Aave proposes risk parameter adjustments for DAI as MakerDAO prepares for upgrade

If implemented, the new framework is designed to lower potential risks while creating minimal negative impact to Aave's users.

Decentralized lending protocol Aave has launched a new proposal to adjust the risk parameters of the DAI stablecoin in response to concerns over MakerDAO’s aggressive expansion plans.

The proposal, put forward by the Aave Chan Initiative (ACI) team through the Aave Risk Framework Committee, aims to lower potential risks while minimally impacting users.

The key aspects of the proposal include setting DAI’s loan-to-value ratio (LTV) to 0% on all Aave deployments and removing sDAI incentives from the Merit program, effective from Merit Round 2 onwards. These measures come in response to MakerDAO’s recent D3M (Direct Deposit Module) plan, which rapidly expanded the DAI credit line from zero to an estimated 600 million DAI within a month, with the potential to reach 1 billion DAI in the near future.

“These liquidity injections are done in a non-battle-tested protocol with a “hands off” risk management ethos and no safety module risk mitigation feature,” the ACI team stated.

The ACI team believes that the proposed changes will have a minimal impact on users, given how only a small portion of DAI deposits serve as collateral on Aave. There’s also the fact that users can easily switch to alternative collateral options such as USD Coin (USDC) or Tether (USDT), the ACI team claimed.

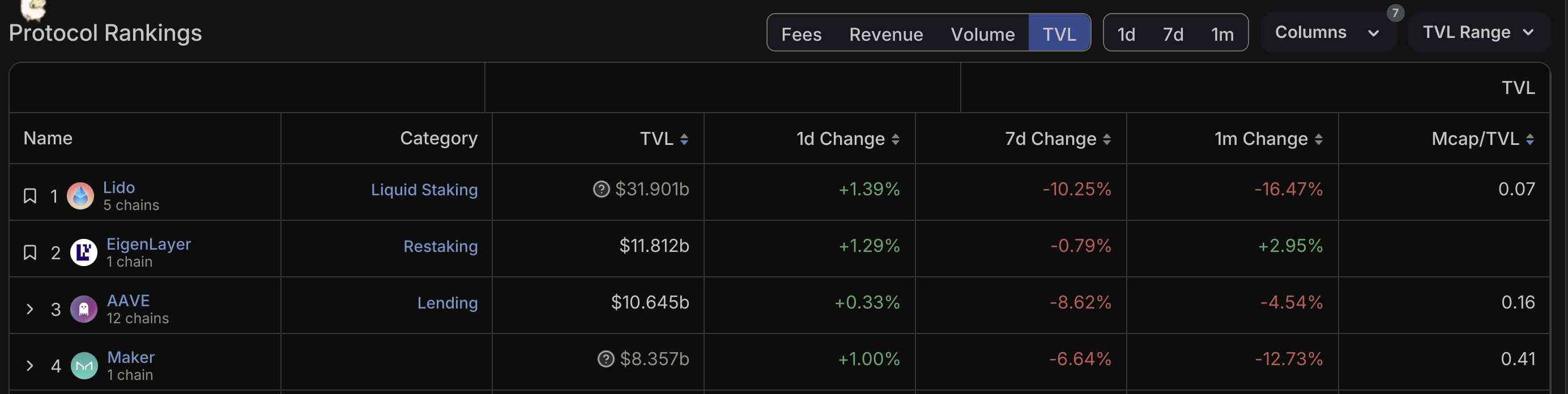

TVL comparison chart between top 4 DeFi protocols. Source: DeFiLlama.The proposal cites Angle’s AgEUR (EURA) as an example of the potential risks associated with ostensibly “aggressive” stablecoin minting practices. This coin was minted into EULER but suffered a hack within a week of launch. This incident highlights the dangers of stablecoin depegging when used as loan collateral on Aave.

Meanwhile, MakerDAO is gearing up for its highly anticipated “Endgame” upgrade. This update will move the MakerDAO ecosystem to scale the protocol’s decentralized stablecoin, DAI, from its current $4.5-billion market capt to “100 billion and beyond,” as the protocol claims, rivaling Tether’s USDT. The five-phase plan, announced by co-founder Rune Christensen, includes engaging an external marketing firm to rebrand the operation and redenominating each Maker (MKR) token into 24,000 NewGovTokens.

The Aave proposal comes as competition in the decentralized finance (DeFi) space tightens, with Eigenlayer recently surpassing Aave to become the second-largest DeFi protocol in terms of total value locked (TVL). However, Aave maintains a significantly higher number of daily active users compared to other top DeFi protocols.

Earn with Nexo

Earn with Nexo