Bitcoin Bears on the Prowl as BTC Options Hit All-Time High

As the market prepares for a fresh bout of volatility, things can swing either way for Bitcoin.

Share this article

There has been a surge of put option buyers and call option sellers in the BTC options market, indicating that Bitcoin bears are alive and kicking. With over $700 million of options set to expire this week, BTC could be in for more volatility.

Insights from Bitcoin Options

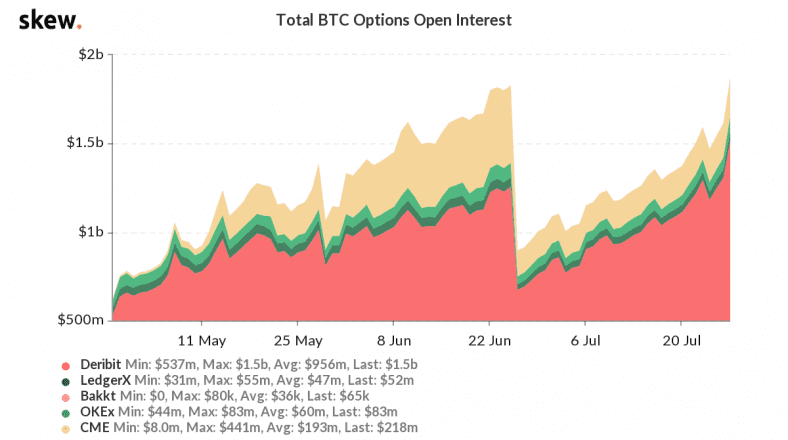

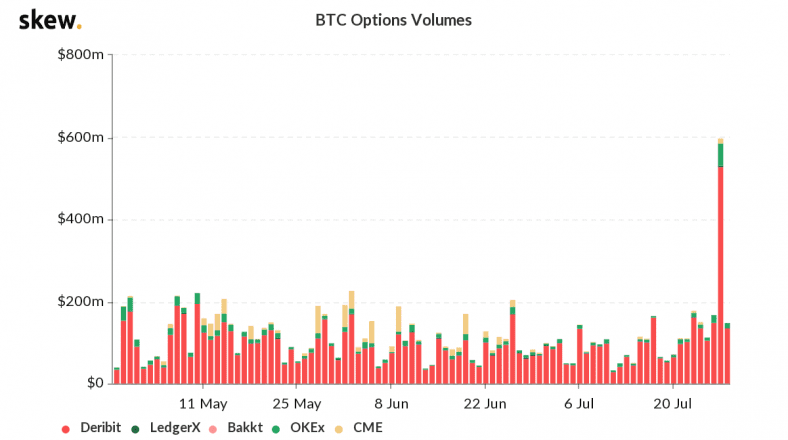

At $1.85 billion, open interest for Bitcoin options is currently at its all-time high. On Jul. 27, Bitcoin options trading volume also hit its highest ever level, with nearly $600 million of options changing hands.

Deribit, as always, is at the forefront of the Bitcoin options market, with close to 80% of all open interest and 90% of its volume.

CME‘s open interest has decreased since the last time open interest was this high, which is evidence that institutions haven’t joined this rally yet.

Record-breaking figures aren’t the most intriguing data points from the options markets.

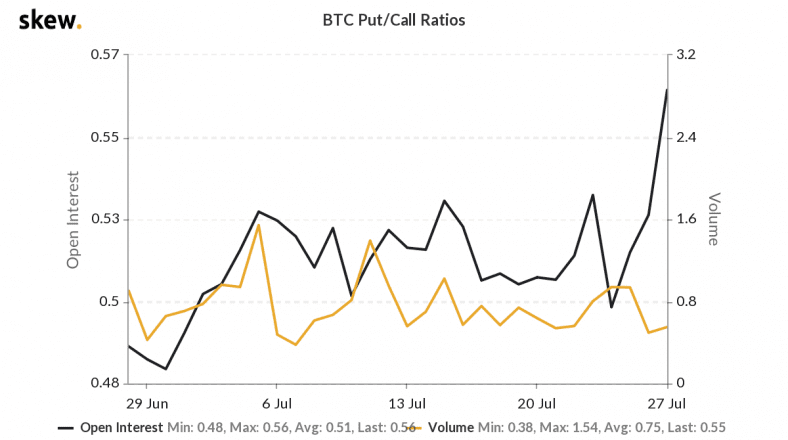

Despite Bitcoin’s explosive price action this week, bears haven’t conceded yet. From Jul. 24 to 28, BTC rose 20%, topping just shy of $11, 500. Bitcoin’s put/call ratio over open interest had a similar spike over the same period.

Bitcoin Bears Hedge Their Bets

Some of these put options are hedges from traders with excess exposure to BTC. A majority of open interest is in strike prices between $11,000 and $20,000.

Another important aspect to consider is how close the expiration date is. There are just three days until expiration, Jul. 31, where 67,000 BTC – or $720 million – worth of options will be exercised or expire.

Usually, large expirations create bursts of volatility. The increase of put options may be coming from speculators who believe this surge in volatility will result in BTC’s price decreasing.

However, last month’s expiration was worth over a billion dollars and didn’t cause any volatility in the market.

To summarize, the options market is still reasonably bullish, with some Bitcoin bears speculating on the potential downside or hedging their exposure with put options.

Share this article

Trending News