Bitcoin, Bitcoin Cash, and Bitcoin SV: A Brief History Lesson

What caused all the hard feelings that continue to linger between the Bitcoin and Bitcoin Cash communities?

With Bitmain’s return to the limelight and Craig Wright’s appearances in continuing legal drama, old Bitcoin rivalries have been flaring up again lately. The most notorious of them all remains the ongoing feud between Bitcoin and its forked brethren, Bitcoin Cash and Bitcoin SV.

For those new to cryptocurrency, the fierce disagreements between these camps may be difficult to understand. What caused all the vitriol and hard feelings that continue to linger between these communities?

This conflict stems all the way back to the original whitepaper vision of Bitcoin, conceived by the enigmatic Satoshi Nakamoto, a person or persons who, to this day, is still unknown (Yes, unknown).

Satoshi envisioned a peer-to-peer electronic cash that, through the powers of decentralization and trustless transaction of value, would avoid the corruption and manipulation that was so prevalent at the time of the 2008 economic collapse. And that has since resulted in massive “quantitative easing” budgetary problems around the world. These economic policies have caused rampant inflation and national debt through the continuous process of printing ever-greater quantities of money.

This is the heart of the conflict. The original vision of Bitcoin as a solution to the problems of corruption, centralization, and manipulation was at stake in the minds of many on all sides of the issue.

Bitcoin. It’s Always Bitcoin.

Bitcoin, in its attempts to scale and be useful as an efficient means of transaction, came up against a wall of sorts in 2017. It was an ironic problem. Bitcoin, critics feared, had become too popular for its own good. It risked not being able to handle a surge in popularity, which could result in congested mempools and inordinately high fees. Of course, these fears were warranted, as Bitcoin did indeed struggle under the pressure of its new-found popularity later that year.

As the Bitcoin network labored to keep up with extreme demand, some tried to spin the perception of Bitcoin as more of a store of value. Money could be stored safely in Bitcoin, like a digital vault, only to be drawn from in times when one wishes to withdraw a larger sum. Activities like buying a $2 coffee would simply be impractical since the transaction fee would cost more than the coffee itself and it might take hours to complete the transaction. “Lighter” coins like Litecoin, for example, could serve the needs of transacting value more efficiently and cheaply, at least until the Bitcoin network had successfully scaled to handle the increase in demand. Many balked at this idea as it violated the original vision of a peer-to-peer electronic cash, which necessitates the key characteristic of cheap and easy portability.

In anticipation of this scalability problem, developers proposed solutions. One idea was to increase the block-size of each block. The advantage of this solution was that all transactions would remain “on-chain”, as in, they would not be offloaded to another mechanism that would require some degree of trust (at least in the minds of some in the community). Keeping things on-chain was a key element of the original vision of Satoshi’s design, according to “on-chain” proponents.

Some resisted this bigger-block idea due to the concern that it would cause a greater degree of centralization. Fewer entities could hold and control the majority of hashing power of the blockchain due to the increased memory demands of maintaining an entire blockchain with larger blocks. The concept of resisting centralization was yet another element of Satoshi’s original vision, and it was difficult to reconcile this conflict with an “on-chain” solution.

Another proposed solution was entitled “SegWit” (or Segregated Witness); a solution that would reduce the demands on the Bitcoin chain by segregating transaction signatures. This solution greatly increased the transaction capabilities of Bitcoin in terms of speed and throughput, but only really started to shine once it began to be adopted on a broader basis. SegWit also enabled more possibilities of second-layer solutions and smart contracts pegged to the Bitcoin network.

And this is where things got really dicey. As SegWit was successfully implemented via a User-Activated-Soft-Fork (UASF), a backup blockchain was kept aside via hard fork, just in case there were problems. This “backup” is now essentially the Bitcoin Cash blockchain. This non-SegWit “contingency plan” was, in itself, a controversial decision that raised the eyebrows of many in the Bitcoin community, offering the opportunity for SegWit opponents to jump ship from the anticipated upgrades.

The soon to come block-size increase, however, came up against a major roadblock of disagreement. Two camps emerged; some supportive of the block-size increase and others wishing to stick with SegWit, off-chain upgrades, and the smaller block-size. Proponents of the bigger block solution resisted the concept of reliance on second-layer solutions and off-chain networks that, in their perspective, took away from the original vision of the Bitcoin protocol. By depending on layers that could theoretically require trust in a way that the original Bitcoin blockchain did not, as it was fully trustless, big-block proponents were very unhappy with this suggested solution. A great debate and passionate arguments ensued in anticipation of the controversial “upgrade”.

