Shutterstock cover by Lysogor Roman.

Avalanche Endures Wild Ride Amid Debate, Price Action

Avalanche could be bound for further losses as transaction fees on the network skyrocket.

Avalanche’s AVAX token recorded another new all-time high of $144.96 Sunday amid intense debates between some prolific industry figures concerning the Avalanche blockchain and Ethereum. On Monday, however, Avalanche experienced a tenfold increase in transaction costs as the network processed more than 669,000 transactions, which appears to have caused some panic among investors as AVAX’s market value dropped significantly shortly after.

Public Debate and Apology

AVAX’s volatile price action the last few days has taken place amid some public debate between industry figures. Three Arrows Capital CEO Su Zhu, who publicly shared optimistic price targets for Ethereum ahead of EIP-1559 launching but has more recently turned his focus to Avalanche (Three Arrows Capital announced it had co-led Avalanche’s $230 million raise in September), engaged in a heated discussion with Synthetix founder Kain Warwick, who posted a tweet noting that he had observed many crypto enthusiasts that had “sold out in pursuit of profit maximization.”

Zhu wrote in a tweet that he himself had “abandoned Ethereum” and that Ethereum had “abandoned its users,” arguing that the cost of using Ethereum had priced out newer users and made less expensive solutions like Avalanche more viable alternatives. “The idea of sitting around jerking off watching the burn and concocting purity tests, while zero newcomers can afford the chain, is gross,” he wrote. Several developers working on Ethereum and projects in the Ethereum ecosystem publicly criticized Zhu for his comments. Zhu also posted price charts highlighting Avalanche’s parabolic rally throughout the weekend then apologized for his statements on Ethereum.

Avalanche Plunges While Gas Fees Surge

Sometimes referred to as a so-called “Ethereum killer,” Avalanche competes by providing users with “blazingly fast” and low-cost transactions.

Despite the significant endorsement from Zhu, Avalanche could be falling short of meeting expectations. The smart contracts blockchain has seen transaction fees skyrocket. A sudden spike in network traffic pushed gas fees as high as $10, with the average gas fee reaching 153 nAVAX.

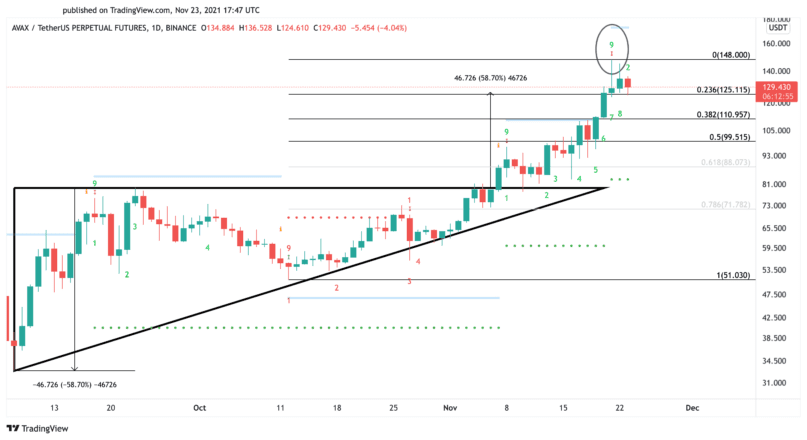

As transactions fees surged to record highs, Avalanche’s market value suffered the most. The DeFi token took a 16% nosedive, going from an all-time high of $144 to hitting a low of $124.60 recently. Further selling pressure around the current price levels could result in further losses.

A daily candlestick close below $125 might push Avalanche to the $110 or even the $100 support level.

It is worth noting that the development team behind Avalanche is already working on different ways to optimize the network and support high demand, low finality, and low fees. As these solutions begin to be implemented, the chances for AVAX the rebound increase.

A downswing to $110-$100 could serve as a buying opportunity for sidelined investors to get back into the market. A rebound from such a crucial support barrier may have the strength to catapult Avalanche towards a new all-time high of $173.

Disclosure: At the time of writing, the author of this feature owned BTC and ETH.

Earn with Nexo

Earn with Nexo