Why Are Institutions Paying Top-Dollar For Grayscale's Bitcoin Trust?

GBTC Premiums hit 45% back in early April.

Share this article

Institutional investors are paying high premiums for shares of the Grayscale Bitcoin Trust (GBTC), which allows them to bet on Bitcoin (BTC) without holding the asset itself.

GBTC is an investment vehicle which tracks the spot price of Bitcoin, providing investors from mainstream finance with a familiar means to gain exposure.

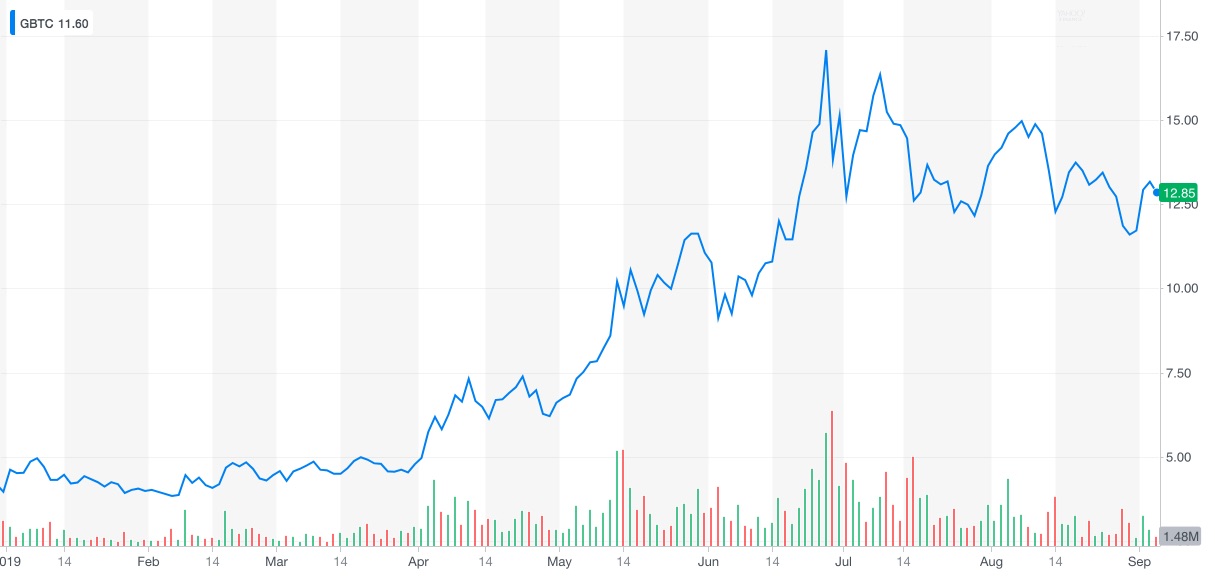

At the time of writing, the market price for GBTC shares was $12.85. With each share tracking the value of 0.00097753 BTC, the underlying value of each share is actually $10.48, at current prices.

By investing in GBTC, investors are paying a premium of 22.6% for Bitcoin exposure.

This premium reflects an increasingly prevalent reality, according to Ryan Alfred, President of Digital Assets Data, a cryptocurrency data provider. Most people, especially those on Wall Street, are accustomed to custodians holding their assets for them, Alfred explained.

“The premium is the amount you’re willing to pay to not custody your own private key, and still get exposure to the underlying,” Alfred said. With more than $2.6bn worth of Bitcoin under management, there are plenty of investors willing to accept the tradeoff.

GBTC is basically “a single-asset index fund” which runs at a premium, in addition to annual fees of two percent. Having first launched in 2013, Grayscale has first-mover advantage and remains one of the few trusted providers in the space.

However, “no institutional would pay this in any other asset-class”, said Alfred. The fact that cryptocurrency is still a fringe asset to most investors, with few alternatives, allows premiums to reach such high levels.

“There’s a lot of latent, almost quasi-institutional demand for Bitcoin that’s being met by this vehicle,” added Alfred. But new GBTC shares are only created in private placements, and there is no ongoing creation or redemption process.

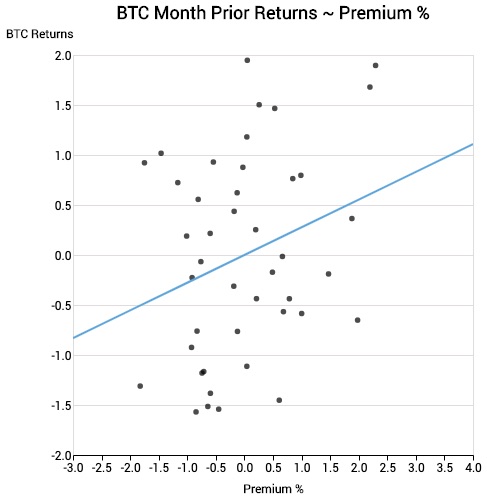

Inelastic supply means that demand can quickly outstrip the number of available shares, ramping up the premiums even further. GBTC is “generally momentum-driven,” added Alfred, trading higher after Bitcoin has a strong price performance.

The BTC price has increased by $7,000 since the beginning of 2019, and GBTC share prices have grown by nearly 180%. Although premiums usually fluctuate between twenty and thirty percent, they surged to 46% above the underlying in the week following the Bitcoin boom in early April.

High premiums are a bullish signal, Alfred says, and show that demand for Bitcoin among institutional investors is currently unfulfilled. The launch of the VanEck-SolidX Bitcoin Trust earlier this week – which includes an ongoing creation and redemption process – will likely improve Wall Street’s exposure to cryptocurrencies, creating a more liquid market in the process.

“[Crypto] is increasingly a non-spot driven market,” Alfred noted. Derivatives volumes are already exceeding those on conventional cryptocurrency exchanges, another sign that the market is becoming institutional-led.

“When there’s a real [Bitcoin] ETF that trades every day with no premium, demand could really increase,” Alfred added.

Crypto purists – the Andreas Antonopouloses of the world – might baulk at the fact that investors are paying more not to hold onto their private keys. But attracting new investors into requires compromises. Investment vehicles like Grayscale’s Bitcoin Trust allow large investors to buy-in to the crypto economy without the technical overhead and risks of managing custody.

Share this article