Bitfinex launches ‘implied volatility’ perpetual futures for Bitcoin and Ether

The new contracts track how fast (or how slow) Bitcoin and Ether move in either direction over 30 days.

Bitfinex Derivatives, the derivatives platform operated by iFinex Financial Technologies Limited (Bitfinex) has launched two new perpetual futures contracts set to track the implied volatility of Bitcoin (BTC) and Ether (ETH) options

The announcement comes as Bitfinex seeks to expand its suite of trading tools in response to its perceived surge in the crypto market’s volatility. According to Bitfinex, implied volatility in this offering “measures the constant, forward-looking expected volatility in the options market.”

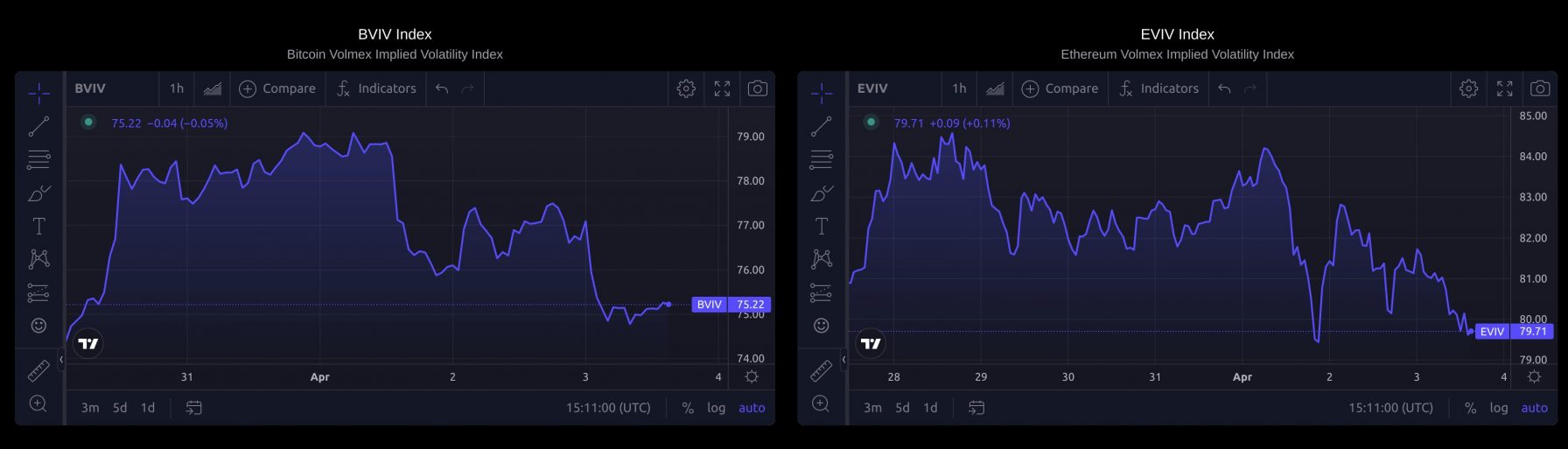

The new contracts are based on the Volmex Implied Volatility indexes: the Bitcoin Implied Volatility Index (BVIV) and Ethereum Implied Volatility Index (EVIV). These indexes track the 30-day expected volatility of BTC and ETH options contracts. Volmex Labs licensed the indices for Bitfinex, enabling Bitfinex to use them for the new perpetual futures offering. The BVIV and EVIV are the first crypto volatility indices in the industry.

These new perpetual futures contracts will track the 30-day expected volatility of Bitcoin and Ether options based on the indexing methodology developed by Volmex Labs, and are claimed to be capable of being traded with up to 20 times leverage.

“By measuring the market’s expectation of future price volatility, the BVIV and EVIV contracts are essentially tracking ‘fear’ in the market of expected price movements in Bitcoin and Ether when the market is fearful and, generally, the expensiveness of the relevant options contracts,” Bitfinex said in a press statement.

Jag Kooner, head of derivatives at Bitfinex, emphasized the significance of these new offerings. Kooner claims that the indices enable Bitfinex Derivatives users to “not only monitor but actually trade the implied volatility of Bitcoin and Ether in a simple perpetual format.”

Perpetual futures, also known as perpetual swaps (perps), are derivative contracts that allow traders to speculate on an asset’s future price without an expiration date. Kooner noted that perpetual futures are the “most tradable format in the crypto space,” as they do not rely on a dated structure like other contracts.

The funding rate mechanism in such a format helps keep prices for perpetual prices synced to the underlying asset or index (BTC and ETH, in this case). With the new volatility futures, Bitfinex users can now bet on anticipated bullish or bearish price movements.

In this format, betting with long volatility correlates with the asset’s price movement based on how violently it changes over a specific duration. When investors anticipate significant price fluctuations, volatility rises; conversely, when the expectation is for muted price movement, volatility contracts.

Cryptocurrency volatility reached all-time highs in March 2024, with the Crypto Volatility Index (CVI), a “market fear index” for the crypto market, peaking at 85 points on March 11. This spike in volatility occurred just two days before Bitcoin reached its historic high above $73,000 on March 13. Currently, the CVI measures implied crypto volatility at around 76 points.