Bitcoin Investors Tested by Stimulus and Vaccine News

The crypto market is fraught despite news around a U.S. government stimulus and possible vaccine.

Key Takeaways

- The U.S. government is considering a $908 billion bipartisan stimulus proposal as a follow up to expiring relief packages.

- The FDA has released a preliminary report which finds that Pfizer and BioNTech’s vaccine is “strongly protective.”

- This news could give Bitcoin a chance to act as a hedge against inflation, though it remains a risk asset.

Share this article

Bitcoin is being tested as an inflationary hedge, as responses to COVID-19 will shape the economy over the next few months.

Stimulus & Vaccine News

Responses to COVID-19 are bound to affect the economy. A bipartisan bill for $908 billion has become the basis of the negotiation for U.S. lawmakers for the next of government stimulus. The details of the bill are expected to be released this week.

On Tuesday last week, Senate majority leader Mitch McConnell deflected on the bipartisan relief package. The Republican Party leader instead plans to pass a “target relief bill” to the tune of $500 million. Nevertheless, McConnell acknowledged that with rising COVID-19 cases and expiring relief packages, the government “[doesn’t] have time to waste time.”

The lower house of the U.S. Congress will decide on extending the current session until Dec. 18, hoping that the government makes a decision on funding a relief program soon.

At the same time, pharmaceutical companies such as Pfizer have made significant progress on a COVID-19 vaccine. An FDA report released Tuesday on Pfizer and BioNTech’s vaccine was highly optimistic. It stated that the prospective vaccine is “strongly protective.” The health department will release a statement to the public about the vaccine on Thursday, Dec. 10.

News of a vaccine will affect public policy decisions, and, in turn, the economy. However, that news does not direct address immediate needs, such as high COVID-19 case counts and high unemployment rates, which will affect the economy as well.

News Might Not Help Bitcoin

It is a widely accepted notion that economic stimulus plans are a perfect recipe for high inflation in the future—a trend that could benefit Bitcoin and gold if it occurs.

The increase in greenback supplies due to monetary and economic stimulus has hurt the value of the U.S. dollar throughout the year. The U.S. dollar index plummeted to $90.30 on Monday from highs of $104.00 in March. By contrast, gold and Bitcoin gained significant traction as an inflationary hedge during the year.

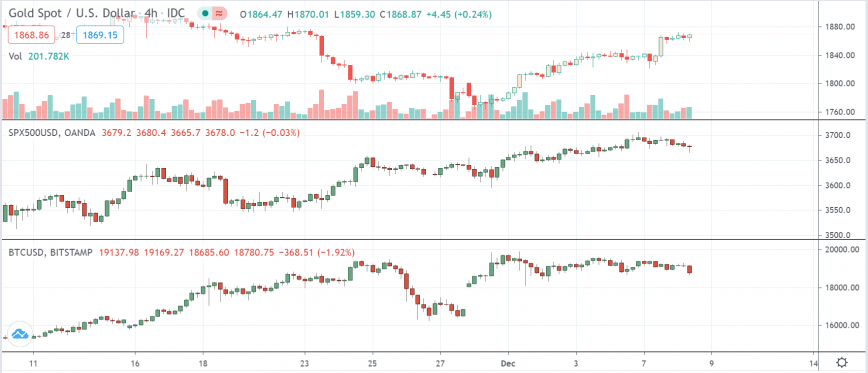

Nevertheless, Bitcoin remains a risk asset. Over the last two days, gold prices have increased by 2.1% on positive stimulus talks; Bitcoin dropped from $19,500 to lows of $18,600 during the same period.

In short, the economic downturn is starting to weigh down on risk assets. Bitcoin’s performance relative to gold and stocks in the next few months will make or break its reputation as an inflationary hedge.

Share this article