And Then There Were Two…

Thus, the great forking of Bitcoin took place. It’s true, forks of Bitcoin had taken place in the past, but none were of this scale in terms of community division, and no previous forks had sparked so much controversy.

Now, two Bitcoin blockchains existed with a great deal of volatile disagreement over which was the true embodiment of Satoshi’s vision: Bitcoin, or “Bitcoin Core”, as some in the Bitcoin Cash camp like to call it in order to distinguish the SegWit-enabled version from, in their minds, the original vision of Bitcoin, and the newly-dubbed Bitcoin Cash, proponents of whom identified this new coin as the “true” Bitcoin.

On the flip side, those who stood by the SegWit-enabled Bitcoin blockchain sometimes derisively referred to Bitcoin Cash as BCash in order to diminish its connection with the original nomenclature. This naming debate persists to this day and can often be seen in angry and dismissive Twitter and Reddit snipes between disagreeing parties.

In fact, it was not even certain which version of Bitcoin would retain the “Bitcoin” name on exchanges, although eventually exchanges decided to stick with the name “Bitcoin” and the ticker BTC for the SegWit-enabled blockchain and “Bitcoin Cash” with the BCH ticker for the bigger-block, non-SegWit blockchain. All holders of Bitcoin received the same amount of the forked Bitcoin Cash at a 1:1 ratio (assuming exchanges and wallets supported the fork), so the original name really could have been up in the air for a short time as it might easily have been attributed to the other blockchain if there was enough agreement.

Confusion Persists

Bitcoin Cash proponents continue to deliberately confuse onlookers by claiming the Bitcoin name as their own, even going so far, for a period of time, as to hold on to the Bitcoin handle on Twitter rather than going with a more accurately named Bitcoin Cash handle. This account abruptly and mysteriously changed hands in August this year and has since abandoned any support for Bitcoin Cash.

The same confusing nomenclature persists on sub-reddits and even on the website, Bitcoin.com, which is, in fact, a Bitcoin Cash website. If you’re looking for the actual Bitcoin website, Bitcoin.org is the place to go. The community justifies this deceptive behavior by arguing that it is their adamant belief that Bitcoin Cash is the “real” Bitcoin. This, of course, only adds more fuel to the fire of this heated controversy.

Add to the mix the further fragmentation of the Bitcoin Cash network, with the forking of Bitcoin Cash itself into two blockchains last year. One chain remained as the Bitcoin Cash fork and the other was dubbed Bitcoin SV, or Satoshi Vision. Not satisfied with the Bitcoin Cash solution, this further fork aimed to take Bitcoin way back to its original design, with the addition of greater capacity to handle enormous blocks in order to maintain a purely “on-chain” network with high throughput. After millions were spent in a highly centralized hash battle for supremacy that saw money wasted on both sides, Bitcoin SV, or BSV, failed to see the same degree of success or adoption amongst crypto users and traders.

