Bitcoin Regains Significant Support Level, Aims for $9,000

Volatility is back in the cryptocurrency market and Bitcoin is aiming for a move to $9,000 or higher.

Key Takeaways

- Bitcoin started off the week strong surging over $390 in price.

- The sudden bullish impulse signals that BTC could be breaking out of a pattern that estimates a 36% upswing.

- Regardless, market participants must be aware of the major resistance level that sits at $7,260.

Share this article

Over the last few hours, the Bitcoin bulls seem to have taken control of BTC’s price action. Even though a significant resistance level lays ahead, a further bullish advance seems imminent.

Bitcoin Appears to Be Breaking Out

Bitcoin has kicked off the week on the right foot.

The flagship cryptocurrency surged nearly 6% from a weekly open of $6,780 to recently hitting a high of $7,170. The sudden $390 upswing appears to be related to an ascending triangle that has been developing on its 4-hour chart since the Mar. 12 crash.

Since then, a horizontal trendline was created along with the swing highs while a rising trendline developed along with the swing lows. This technical formation is considered to be a continuation pattern that forecasts a 36% target to the upside from the breakout point.

A further spike in the buying pressure behind Bitcoin could push it up to $9,500 or higher.

This target is determined by measuring the height of the triangle at its thickest point and adding that distance to the breakout point.

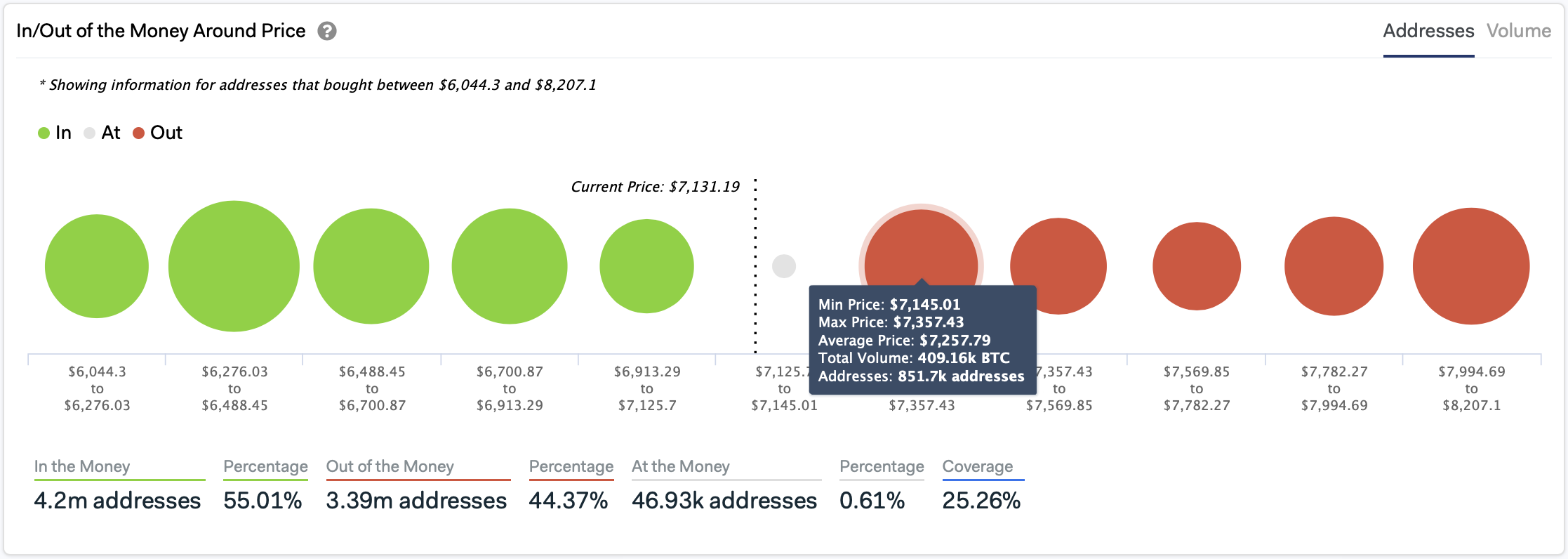

Although the bellwether cryptocurrency appears to be breaking out of the ascending triangle, IntoTheBlock’s In/Out of the Money Around Price model estimates there is strong resistance ahead.

This on-chain index reveals that there are over 850,000 addresses that bought nearly 410,000 BTC at an average price of $7,260.

Such a significant supply barrier could jeopardize the bullish outlook if enough buyers do not step in to allow Bitcoin to advance further up.

Strong Support and Resistance Ahead

Under this premise, the Fibonacci retracement indicator shows that the 50% and 61.8% Fibonacci level could help determine where the pioneer cryptocurrency is headed next.

