Chainlink Must Reclaim $25 as Support to Avoid Bigger Losses

Chainlink has been under pressure lately as large investors book profits.

Key Takeaways

- Chainlink has breached the $25 support level.

- On-chain data shows that the most significant interest area ahead sits at $20.

- While whales continue to book profits, the odds for lower lows increase.

Share this article

Chainlink has lost a significant demand barrier as support, while whales seem to have gone on a selling spree. Given the lack of support underneath LINK, investors must prepare for further losses.

Chainlink Is Under Pressure

Chainlink whales have been offloading their holdings.

Behavior analytics platform Santiment reveals that the number of addresses with 10,000 to 10,000,000 LINK has significantly declined over the past few days.

Roughly 30 whales have left the network or redistributed their tokens since Aug. 23.

The recent decrease in the number of large investors behind Chainlink may seem insignificant at first glance. Still, these whales hold between $240,000 and $240 million in LINK. Such a spike in selling pressure can translate into millions of dollars.

Further increase in the sell orders could lead to more losses, especially when considering that Chainlink has no significant support barrier underneath it.

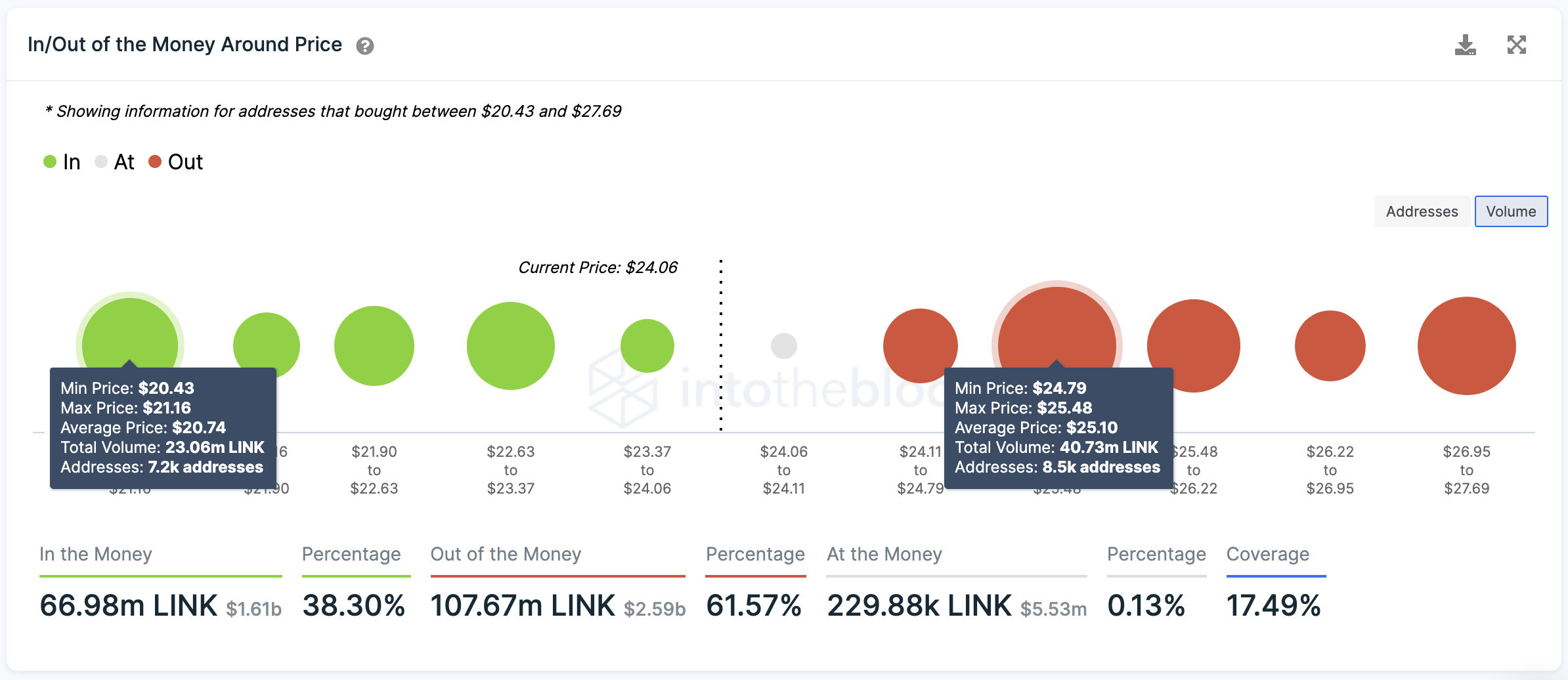

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that the only considerable demand barrier lies between $20.40 and $21.20. Around this price level, roughly 7,200 addresses had previously purchased over 23 million LINK.

On the other hand, the IOMAP cohorts show that Chainlink could have a difficult time recovering the losses incurred. More than 8,500 addresses are holding nearly 41 million LINK at an average price of $25.10.

Such a critical supply barrier may have the ability to absorb any upward pressure. Holders who have been underwater could try to break even on their positions, slowing a potential recovery. Therefore, only a decisive daily candlestick close above it could serve as confirmation that the bearish outlook will be invalidated, leading to an upswing toward $27.

Share this article