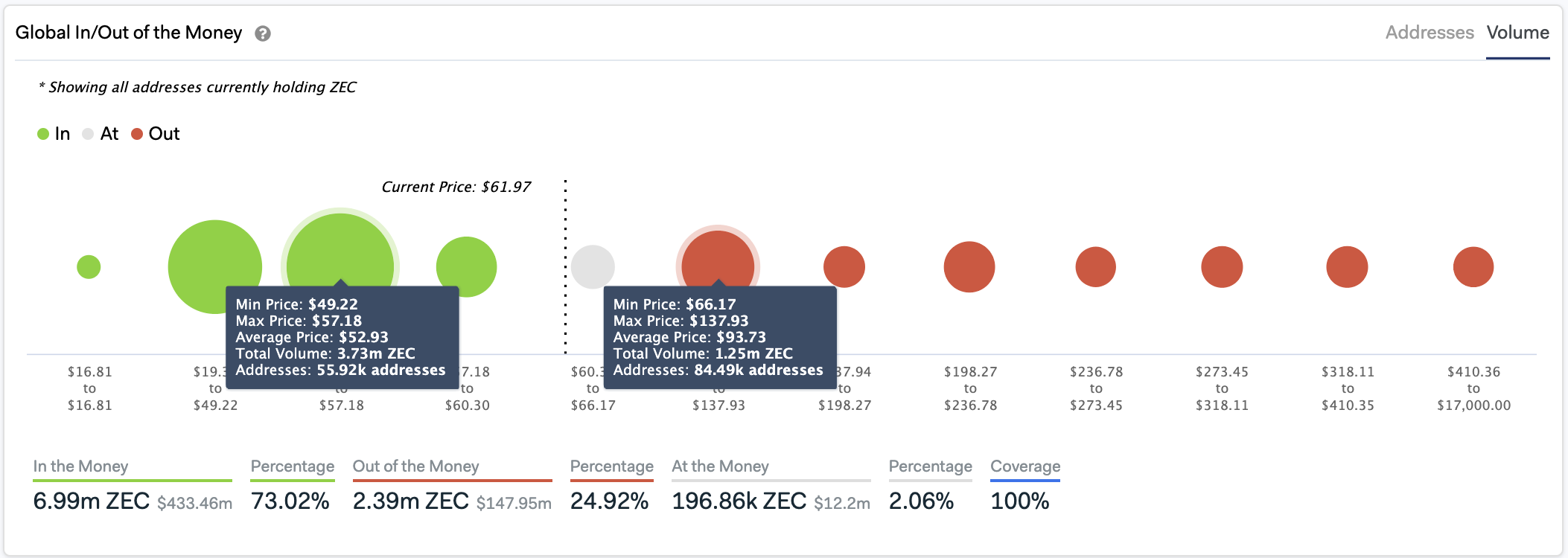

An increase in the selling pressure behind Zcash may send its price down to the $49-$57 support level. Here, IntoTheBlock’s “Global In/Out of the Money” (GIOM) model reveals that nearly 56,000 addresses had previously purchased over 3.7 million ZEC.

This robust supply wall may have the ability to prevent Zcash from further losses. Holders within this price range would likely try to remain profitable in the event of a retracement. They may even buy more ZEC to help prices rebound to higher highs.

It is worth mentioning that a green two candlestick trading above a preceding green one candle can invalidate the sell signal presented by the TD setup. If this were to happen, investors must pay close to the recent high of $64. Moving past this hurdle might ignite FOMO among traders, pushing ZEC’s price towards the mid-February’s top of $76.

Share this article