Bitcoin And Bonds: Why Are These Two Assets Moving Together?

The trend appeared earlier this year.

Bitcoin (BTC) is often described as “digital gold”, but it could soon be described as “digital bonds.” New data suggest an interesting relationship developing between Bitcoin and the yields on government-issued debt.

As the graph below highlights, Bitcoin (blue line) appears to have developed a negative correlation to the yield on two-year U.S. Treasury Bonds (yellow line) in Q1 2019. This development coincided with Federal Reserve Chair Jay Powell reversing the Quantitative Tightening policy which he had tentatively pursued since Q3 2018.

As Crypto Briefing previously reported, investors are increasingly concerned about the long-term effects of Quantitative Easing. A return to cheap money may have spurred a move into safe-haven assets, such as bonds or (possibly) Bitcoin, in anticipation of a recession or even a collapse in confidence in fiat currencies.

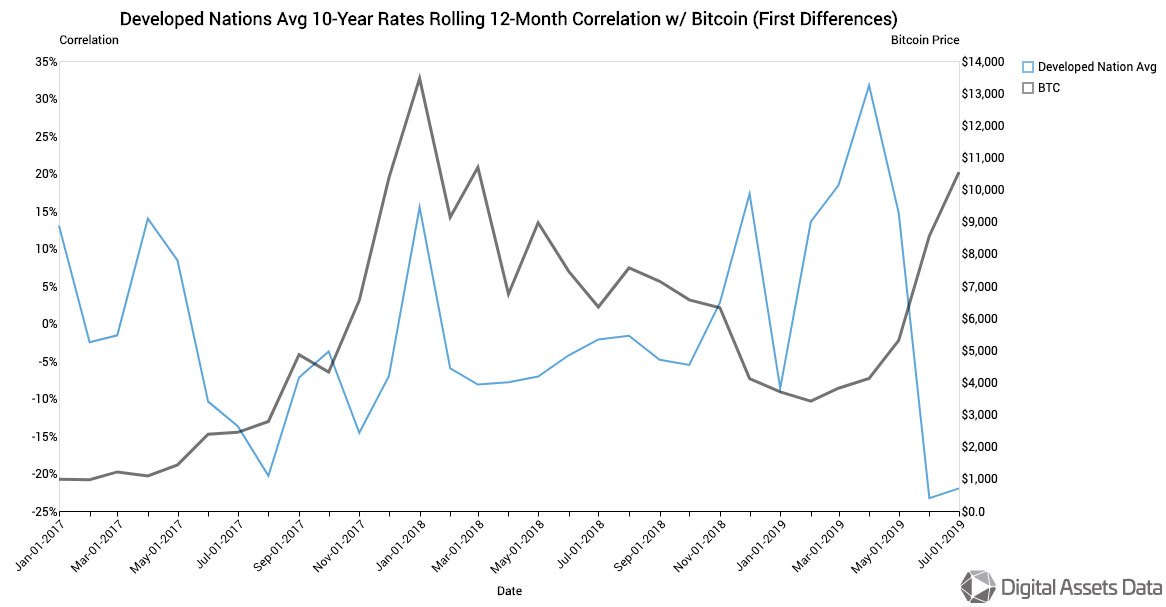

A similar trend is found with bond yields from other high-GDP countries. Analysts from Digital Assets Data have determined that on a rolling 12-month period, a “decidedly negative relationship” has developed between Bitcoin and average 10-year yields from developed countries (including the U.S.) across Q2 2019.

Bond yields and bond prices have an inverse relationship, with a low yield indicating high demand. Because bonds are safe-haven assets, yields usually fall during recessions, particularly in developed countries with a low risk of default.