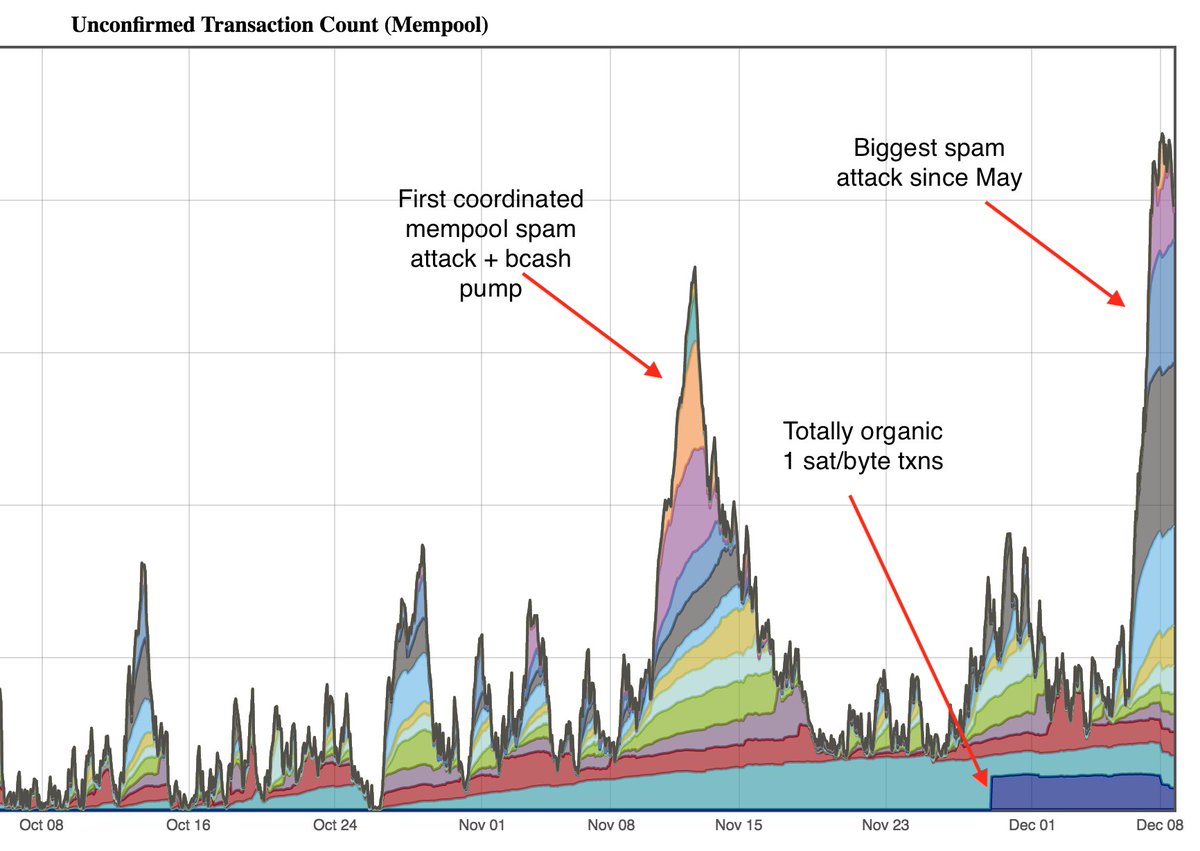

Since those early days in the existence of the Bitcoin Cash network, the influence of Bitcoin itself has grown much more dominant, whilst Bitcoin Cash has faded somewhat in significance and usage. This is partly due to the fact that Bitcoin retains a massively dominant edge in hashing power, with far greater network security and transactional usage than the Bitcoin Cash network. Even Dogecoin — a joke currency — has seen more action and has more active addresses than Bitcoin Cash has. Bitcoin’s SegWit solution has successfully reduced transaction costs and mempool loads considerably. It is often more profitable to mine Bitcoin mostly due to the higher fees that, in turn, ensure the network’s security. Still, the fees are nowhere near the insane levels endured in late 2017, when the mempool was frequently spammed, often costing more than $50 just to send a little transaction.

Security Trumps All

While Bitcoin Cash has managed to find success remaining much cheaper in terms of transaction fees, it has not succeeded in overcoming the more expensive Bitcoin network, mostly because of the unsustainably low fees and much, much lower hashing power. For example, the cost of a 51% attack for a single hour against Bitcoin Cash would cost only $72,000, whereas the same attack against Bitcoin would cost around $550,000. Bitcoin SV is even more vulnerable, with much lower hash-rates than the Bitcoin and Bitcoin Cash networks. This makes the problem of double-spending a far greater concern using Bitcoin Cash or SV than it is with the Bitcoin network, requiring more confirmations before being assured of the legitimacy of transactions. While the Bitcoin Cash blockchain has been successfully re-organized by just a couple miners and has recently seen a single miner threatening to take control of the entire network with 51% of hashing power, the same such attack on Bitcoin would be impossible. If such an attack against Bitcoin were to be successful, users, traders, and investors alike would instantly lose respect for the security and integrity of its network.

As institutions continue to enter the fray, Bitcoin will exert its dominance while rivals like Bitcoin Cash and Bitcoin SV struggle to achieve anywhere near the same degree of respect and utility in the larger community, mostly due to their security flaws. Deceptive messaging, along with the higher volatility of Bitcoin Cash prices may keep the currency around for the purposes of speculation, but it appears to be facing an inevitable demise at some eventual point in the future. Low fees and zero-confirmation transactions will do nothing to make Bitcoin competitors better than the most secure blockchain. Security trumps all other factors, and for this reason, Bitcoin is destined to remain the dominant network. In the end, it seems that you get what you pay for.