Coinbase IRS On The Side Of Caution

Three months after Coinbase was ordered to hand user records over to the IRS, their team has unveiled their latest improvement. The Coinbase tax tool should help basic users track gains and losses to help with tax preparation - but isn't compatible with the GDAX exchange.

Three months after Coinbase was ordered to hand user records over to the IRS, their team has unveiled the latest improvement to the popular exchange: the Coinbase tax tool should help basic users track gains and losses to help with tax preparation – but isn’t compatible with the GDAX exchange.

Although there is still some uncertainty over exactly how taxes should be calculated, the IRS is clear on one thing – converting cash into virtual currency is a taxable event.

The tool, aimed at US customers, allows users to generate with a single click a report that shows all the transactions associated with their Coinbase account. This was announced in a blog post on Medium, after repeated reminders last year that Coinbase users need to remember to pay their taxes.

The blog post offers three steps to calculating taxes; generating a report of detailed transactions, calculating gains and losses, and then filing them with the help of a professional.

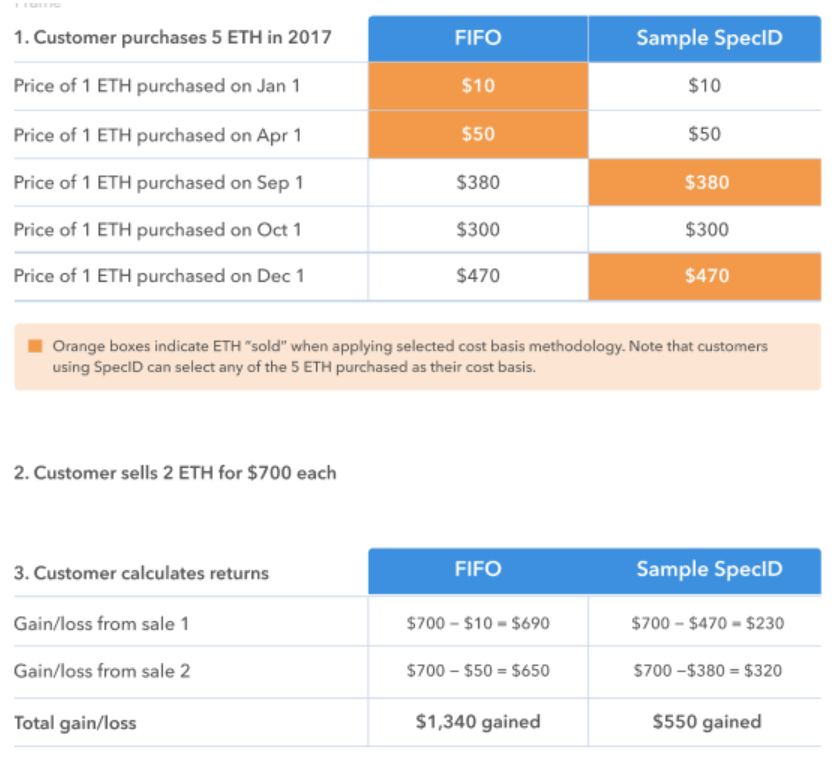

The difficulty is that the IRS offer no standard guidance for applying your cost basis to individual sales or exchanges of digital assets, so Coinbase has offered two approaches: FIFO and SpecID methodology:

- First in first out (FIFO) — This method assumes that the first assets you purchased are also the first assets you sold or exchanged. Your gain/loss is calculated based on the price you paid for the oldest assets in your portfolio, and the asset price at the time of sale or exchange. This is the most common approach for traditional investments.

- Specific Identification (SpecID) — This method relies on investors to specifically identify to their tax professional the assets they sold or exchanged. This is also a common approach for traditional investments, but requires significant effort from the investor.

An example of gain/loss calculation with each methodology

With the current uncertainty around crypto asset classification, and lack of specific guidance on taxes, this is all that Coinbase is currently able to provide. When an appropriate classification has been determined, or a new asset class defined, then we can expect to see further guidance from the IRS on tax, and more sophisticated tools for calculating it from companies like Coinbase.

In its current state the tool is likely to be most useful for newcomers who use Coinbase exclusively, but it is unlikely to offer much utility to those who only use it as a fiat gateway: It cannot provide information on transactions completed on other exchanges, even those of its parent company GDAX:

“Remember, this report only details transactions associated with your Coinbase account. In order to create a complete view of your digital asset investments, you will need to download similar reports from all other exchanges you have used”

Coinbase is not the only company to offer a tool to help calculate tax, is unique in that it offers it free of charge. Individuals that use a range of exchanges can find more comprehensive tax calculations from companies like Bitcoin.tax, and CryptoTaxPrep.