Betting On Augur: 8 Reasons To Be Bullish On REP

<a href="https://www.augur.net/"><span style="font-weight: 400;">Augur</span></a><span style="font-weight: 400;"> (REP) will be the talk of the cryptocurrency community when they go live on the Ethereum mainnet on July 9th, 2018.

Augur (REP) will be the talk of the cryptocurrency community when they go live on the Ethereum mainnet on July 9th, 2018. Augur, known by most for being the decentralized “betting market”, is more than just that – it is a decentralized prediction market and oracle service that wants to use the wisdom of the crowd to create a complete and accurate forecasting platform. Its token, REP, is a layer-2 crypto asset (layer 1 being the protocol layer) that sits on top of Ethereum.

Augur’s Co-Founder, Joey Krug, sees a world where one day asking Siri “Who will win the 2020 presidential election in the US” will return results that say “according to Augur, John McAfee has a 47% chance to win the 2020 presidential election”.

A platform user has the ability to create a prediction market for any event in the world and market makers can buy shares in the outcome. For example, I could make a market on “Who will win the World Cup?”

The theory behind Augur is that crowdsourcing information increases accuracy, but there is a caveat – it is not the mere number of forecasters, but rather the number of informed forcasters. Having appropriate incentives (financial) for forecasters to predict outcomes increases the accuracy.

In the case of Augur, users are rewarded for buying shares for the correct outcome, and are therefore incentivized to forecast with all available information. It is expected that only the most informed individuals will risk their money when making a prediction, and more informed forecasters will provide more accurate predictions over time, so therefore the share prices of prediction markets will accurately reflect the real-world possibility that said outcome will occur.

Augur’s purpose is to democratize and decentralize finance by creating a global, frictionless and highly liquid prediction market. The team recognizes that there are three main problems with the financial system today:

- Segregation: There is little unity among financial markets geographically.

- Capital Intensive: Expensive to create a new market – making a market is a privilege that only the wealthy and well-connected have (e.g. a firm on Wall Street).

- Expensive: Trading fees are quite high. Financial market fees are quite reasonable, but fees can be 10%+ on profits in sports betting for example.

There we have three main barriers to a complete market: segregation as well as fixed and variable cost hurdles.

Two examples of what Augur could do beyond sports betting are:

- Investment Freedom: For example, if you live in China and you want to invest in the US stock market you need to open a trading account with an international broker that is registered with the SEC. There are many online brokers, but there are high fees associated. Augur would allow your average Chinese citizen to purchase a share pegged to the price of $APPL.

- Hedge Against Previously Undiversifiable Risk: A farmer in Chile, where 100% of his yearly revenue is dependent on adequate rainfall, can hedge against the risk of drought by creating a market related to the amount of rainfall in Chile that year. This concept of a state-contingent claim makes it possible to arrange a risk portfolio for the farmer with any conceivable payoff vector. A simple example: In perfect conditions the farmer makes $1M USD. In a drought the farmer makes $0 USD. The farmer needs $200k USD to support his farm and family through to the next season, and has no cash on hand for a contingency fund. The farmer can create a market on Chilean rainfall where he will make $200k USD in a drought, but lose his principle in good weather conditions. The farmer therefore creates a payoff vector from $200k USD to < $1M USD (depending on the market rates). He protects his downside by limiting his upside to support his family and keep his business afloat.

The project was founded in 2014 and issued an Initial Coin Offering (ICO) from August to October 2015, raising a total of $5.3 million USD by pre-selling 80% (8.8 million REP) of the total token supply. The remaining 20% was allocated to the project team. This was one of the first projects to build on top of Ethereum, and the launch is long-awaited.

Is this a glorified gambling platform?

I do believe that the first mainstream adoption for Augur will surround sporting events, such as Major League Baseball game outcomes, but Augur aims to become a complete market to hedge against world events as a prediction market. The success of this depends on user adoption, which is a circular dependency on blockchain/crypto adoption in general, but I believe Augur is poised to have more on-chain transactions and daily active users (DAU) than any other Ethereum dApp as of right now. That’s not saying much – as of June 1st, only 4 dApps on Ethereum had more than 500 DAU (Bancor, CryptoKitties, IDEX, and ForkDelta) – but it gives Augur a competitive advantage.

There is sound research that supports what Augur is doing:

The University of North Carolina (UNC), Oxford University, and Joyce E. Berg (professor at University of Iowa) have all done studies indicating that prediction markets provide superior forecasting for event outcomes than traditional forecasting methods.

Economist Friedrich Hayek wrote an influential paper in 1945 called “The Use of Knowledge in Society” in the American Economic Review. His paper outlined that prices are information and that knowledge is decentralized among people (i.e. a group of 5 people has more combined knowledge that any one specific person in that group), therefore planning and control over resources should be decentralized. He summarizes by arguing that more ways to price things (anything) makes for a more efficient economy in terms of economic coordination.

