The Best Crypto Derivative Exchanges

Crypto derivatives help traders manage their risk and amplify their profits. Here are the best places to trade them.

Derivatives are efficient trading instruments that can offer traders an edge in managing risk and multiplying profits. Here are the top four crypto derivative exchanges that we recommend.

Why Use Derivatives?

The main goal of investing and trading is to make profits by minimizing risk and maximizing rewards. Derivatives offer traders a capital-efficient way of gaining exposure to cryptocurrency

If a trader wants to open a long position worth one BTC in spot markets, they will have to fork out the cost for a full BTC upfront. But if this investor instead decided to use an options contract, the premium for an at-the-money option is usually less than 10% of the initial cost for a spot position for a similar amount of leverage.

Another vital benefit provided by derivatives is that of hedging. To offset the risk of a one BTC long position in the spot market, a trader can gain one BTC of short exposure for a fraction of the cost with a future or option contract.

For a minimal cost, a trader can either create exposure to one side of the market or hedge their existing exposure to the market. However, derivatives, specifically the use of leverage, can be dangerous if not used carefully.

The Four Best Derivative Platforms

Choosing the right derivatives exchange depends on what a trader needs from the market. Unlike legacy markets, where each broker has the same derivatives that trade on a single exchange, each cryptocurrency derivative exchange has its own products.

As a result, it is a must to understand the features of different derivative exchanges before making a decision.

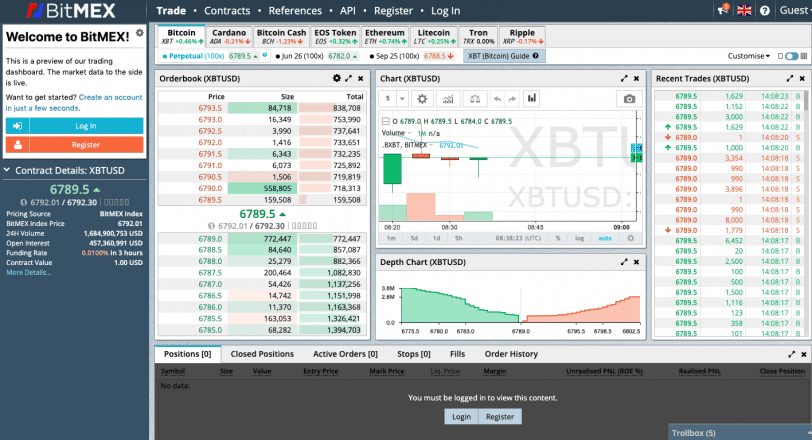

1. BitMEX

The oldest derivatives exchange in crypto, BitMEX built its moat early on in 2014 when crypto markets were still in its infancy.

BitMEX offers futures and perpetual swap contracts. In fact, BitMEX created the perpetual swap, which is now crypto’s most traded derivative.

Over 90% of BitMEX’s volume comes from one contract—its Bitcoin perpetual swap. This contract has over $1 billion of volume on a daily basis. Moreover, BitMEX is the only crypto derivatives platform to have more than $1 billion in open interest.

It is the trading platform of choice for Bitcoin maximalists, as trading can only be done using a BTC deposit; no stablecoins. Larger traders also prefer BitMEX because it offers the tightest bid-ask spread in crypto, resulting in less slippage on big orders. The exchange also offers up to a whopping 100x leverage on select pairs.

But BitMEX only has three trading pairs against the USD (BTC, ETH, and XRP), while the rest are fairly illiquid contracts that are pegged against BTC. It is also susceptible to system overloads during peak volatility.

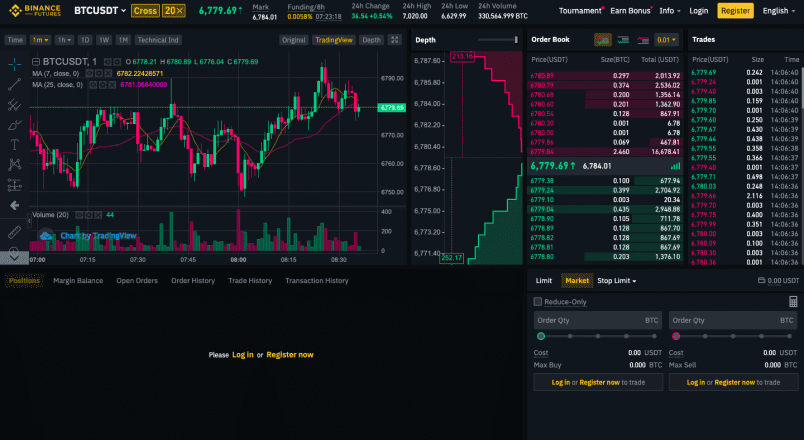

2. Binance

When the reigning king of the spot market decides to launch derivatives instruments, traders tend to flock. In the seven months since Binance first initiated derivatives trading, it has cemented its place by becoming the highest-volume platform.

