Ampleforth's Unique Design Put to the Test After Market Cap Drops 55%

Ampleforth's economics make pumps steeper and dumps deeper.

Key Takeaways

- Ampleforth has been on the receiving end of community backlash following a 55% drawdown for investors.

- AMPL's market cap grew by 10x, but price rose only 30% over the same period.

- With a target price near $1, the crash in price confirms Ampleforth is working as expected.

Share this article

Ampleforth and its token, AMPL, are the center of attention as the network’s market cap crashed over 55% from its peak. However, this was an expected reaction and proves that Ampleforth is working as designed.

Ampleforth’s Complex Economics, Easy Returns

Ampleforth is an ambitious project trying to change the dynamics of money. This kind of ambition often comes with significant risks, which are being put on display today.

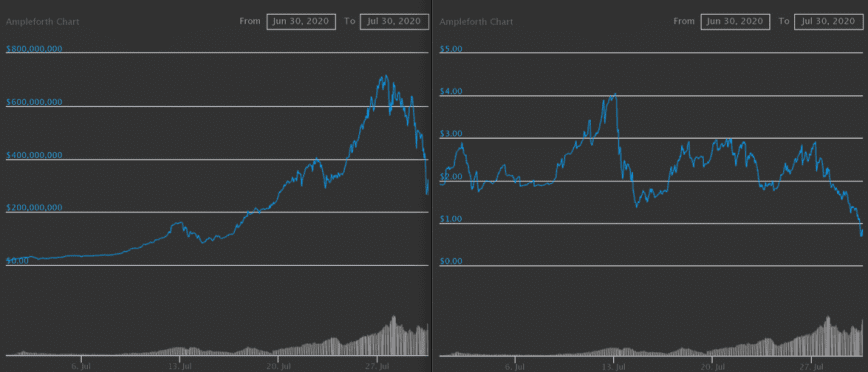

From its peak of $717 million, AMPL’s market cap is down $325 million at the time of writing – a 55% drawdown. But for anyone that did their homework on Ampleforth protocol’s economics, this comes as no surprise.

The concept of reflexivity is incorporated within Ampleforth, making the ups and downs far steeper.

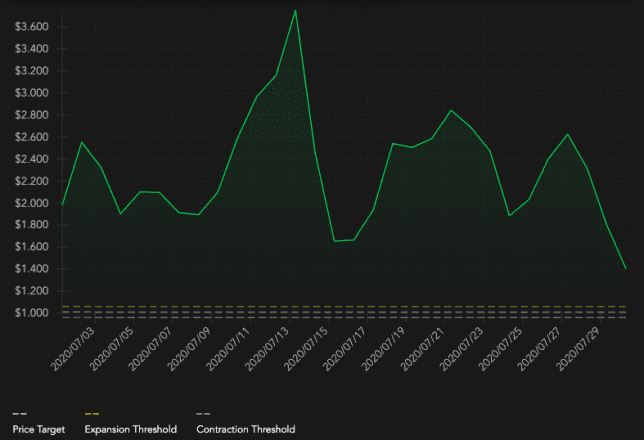

In simple terms, if the price of AMPL remains above its target price, it is in an expansionary threshold. The protocol increases supply by airdropping tokens to existing holders in a proportional manner, eliminating investor dilution.

However, if AMPL price is below its target price, the supply contracts, burning AMPL in all addresses in a proportion that keeps each address’ ownership of tokens stable in percentage terms.

As AMPL climbed higher and higher, eventually reaching $4, the target price was always at $1.009. Believe it or not, as AMPL hovers between $.65 and $.80, it’s a sign that the protocol is working as designed.

The reason market cap expanded over the last month was to increase supply and incentivize AMPL holders to offload some tokens, creating selling pressure and bringing AMPL closer to its target. However, the target price is by no means a peg. There are incentives to encourage the convergence of market price and the target price, but it’s ultimately up to the market to decide AMPL’s price.

On Jul. 14, the price of AMPL was $2.25, and the market cap was $85 million. Less than two weeks later, on Jul. 27, the price was $2.91 while the market cap was $717 million.

The mechanism is not perfect and may require refinements. But whether or not it adhered to the target price, AMPL certainly did its job – grow the size of the network with minimum volatility to the token’s price.

Share this article