Why Bitcoin Will Not Soar In A Recession

Share this article

Economists find it increasingly likely that the US will soon experience a recession. Many Bitcoin speculators believe that the price of Bitcoin will rise in a recession, but that may be wishful thinking. Cryptocurrency behavior depends on what type of recession the economy is in. In a typical recession, Bitcoin would be sold down like any other risk asset, but it would thrive in a currency or a sovereign debt crisis. Bitcoin works as a hedge against calamity, not recession; it’s most likely to rise when there is inflation and declining trust in government.

Choppy Waters Ahead

A recession is defined as a declining economy for two successive quarters, and we may be already be seeing signs of an early sell-off: the S&P 500 lost more than 10% this October. Nouriel Roubini, one of few economists to predict the housing crash of 2008, has recently emphasized the US’ increasing financial obligations in mortgages, student loans and credit card debt. These factors, he notes, are expected to intensify the next recession, which could be worse than 2008. Roubini is confident that we will see a financial crisis by 2020.

Other factors, such as the ten-year bull run in the US equities market and the fact that the Federal Reserve has raised interest rates three times this year, suggest that the US economy could soon experience a downturn. As Forbes wrote, two things are almost certain: (1) the US economy will sink into a recession and (2) no one knows when.

Is Bitcoin a Lifeboat?

Crypto enthusiasts like Anthony Pompliano have suggested “shorting bankers and longing Bitcoin” as an anti-recession hedge. Their reasoning is that, since Bitcoin is disconnected from the financial system and negatively correlated with equities markets, Bitcoin prices will rise if equities fall.

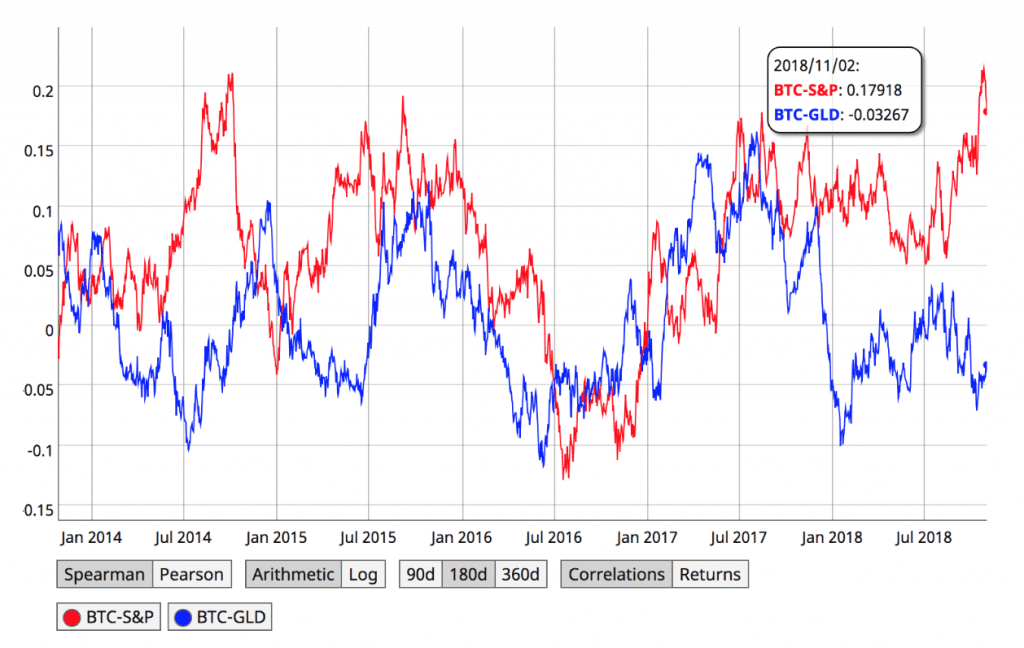

This year, Bitcoin has become increasingly correlated with the S&P 500 (see graph below). The S&P actually hasn’t been negatively correlated with Bitcoin since late 2016, and even then, the range of correlations fell between -0.1 and +0.2, indicating little to no correlation in either direction.

Bitcoin also seems to be less correlated with gold than it is with US equities: an interesting datum, considering that the “Bitcoin will rise in a recession” theory seems to be based on its similarity to gold. This, incidentally, is also poor reasoning: gold doesn’t flourish during a recession, so much as it suffers less than equities.

