Chainalysis: $2.8B Bitcoin Laundered Through Exchanges in 2019

OTC brokers may be to blame.

Chainalysis, a major blockchain analysis firm, has published a blog post concerning last year’s Bitcoin laundering trends.

The Role of Exchanges and OTC Brokers

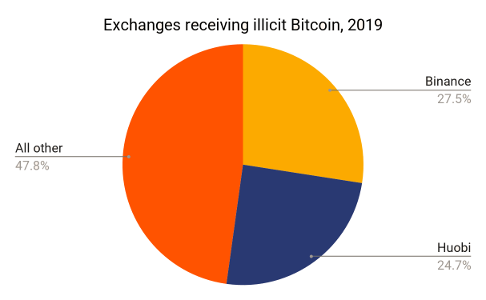

The firm traced $2.8 billion of illicit Bitcoin that was deposited to exchanges over the course of 2019. Binance and Huobi each received about one-quarter of that total, while assorted exchanges received the rest.

Chainalysis suggests that exchanges should have caught illicit Bitcoin through KYC measures, which provide the ability to recognize stolen Bitcoin and coins that have been tainted by crime.

It may be surprising that high-ranking exchanges fail to stop illegal activity, the firm writes. The full explanation is more complex, however.

Chainalysis notes that although illicit Bitcoin was sent to 300,000 exchange accounts, much of that Bitcoin was concentrated in several large accounts. This suggests that criminals are cashing out Bitcoin via third parties, which in turn deposit the Bitcoin on an exchange.

Chainalysis believes that OTC brokers are those third parties. These brokers facilitate trades between buyers and sellers, providing an important source of market liquidity.

Unfortunately, OTC brokers also have relaxed KYC standards, meaning that they may handle illicit Bitcoin, either deliberately or accidentally.

The Rogue 100

Chainalysis isn’t naming its suspects, but it has identified 100 “rogue” OTC brokers that may be laundering Bitcoin.

32 of those brokers are among the 810 accounts that received the most tainted Bitcoin. 70 of those brokers have accounts on Huobi. And although none of those brokers have accounts on Binance, that exchange may have its own bad actors.

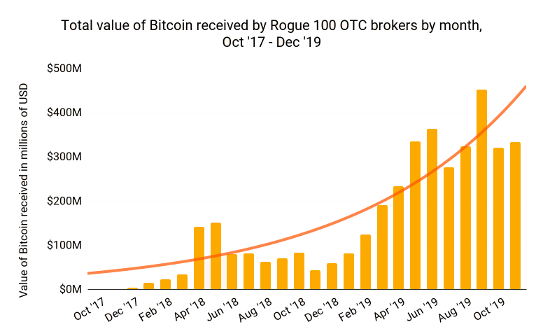

The rogue 100 are also highly active. Chainalysis says that these OTC brokers may account for as much as 1% of Bitcoin trading activity every month. It adds that they are highly involved in scams such as last year’s PlusToken sell-off.

These OTC brokers have also grown rapidly since 2017, as shown in the chart below:

Solving the Problem

Chainalysis suggests that crypto exchanges should take a firm stance against illicit funds by scrutinizing OTC desks as harshly as they scrutinize criminals.

If exchanges manage to block most illicit Bitcoin, there would be little incentive for Bitcoin-related crime.

On the other hand, decentralization advocates argue that exchanges have no right to interfere with the flow of crypto. Stricter rules may do more harm than good if they prevent legitimate investors from circulating cryptocurrency as well.

Arguably, regulations already require overly strict policies—but the debate will continue regardless.

Earn with Nexo

Earn with Nexo