Chainalysis finds pump-and-dumps in over half of 2023 DEX Ethereum listings

These manipulation schemes made up just 1.3% of all DEX trading volumes on the Ethereum blockchain.

Share this article

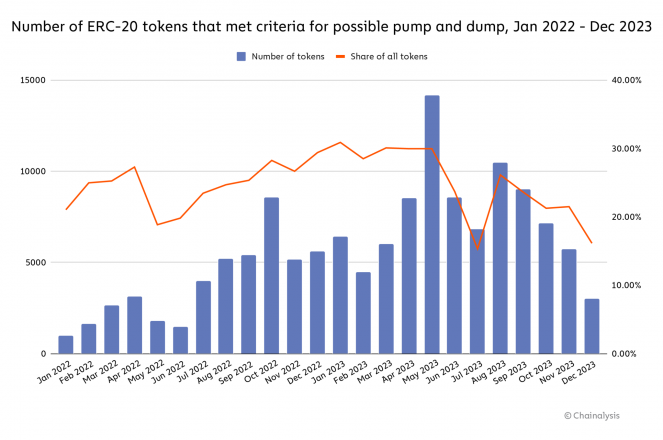

A new report from blockchain analytics firm Chainalysis suggests that 53.4% of ERC-20 tokens listed on decentralized exchanges (DEXes) in 2023 exhibited signs of potential pump-and-dump schemes.

In total, around 90,408 tokens out of over 370,000 launched on Ethereum last year met the firm’s criteria indicative of pump-and-dump tactics – where bad actors artificially inflate the price of an asset before dumping their holdings for a profit.

Per the report, the total profit accumulated from the 90,408 probable pump-and-dumps was an estimated $241.6 million last year. However, on average each token only netted around $2,672 for the perpetrators.

Chainalysis also highlighted that these likely manipulation schemes accounted for just 1.3% of all DEX trading volume on Ethereum in 2023 – though evolving technologies remain under-monitored terrain for such tactics.

To identify suspicious activity, Chainalysis looked for tokens that were purchased multiple times by unconnected DEX users, suggesting some traction. The criteria also included tokens that had over 70% of liquidity removed by the largest holder within weeks of launch and currently have less than $300 in liquidity, indicating minimal trading activity.

While meeting these criteria does not confirm illicit behavior, they allow investigators to pinpoint patterns requiring further scrutiny. These tactics can leave everyday investors with near-worthless assets after prices collapse post-dump.

Share this article