Kenneth Arrow and Gerard Debreu (the same duo that came up with the infamous Social Welfare Function from ECON101) ended up winning a Nobel Prize for their idea of “complete markets”. A complete market has two conditions:

- Negligible transaction costs (therefore perfect information)

- Pricing for every asset in every possible state of the world

The idea of a complete market is that the ability to speculate on anything makes the economy more efficient because you can hedge against certain risks and make bets that you otherwise wouldn’t be able to make. Augur’s idea is to create this type of dynamically complete market (can enter and exit self-financing strategies) for the first time by enabling cheap financial markets that expand globally.

Is Ethereum the right platform for Augur?

I believe that, as of right now, Ethereum is not the proper platform for Augur to be operating on. This is a quote from Augur’s June 6th development update:

“We will be putting out some content soon regarding average transaction prices and features that should be expected with the v1 launch. It will be a bit expensive and limited to the throughput of Ethereum, however, it will work “

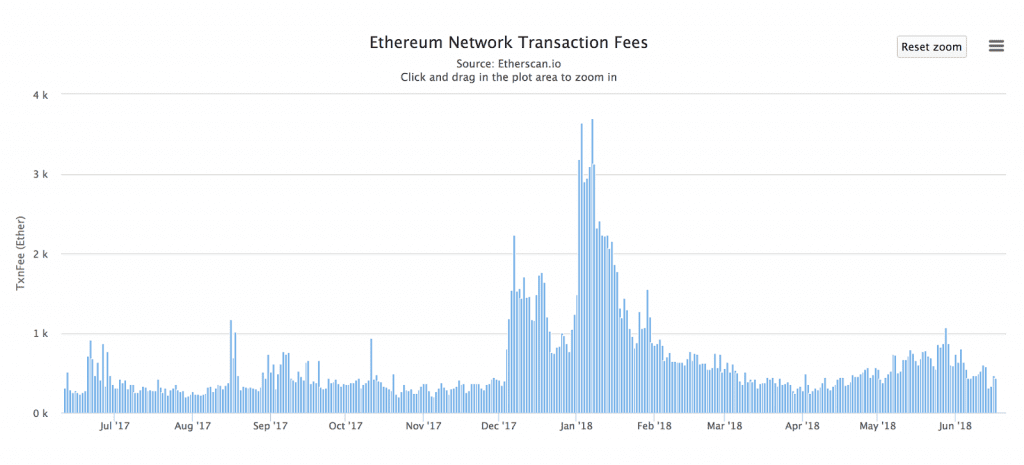

If Augur has a goal of being a complete market, where a prerequisite is negligible transaction costs, does it make sense to continue in the long term on a platform that has low DAU, but high (and rising) transaction costs? Transaction costs on Ethereum are rising (with only 4 dApps having more than 500 DAU) and significant more on-chain traffic is coming.

Augur (REP), Golem (GNT), and Decentraland (MANA) are all close to launching major features of their offering on Ethereum. It makes more sense for Augur to be on a chain with free transactions to facilitate a complete market.

Data from etherscan.io

8 Reasons Why I am Bullish on Augur (REP)

- Oracle Problem:

Augur’s solution to the oracle problem is the most novel, realistic and decentralized that I’ve seen. An oracle is the source of information for a smart contract – it provides a smart contract with the necessary inputs to execute. For example, telling the smart contract “Donald Trump has become president of the United States of America”. The oracle problem refers to the inherent centralization of an oracle.

A major problem for betting platforms on the blockchain is that there is always a single point of failure. For example, if there is a market for the outcome of an MLB game, and the smart contract fetches information from MLB.com, then MLB.com is the single point of failure, and this is no longer a decentralized system. A nefarious actor could infiltrate the server and change the outcome of the game to satisfy the smart contract in a way where they are rewarded financially.

An oracle can also be a single person, but who’s to say that person can’t be identified and bribed to falsify their reports? Code is law on Ethereum, so therefore whatever the oracle reports is law and cannot be reversed. There is a lot of risk to have this pivotal responsibility in the hands of one person or one server.

Augur decentralizes the oracle function, where token holders are all able to stake REP to report to smart contracts. Token holders are incentivized to report correct results, because they risk losing their tokens if they don’t. To simplify a more complicated incentive structure: those who report correct results share the tokens of those who reported incorrect results. A token holder must respond to a smart contract within a certain time period.

- Team:

Joey Krug, the co-founder of Augur, is one of the most forward-thinking people in the crypto space. He has been active in crypto since 2010 and he’s only 22 years old. He’s also joined on as the Co-Chief Investment Officer at Pantera Capital since finishing the back-end development of Augur, which is one of the largest crypto hedge funds in the US.