A 4-hour candlestick close above resistance will add credence to the target presented by the ascending triangle. On its way up, Bitcoin could struggle to break the 38.2% and 23.6% Fibonacci levels. These resistance barriers sit at $8,000 and $9,000, respectively.

Nevertheless, moving below the support level could encourage market participants who are already in “extreme fear” to panic sell their holdings. The bearish momentum could see Bitcoin fall to the 78.6% Fibonacci level that sits at $5,400, or even to the recent low of $4,000.

Moving Forward

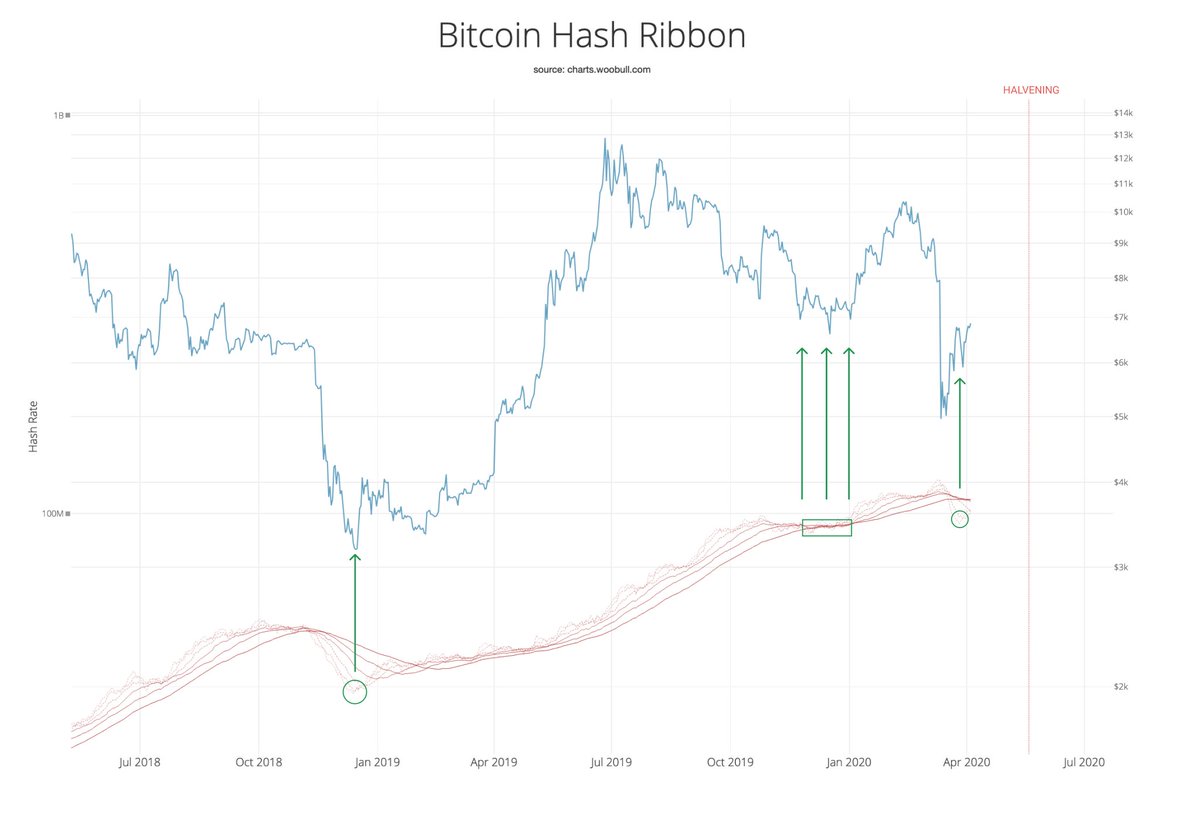

On-chain analyst Willy Woo recently stated that Bitcoin appears to have reached a market bottom based on its hash ribbons chart.

This index takes into consideration the rate of change in mining difficulty. The chartist maintains that during the recent crash, a significant number of miners capitulated and now “only the strong remain.”

Woo does not expect miners to continue to add more selling pressure to the flagship cryptocurrency even though the profit margin for minting new coins are at historic lows.

While miners appear to be discouraged from the recent price action, retail investors seem enthusiastic.

Indeed, the search volume for the keyword “Bitcoin halving” keeps accelerating and is approaching levels twice as high as those seen around the previous block rewards reduction event of 2016, according to Arcane Research.

Although this does not guarantee that the run-up to the upcoming halving will be bullish, it certainly puts more eyes on the $6,500 support and the $7,260 resistance level.

Share this article