Bitcoin Risks Mining Death Spiral If BTC Price Plunges Below $3K

Bitcoin's problems might be just beginning. Further drops might cause a domino effect in the incentives that keep BTC networks running.

Bitcoin slid even further downhill this weekend, as the crypto market shed a total $17bn in market capitalization. But the problems might be just the beginning, as further drops threaten to cause a domino effect in the incentives that keep mining networks running.

The danger was first suggested in a tweet by Colin LeMahieu, Nano’s lead developer:

For PoW systems there’s an unfortunate feedback loop in price drops. Low price -> low mining rewards -> turn off some miners to lower cost -> lower hash rate -> longer transaction confirmation -> lower price.

— Colin LeMahieu (@ColinLeMahieu) November 20, 2018

“It’s not a fatal flaw though it is a bad user experience,” LeMahieu told Crypto Briefing in an email. “The issue comes when there are large swings in price.” When prices drop suddenly, he explained, transactions get slower.

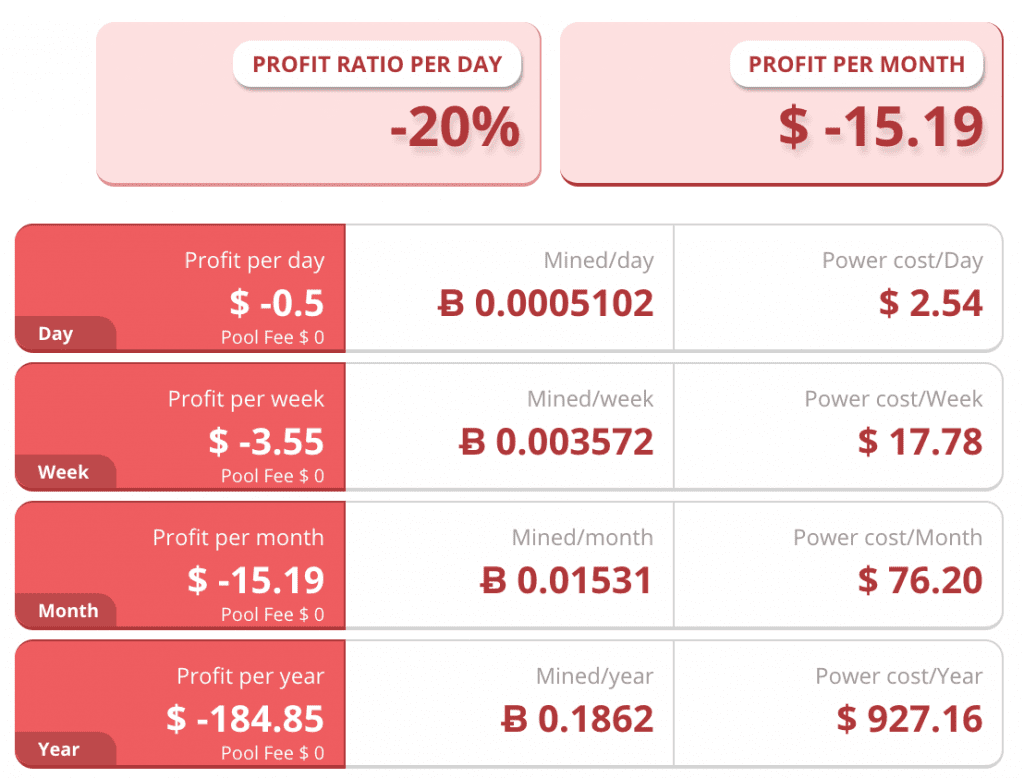

The most severe consequences of these downward pressures have yet to be felt, as mining is still profitable in countries with cheaper energy. However, that may change if prices continue to fall—and miners start to worry about their power bills.

The Mining Spiral

Here’s how falling prices could affect the fundamentals of the Bitcoin network.