Another thing that I really like about the team is that they operate as a bootstrapped startup. They are one of the few projects in crypto that have did an ICO and still worked out of a garage in Palo Alto, CA for several years, which is a breath of fresh air in an industry that has capital inefficiency problems where projects raise millions of dollars and spend lavishly with poor capital allocation plans. The team works 100% remote now, but it’s clear they place value on lean startup methodologies.

- Token Economics:

As an analyst I like to invest in tokens that have a reason to hold them. Their token economics need to “make sense”. A holder of REP is entitled to oracle fees, which are shared pro-rata among those who participate in the reporting system each week. As a token holder, your “dividend” is in oracle fees, which are that you can earn by participating in the Augur reporting system. These dividends are generated through market fees. A REP holder is not simply holding the token based in the hope that it will go up. It is cash generative (even though I don’t think it should be modeled that way for valuation purposes).

- Competition:

I have analyzed competitors of Augur that are decentralized (Gnosis, Stox, Bodhi and Mevu) and centralized (PredictIt) prediction markets and I believe that Augur has the largest addressable market and is the most competitive.

Gnosis uses a (mostly) centralized oracle system with an overly-complex token economic policy (which is an added level of friction for adoption) and Stox requires that all of its markets be denominated in its native token, STX, while also being built on Ethereum. Bodhi, built on the QTUM blockchain, is in my opinion their closest competitor, but they have reach mostly in Asian markets as of right now. Mevu is focused on the niche of sports markets.

In terms of centralized prediction markets I believe Augur has fundamental structural advantages such as global liquidity, a potentially better fees structure (lower fixed costs), and no counterparty risk.

- Real Use Case:

It’s a unicorn when you find a working project that uses blockchain technology, and community members are very excited to finally have a solution like Augur to eliminate counterparty risk in betting and in online markets.

- Pantera Backing:

There is a chicken and egg problem for platforms like Augur. Augur needs liquidity to attract users and users want liquidity to use Augur. Krug announced when he was joining Pantera Capital that one of his motivations was to ensure liquidity on the Augur platform by using their war-chest of capital. He noted that the #1 reason for startup failure is product-market-fit and partnering with Pantera can inject capital to meet the liquidity requirements to start these markets.

- History:

Augur was one of the first high-profile ICOs in this space, and they have a loyal following that has made a lot of money from their ICO. One of my theories about Ethereum being “too big to fail” is that they have such a loyal following that has followed the project since inception (and doesn’t plan on leaving); and that it remains loyal because they have had 1000x returns on their investment. I believe similar comparisons can be made to Augur.

- Low Barrier to Entry:

Participating in an Augur market could be the first time that someone interacts with a blockchain or uses cryptocurrency, and I believe this low barrier, low friction path of entry into blockchain and cryptocurrency is extremely important for the industry as a whole. I haven’t seen an in-depth go-to-market strategy from Augur’s team, which is an extremely important consideration that I will be paying close attention to. Let’s compare blockchain to the Internet as a proxy: most people first started using the Internet because of an application that provided them utility (i.e. email, Facebook, instant messaging, Google searches, etc.). Augur is a chance for the same thing to happen in crypto.

- Market Potential:

The size of the online gambling market alone is over $50 billion. A speculator can do their own math on what fraction of that they think Augur can capture to do their own valuation, but the market size of one portion of Augur’s target market is immense.

Some have tried to value REP as a cash generative asset, which I don’t agree with, and I have done my own valuation of Augur and remain bullish at the current price point based on the valuation assumptions I made. I have also done analysis on historic price reactions on tokens in the 6 weeks leading up to their go-live, and remain bullish that Augur could increase in value if the coin follows similar trends.

In a previous article I wrote about a framework to analyze the most likely next Coinbase listing, and REP was a probable token to be listed. I believe this hypothesis still holds (even with the ETC listing) as Coinbase has yet to add an ERC20 token. A Coinbase listing could give REP the liquidity, access and familiarity it needs to be the killer application that the crypto industry has been waiting for. I believe Augur will need to prove its legitimacy before Coinbase considers a listing (in alignment with my analysis in my previous article), and regulation needs to be more clear.

It is important to note that there is significant risk associated with purchasing REP tokens. I am not a lawyer, but REP is not licensed as a gambling entity in any jurisdiction that it operates in, so there are legal questions to be answered. It is unclear if Augur will be regulated as a prediction market, or as an online gambling platform, so the regulatory landscape has an impact on REP more than it does for other assets in crypto. Although, the legalization of sports betting in New Jersey looks to be a positive sign for the outlook of Augur operating in the United States.

Disclaimer: The author holds assets in various cryptocurrencies, but not REP.

This article has been updated to note that the company is now operating remotely, and to clarify token economics.

Earn with Nexo

Earn with Nexo