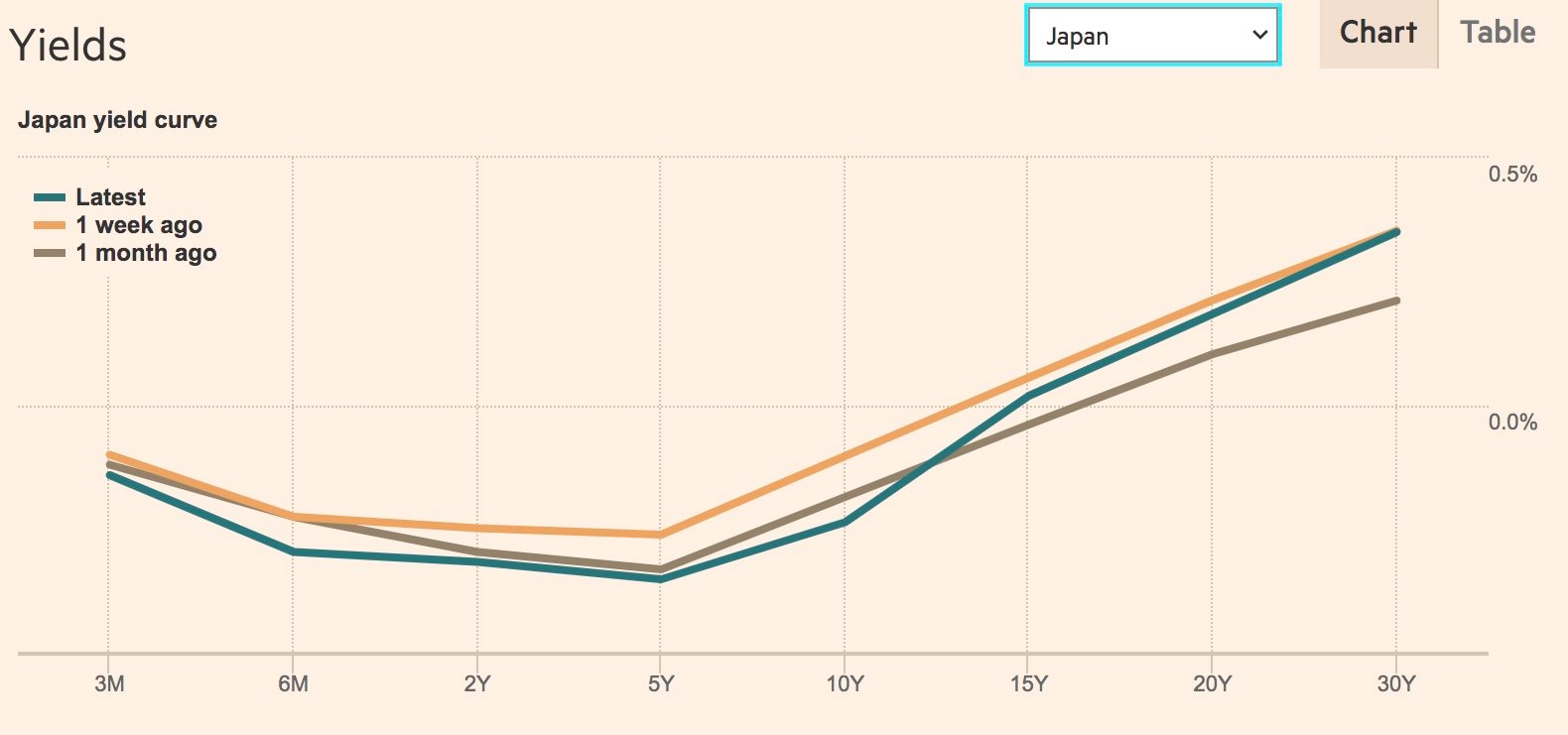

Since 2008, yields on bonds issued by Switzerland, Japan and the Eurozone have fallen to historically unprecedented levels. In some cases, yields have even been negative, meaning that investors are actually paying interest to lend money to the bond issuer.

Bitcoin’s price recovery during Q2-Q3 coincided with a decided drop in bond yields from developed economies, against a backdrop of fears of a recession. It could be a sign that investors are purchasing both as stores of value, anticipating a global economic downturn.

“We are seeing more alignment,” said Kevin Kaltenbacher, Data Scientist at Digital Assets Data. Fears of a global economic downturn have “tended to be bullish for Bitcoin,” he added. If the slowdown continues, the two assets might develop a still closer relationship.

The relationship with bonds appears to have developed as the asset was repositioned from ‘digital cash’ to ‘digital gold.’ Although originally launched as a peer-to-peer payments solution, technical limitations have seen Bitcoin’s use-case evolve to take advantage of a low correlation with traditional markets.

The broader investor community has “started to take notice of this asset class, seeing [Bitcoin] as a safe haven and store of value type of asset,” Kaltenbacher says,which could align it closely to bonds. Although it’s still too early to tell whether this will develop in the long term, he says, it could become a “fairly resilient narrative”.