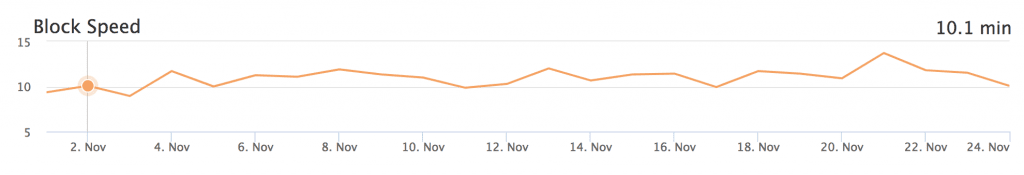

Although block mining is often regarded as a cryptographic “puzzle,” it might be better regarded as a game of darts, with each miner throwing blindly until someone hits a bullseye and claims the prize. Every two weeks, the Bitcoin network makes the target larger or smaller, to ensure that someone scores about every ten minutes.

These consensus changes work fairly smoothly in the long run, but they run into trouble when there are sudden changes in the number of players—or the value of the prize. A sudden drop in the value of block rewards might cause some Norwegian or Chinese dart-throwers to drop out of the game, leaving only a handful of players aiming at the same tiny target until the next difficulty adjustment.

But a drop in miners can compound problems further, since it now takes fourteen or fifteen minutes to mine a ten-minute block. Since the interval between difficulty adjustments is measured in block times, that two-week period could become three weeks or even longer.

Then prices drop even further, as Bitcoin users and merchants give up on a currency which has inconsistent and unpredictable transaction times—causing further price drops, and more miners to quit, thereby making transaction times take even longer.

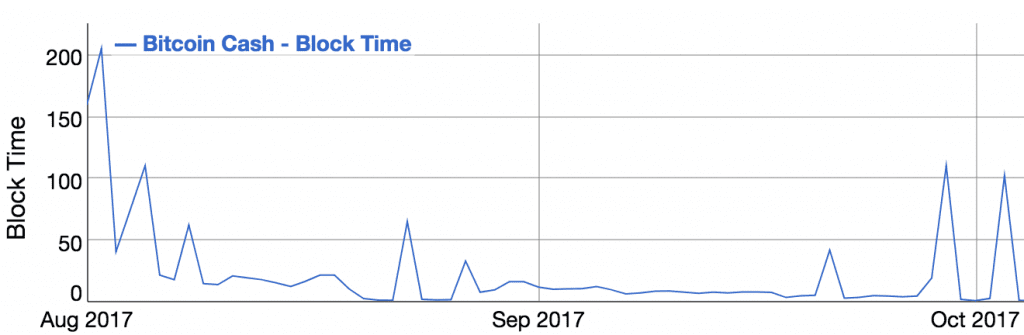

These problems aren’t just theoretical. The initial fork of Bitcoin Cash was marred by several hundred-minute blocks as the new network struggled under the previous high difficulty levels.

$3,000: Bitcoin’s Event Horizon

Despite the most recent sell-off, mining is still (barely) profitable in some wholesale energy markets. But even those profits are starting to thin, with reports of some mining installations selling their ASIC equipment “by the kilo.”

The sell-offs are likely to continue if Bitcoin prices sink past $3,000 USD – the average price of producing one bitcoin in China, where 74% of all mining occurs.

Hashrates have been slumping since October, and block times consistently exceeded ten minutes over the past month – even after a difficulty reduction on November 17th.

What Next?

It’s not quite clear how far the downward cascade could bring the price of Bitcoin. In the long run, of course, hashing power and difficulty levels would both sink until they reached an equilibrium, with rewards just high enough to sustain the remaining miners.

But in the short term it would likely deepen and protract the ongoing crypto recession, as the problems in the transaction network highlight the uncertainties of cryptocurrency transactions. For those paid in cryptocurrency–or who rely on it for cross-border remittances– it might become more attractive to go with Western Union after all.

That wouldn’t be the end of crypto, or even of Bitcoin. But it would cause quite a bit of hodler’s remorse, and justify some of the skepticism against cryptocurrency’s ability to survive as an economic system.

It would also throw a wrench into the fundamentals of the network, which has only started to assert its viability as a payment system. Depending on how big the wrench is, the engine might take a long time to fix.

The author is invested in Bitcoin, Bitcoin Cash, and Nano, which are mentioned in this article.

Earn with Nexo

Earn with Nexo