Anchor Reveals GDP-Pegged Stablecoin On Ethereum and Stellar

Share this article

A project launching a new stablecoin pegged to global GDP has opened up its platform for public testing. An algorithmic stable coin, Anchor says the new testnet will allow users to trial its interface as well as create wallets for Ethereum and Stellar-based cryptocurrencies.

Anchor Tokens (ANCT) mirror global economic growth by tracking a series of indicators, known collectively as the monetary measurement unit (MMU), which includes the value of fiat currencies, as well as national GDP and bond yields.

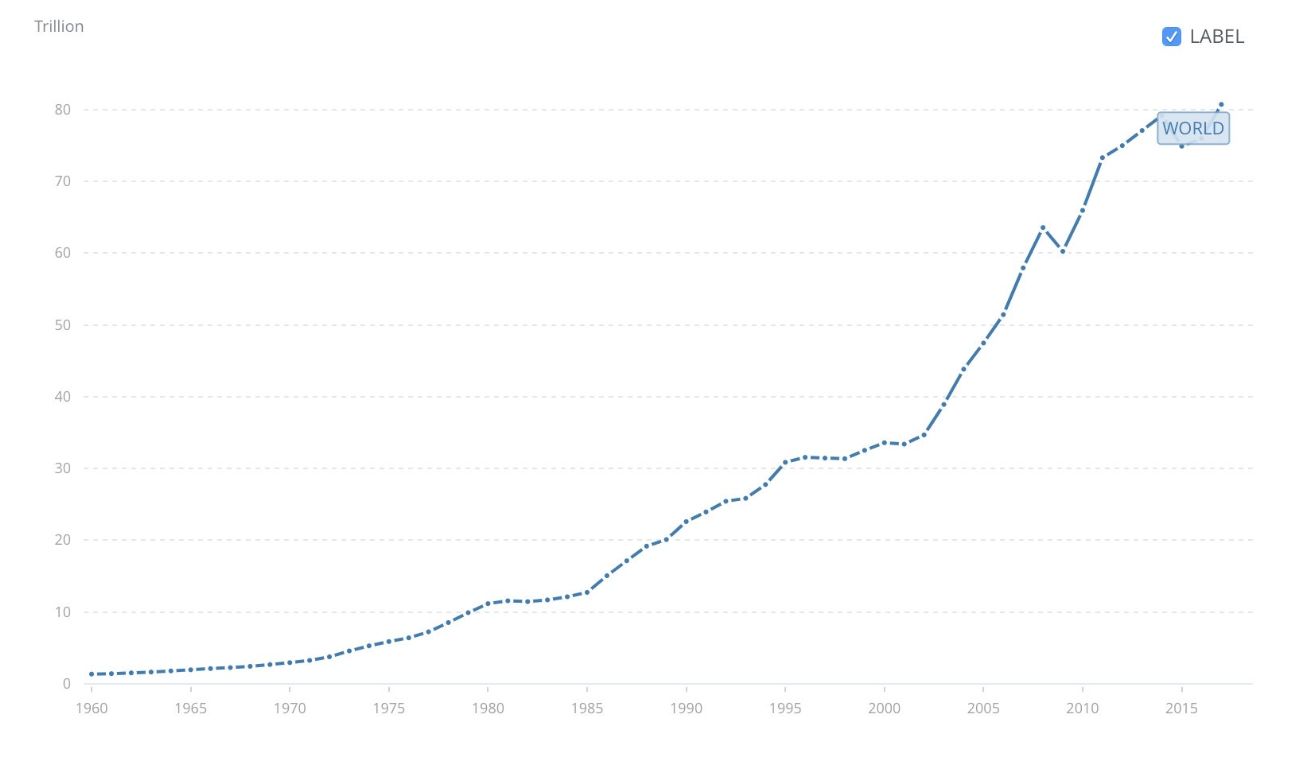

As well as hedging against localized volatility, Anchor says their stablecoin protects holders from inflation. As global GDP increases, so too will the value of ANCT. Data from the World Bank shows that since 1960, global GDP has expanded from $1.3trn to $80.7trn.

