Shutterstock cover by Paul Brady Photography

Bitcoin, Stock Markets Await Fed’s Policy Meeting

All eyes are on the Fed’s policy meeting today as markets await the U.S. banking authority's economic forecast.

The U.S. Federal Reserve will conclude its policy meeting today and release an economic forecast report pinning down expected growth and interest rates.

Markets in Anticipation

Markets globally are eagerly waiting for the Fed’s announcement on bond purchases and the timeline for increasing interest rates.

The Fed has been buying up the treasury and corporate bonds at cheap rates to provide liquidity to the U.S. economy after COVID-19. But in doing so, it has been increasing inflation and debt in its balance sheet. Since the COVID-19 recovery began, the Fed has shown no sign of slowing down purchases before early 2022.

In its last meeting, the Federal Open Market Committee suggested that it could start a discussion on tapering the $120 million monthly bond purchases “at upcoming meetings.” Any plans to slow down purchases by Q3 this year could drive down stock prices, increase treasury yields, and negatively affect the value of inflationary hedges like Bitcoin.

Moreover, the Fed sets the base interest rate to lend money to other banks. An increase or decrease in this rate causes huge shifts in the economy as borrowers readjust their investment strategies. For instance, if the Fed were to increase interest rates at this point, the treasury yields would spike, and investors would likely dump stocks for high-yielding bonds. This is a similar effect to bond purchase tapering.

The Fed’s Dot Plot and Chairman’s Address

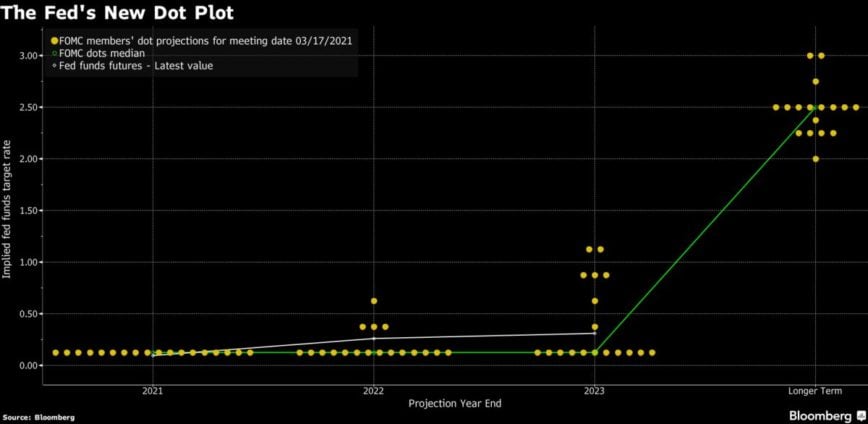

Two important things to watch out for are the Fed’s Dot Plot of its economic forecast and the tone Fed chairman Jerome Powell sets for global markets. Powell will address the media after the meeting.

The Board of Governors and the regional presidents quarterly fill out the projections for this year, the next two, and the long-term projection beyond 2024. The aggregate results are published on the FOMC “projected appropriate monetary policy” table and plotted as the “Fed’s Dot Plot,” which has been key in driving market sentiments.

According to last quarter’s estimate, the Fed has no plans to increase rates before 2024. However, this time, more dots on higher values for the year 2023 could worry risk-prone investors.

The annual consumer price index, a proxy for inflation, projections reached 5% for all items and close to 4% excluding food and energy last month, the highest in a decade.

How Powell addresses inflation is crucial. Until now, the Fed has planned to continue the purchases for the better part of this year. Moreover, in last quarter’s address, Powell said that the Fed would “not seek inflation that substantially exceeds 2%.”

Bitcoin’s Reaction to Macro View

Recent activity suggests that the market does not expect a change in the Fed’s stance before August’s Jackson Hole Economic Symposium. The recent bullishness in stocks and the weakness of the dollar have exhibited this trend.

On the other hand, Bitcoin and the rest of the crypto market have largely remained non-correlated with traditional assets.

Over the last year, Bitcoin’s correlation with the stock market has been stronger than gold. But the magnitude of the correlation since last year has been weak at around 0.26 (a correlation above 0.5 is considered a strong positive correction). The one-year daily correlation with gold was 0.2.

Overall, many analysts have inferred that Bitcoin price moves are independent of the stock market and commodities, but driven by adoption. Nevertheless, the cryptocurrency has exhibited an impulse reaction to macro announcements in the past, and COVID-19 significantly shaped its investment thesis.

Some hedge funds have started to view Bitcoin as an appropriate inflationary hedge. Still, the price volatility has helped it perform closely to stock markets as a risk-on asset.

Bitcoin and gold have been moving in opposite directions since last month. At the same time, the S&P 500 and NASDAQ 100 indices recorded new highs.

Bitcoin’s reaction alongside gold and the stock market after Fed’s announcement could be a strong indicator of its short-term narrative as an inflationary hedge or risk-on asset. BTC has tumbled just below $40,000 today, last trading at $39,183.