Binance has perpetual futures contracts for a large variety of altcoins against USDT, which is one of its largest merits. Additionally, one can trade futures for all of these pairs while holding collateral in USDT, offering capital protection against volatility.

As the largest spot exchange for retail traders, Binance offers a seamless experience when switching from spot to derivatives and vice versa. The integration of both of these markets in a single UX makes Binance a great platform for those looking to hedge their spot positions with futures. Binance Futures offers up to 125x leverage, but its UI can be laggy at times.

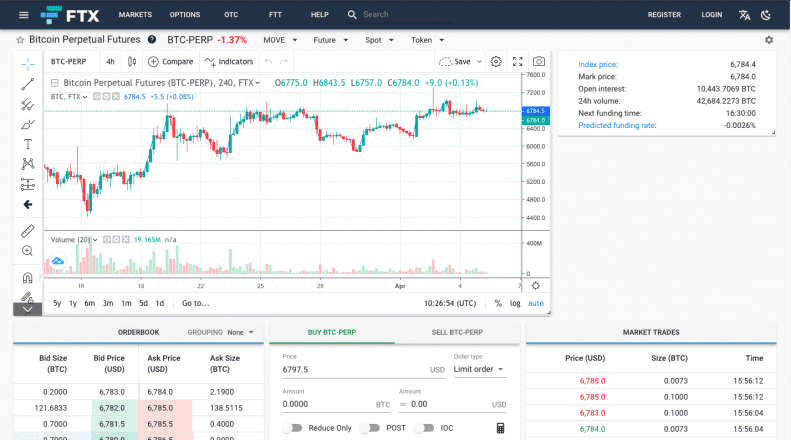

3. FTX

This is one of the younger platforms that has quickly captured the attention of retail and institutional traders. FTX offers a wide variety of spot market pairs and derivatives, as well as betting markets.

FTX has perpetual contracts and futures for almost every major altcoins. But what sets them apart from the rest are their innovative products.

The exchange launched “MOVE” contracts that let traders bet on volatility. It is akin to trading the VIX (volatility index) in stock markets. FTX also created leveraged tokens that work like leveraged ETFs (read this to understand how they work).

With several non-crypto products, like U.S Presidential election betting, FTX sets the bar high for multi-faceted crypto derivatives platforms.

FTX is the only platform with futures, perpetual contracts, and options for Bitcoin and altcoins. No other exchange has options for altcoins other than ETH. With a strong variety of products, up to 101x leverage, and a smooth UX, FTX is becoming the primary battleground for battle-hardened speculators.

FTX has fared well during times of high volatility. However, since it is fairly young, it is yet to see a major stress test during an exuberant bull market.

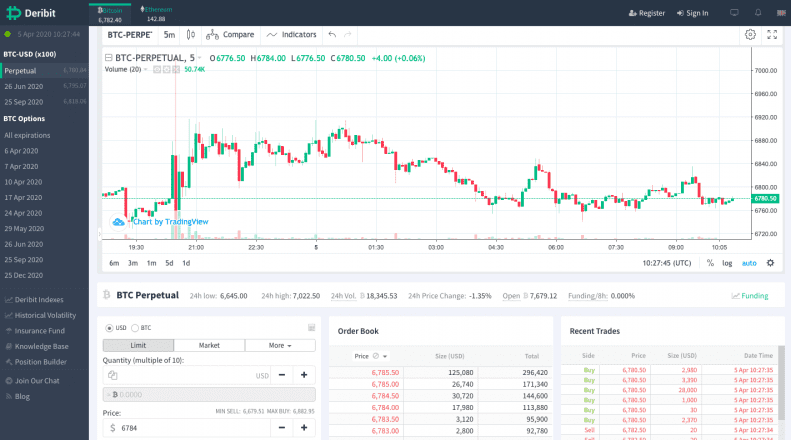

4. Deribit

An option trader’s paradise, Deribit is the single most liquid Bitcoin options exchange, even when compared to CME and Bakkt.

Deribit enjoys over 85% of all Bitcoin option liquidity. The exchange offers perpetual swaps and futures too, but it has made its claim to fame with hallmark option volume. The exchange averages over 60,000 BTC of daily open interest, per Skew.

Among other things, Deribit has a portfolio simulator that lets traders play around with different options spreads to calculate their profit or loss. Deribit offers up to 100x leverage for perpetual contracts.

For option traders and hedgers, Deribit is undoubtedly the best option (pun intended).

Earlier this year, the exchange had troubles with its index, causing a flash crash and mass liquidating many traders. But, they accepted their mistake and promised to refund traders who were liquidated as a result of their index’s failure.

During the March flash crash, Deribit was once again caught with mass liquidation. The exchange’s insurance fund paid out massive sums of BTC to users.

These two events signal that the exchange has some things to figure out before becoming one of crypto’s heavyweights, but also that they are honest in their operations.

From our experience, BitMEX, Binance, FTX, and Deribit are the best crypto derivatives exchanges on the market. Between the four, traders can access a variety of instruments with ample liquidity.

Earn with Nexo

Earn with Nexo