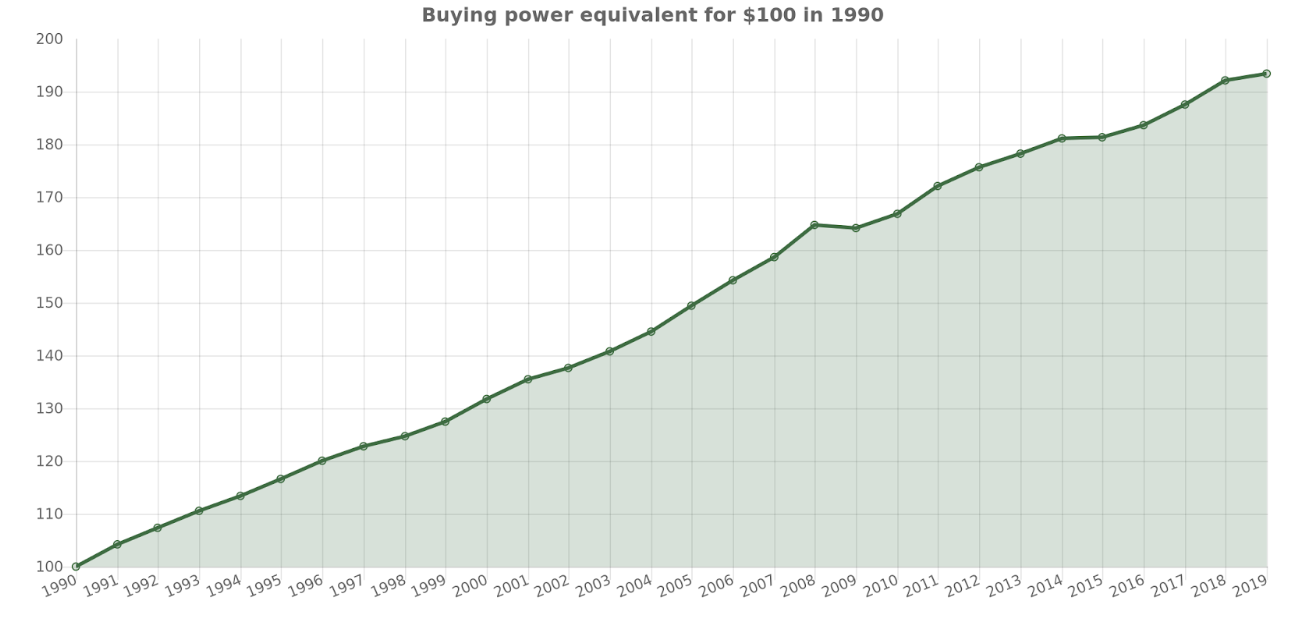

Most stablecoins currently available – Tether (USDT), TrueUSD (TUSD) and Circle (USDC) – are pegged to the value of the US dollar. They are stable relative to cryptocurrencies, but the USD price still fluctuates; its purchasing power is a mere fraction of what it was, even 30 years ago. According to the Bureau of Labor Statistics, $100 in 1990 was equivalent to $192.18 in 2018.

Today’s platform is only a testnet, meaning users will only be able to trade pseudo Anchor tokens. Actual ANCT will first be distributed two months after a private token sale for Dock tokens (DOCT) – utility tokens providing initial access to the mainnet platform – scheduled for early May.

The project aims to move towards a decentralized governance system later this year, which will be comprised of 21 independent validators, preferably from “reputable” institutions, with one place reserved for a representative from the Anchor team.

Daniel Popa, founder and CEO of Anchor, explained that pegging to global GDP, while complicated, ensured value could be preserved, long-term. “Many stablecoins currently on the market offer digitized versions of fiat currencies, which intrinsically lose value due to inflation and are vulnerable to market fluctuations and volatility,” he explained.

Share this article