Although gold is a better refuge than the stock market during a liquidity crisis, neither choice is optimal.

What will Bitcoin Do In a recession?

The answer to this question depends on the type of recession as well as the conditions that caused it, as Dan McArdle of Messari pointed out. The two largest depressions in US history were deflationary, and a light-to-moderate recession is likely if history is telling.

There are two possibilities for a recession:

- Light to moderate recession (liquidity crisis)

- Sovereign debt crisis / currency crisis

In the more likely probability of a liquidity crisis, Bitcoin investments will perform poorly, but they are likely to outperform the market in a currency crisis.

A light-to-moderate recession (liquidity crisis) would be characterized by calling debts due and a flight to cash to pay off those debts. It would be hard to get loans, and people would move out of their risk assets in return for dollars to pay their debts. This move to cash decreases the value of risk assets. Bitcoin would be sold for dollars, and its price would fall in accordance with every other light-to-moderate recession to date.

Fiat’s Difficulty is Bitcoin’s Opportunity

The “bull case” for Bitcoin is when a moderate recession starts to boil over into a sovereign debt crisis or currency crisis. If the general public starts to question whether or not central banks can maintain the nation’s currency – that is Bitcoin’s time to shine.

We can look for an example of this “bull case” by comparing Bitcoin to gold (which has yet to be proven as a store of value in a time of need).

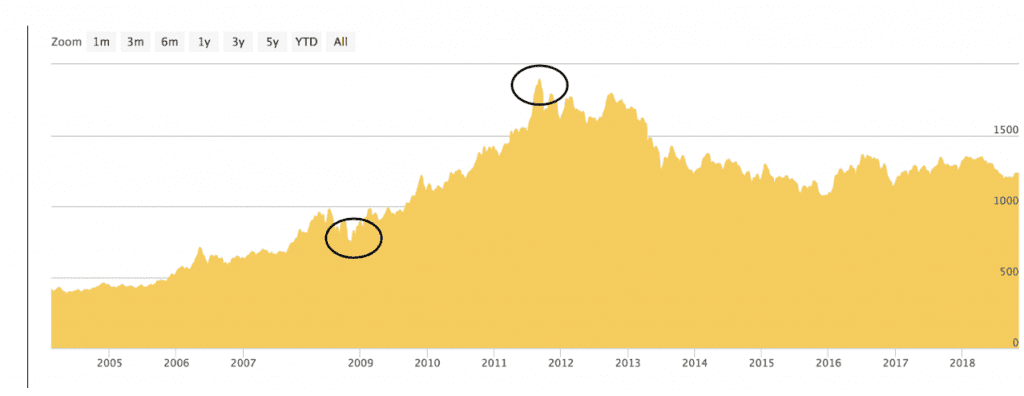

The last US recession had an initial liquidity crisis and the price of gold followed the markets when people put their money into cash to pay off their debts – following the typical cycle of a light-to-moderate recession.

The eurozone debt crisis was the world’s biggest problem in 2011, but the crisis started in 2009 when the world first realized Greece could default on its debt. Poor European fiscal policies led to concerns about the Union’s ability to keep the euro afloat, sparking a capital flight to gold. Gold reached an all-time high (see below). If we accept that Bitcoin will behave like gold as a store of value, then Bitcoin would probably perform very well in a combined recession-and-sovereign debt crisis. However, this event is much less likely than a smaller recession.

While most people think a tanking economy is good news for Bitcoin, that narrative is too simple. The most likely eventuality is that Bitcoin will perform similar to other risk assets.

That doesn’t mean that Bitcoin’s value proposition is broken; simply that it will perform differently in different types of recessions. In some recessionary scenarios, it will not be an effective hedge.

There are also scenarios where, unlike equities and cash, Bitcoin could perform well. However, a liquidity crisis in a recessionary period is not one of them, trader superstitions aside.

The idea that Bitcoin is a refuge from inflation has limited usefulness. Bitcoin has other positive attributes, including its ability to be a global digital cash that can be sent anywhere in the world within minutes. Most non-fiat productive assets are hedges against monetary inflation in the developed world; it’s time to stop propping up the myth that Bitcoin exists to save us from a recession.

The author is invested in Bitcoin and other digital assets.

Share this article