Can Bitcoin Cure the Zombie Economy?

As markets detach from real economic activity, some analysts have labeled the next financial era as "zombie-like." With this in mind, could radical solutions like Bitcoin finally prove their worth?

Key Takeaways

- Pandemic money printing is set to create a zombie economy.

- Global monetary measures are placing downward pressure on the value of top fiat currencies.

- Could Bitcoin become the only sound money left standing?

Share this article

As financial markets around the world show unusual bullish signals, many analysts have begun to comment on a decoupling of real economic value and a so-called “zombie economy.”

And as fiat currencies are raised from the dead to serve balance sheets, could cryptocurrencies like Bitcoin offer a genuine alternative?

Unprecedented Times Call for Unprecedented Printing

Central banks worldwide have embarked on unprecedented monetary policies in the wake of the coronavirus pandemic.

The Trump administration’s stimulus package plus the Federal Reserve’s quantitative easing program has seen the world’s largest economy flooded with an eye-popping $6.2 trillion.

The Fed has all but guaranteed that this support will be indefinite and infinite.

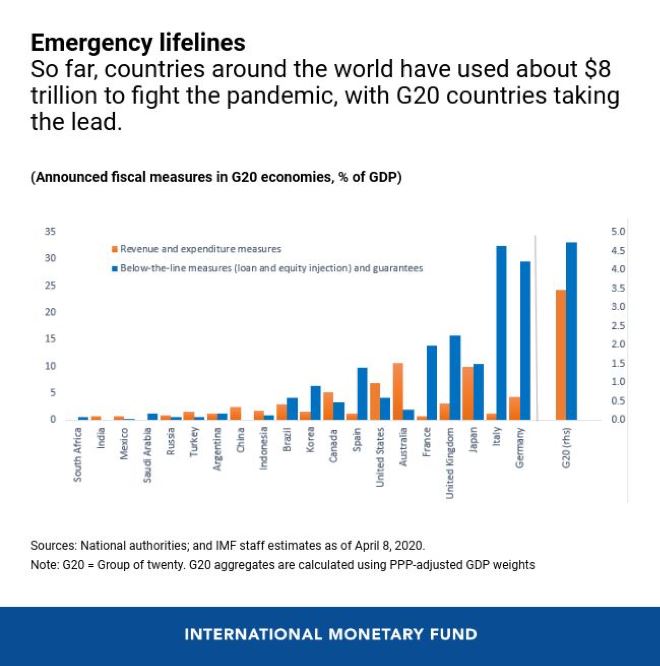

Governments and their central banks around the world have followed suit. Stimulus packages, excluding the Fed’s programs, amount to a combined $8 trillion. The moves come as G20 leaders have pledged to do “whatever it takes.”

The measures dwarf those taken in the wake of the 2008 financial crisis and are closer in scale to programs from the Great Depression.

Fiat Currencies Showing Signs of Distress

As reported by Forbes, the initiatives are already having an impact on national currencies, with the world’s reserve currency, USD, down 4%. Many currencies face mounting pressure as safe-haven assets become increasingly scarce.

A contributor to the outlet, Billy Bambrough, argued:

“Potential risks of the combined cross-party rescue bill and Fed’s biggest-ever bazooka include out-of-control inflation, the dollar’s displacement as the world’s funding currency, and the complete destabilization of the U.S. financial system.”

With interest rates hovering near zero worldwide, and unemployment figures set to soar as the full impact of the COVID-19 lockdown reveals itself in economic data, some are arguing things will never be the same.

Exit the Free Market, Enter A New Normal

Deutsche Bank strategist George Saravelos said that the American financial measures can be better understood as the Fed taking over capital markets.

The analyst argues that by guaranteeing endless asset purchases with an infinite supply of easy money, central banks have effectively entered an era where the state controls asset prices.

In a scathing rebuke of the regulators’ easing measures, Saravelos wrote:

“In a matter of weeks policymakers have become a backstop for private-sector credit markets. At the extreme, central banks could become permanent command economy agents administering equity and credit prices, aggressively subduing financial shocks. It would be a bi-polar world of financial repression with high real economy volatility but very low financial volatility. A ‘zombie’ market.”

Saravelos’ criticism is very much a mirror of Satoshi Nakamoto’s famous genesis block message. The anonymous creator of Bitcoin inscribed the following on Bitcoin’s first-ever mined block:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

The message was a headline from the British publication, The Times, and is often cited as the primary rationale behind Bitcoin. The article reports on the banking industry bailout in 2008.

With a programmed hard cap of 21 million, Bitcoin, unlike fiat currencies, cannot be printed in greater quantities at will.

This is why runaway inflation could easily cause a rush to crypto as currencies face a period of rapid debasement. Central bank actions now will almost certainly cause asset bubbles too, as they did in the previous period of printing press-fueled exuberance (which barely had a chance to reach its conclusion).

Many in the traditional financial world have already connected the dots.

A former Goldman Sachs fund manager has argued that the “coronavirus crisis will cause history’s worst insolvency event.” He moved 25% of his portfolio to Bitcoin.

Ari Paul, co-founder and chief investment officer of BlockTower Capital, tweeted on Apr. 2 that he hadn’t seen “this much organic new interest in bitcoin since early 2017 in my non-crypto circles. Got pinged by 3 separate old friends I haven’t spoken to in years about buying their first BTC yesterday.”

The Looming Apocalypse of the Zombie Economy

Should Saravelos’ fears come to fruition, the global economy faces a situation wherein asset prices are propped up by governments and not any underlying supply and demand forces.

At the foot of those price distortions, the general public will be living in real economies where their sovereign currencies are continually debased by centralized supply expansions designed to breathe life into lagging economies.

The zombie economy threatens to become the new norm.

And highly volatile economic activity that fails to be reflected in tightly controlled financial markets will likely cause untold harm.

Mati Greenspan of Quantum Economics told Forbes:

“What we’re witnessing here is nothing less than the death of capitalism and birth of something new. It’s quite fascinating, really.”

When capitalism dies at the hands of its most prominent proponents, all bets are off as to what the future holds. The zombie economy could be at our doorsteps. The escape route may, or may not, be Bitcoin.

One thing is, nonetheless, for sure: Fiat’s days are numbered.

Share this article