Bitcoin Bloodbath: From Dark Clouds to Silver Linings

The sell-off may not be all doom and gloom.

Share this article

On-chain analysis and developments among payments platforms suggest the Bitcoin bloodbath may yet have a silver lining.

True Believers Hodl On

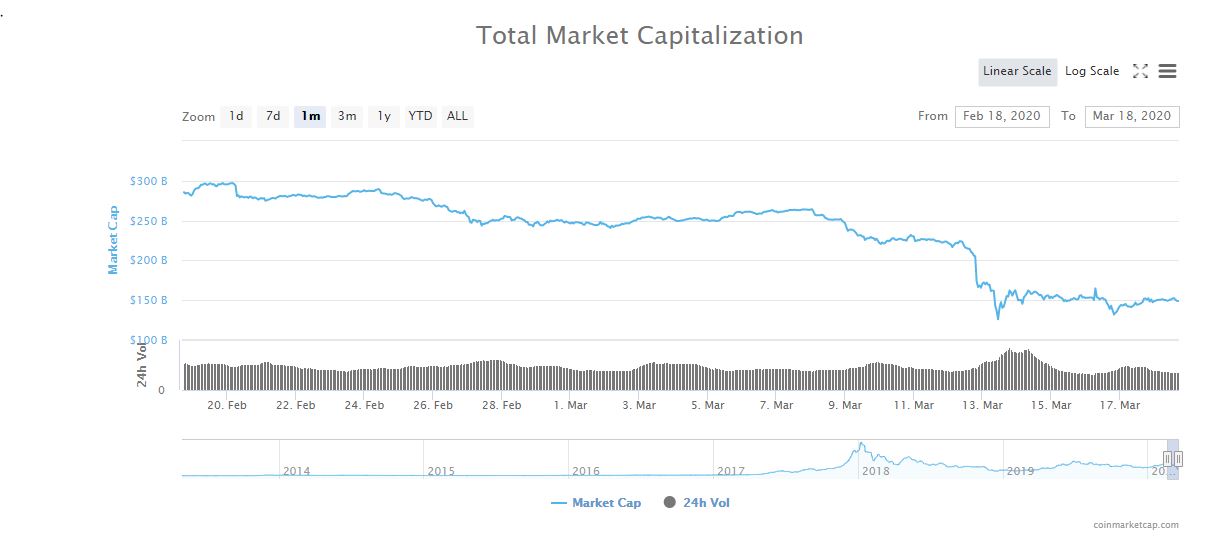

Fears of widespread economic decline due to the coronavirus pandemic led to a broad market sell-off last week in both equities and crypto markets which continued into this week.

Both sell-offs were harsh, but crypto was a bloodbath.

The total market cap was around $290 billion on Feb. 24, but by Mar. 13, it had fallen to $126 billion.

On-chain data suggests that long-term holders of Bitcoin elected to hold onto their crypto, rather than sell into the bloodbath.

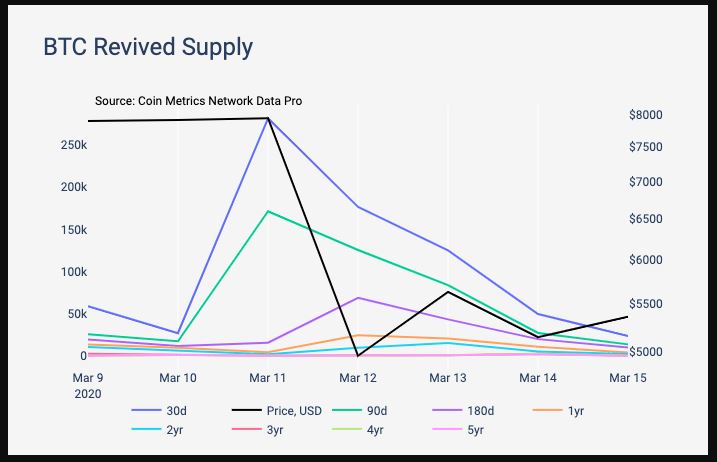

Coin Metrics data found that on Mar. 11, 281,000 Bitcoin that had been held for at least thirty days were traded. Of those, just over 4,000 BTC had been held for at least a year.

The figures suggest that a mere 1.5% of Bitcoin traded during the frenzied bloodbath were long-term Bitcoin holders. Most of the trading was in Bitcoin held for less than a year.

While new Bitcoin holders were selling as prices plummeted, old Bitcoin largely stayed put.

The Crypto-Curious See Bloodbath as Opportunity

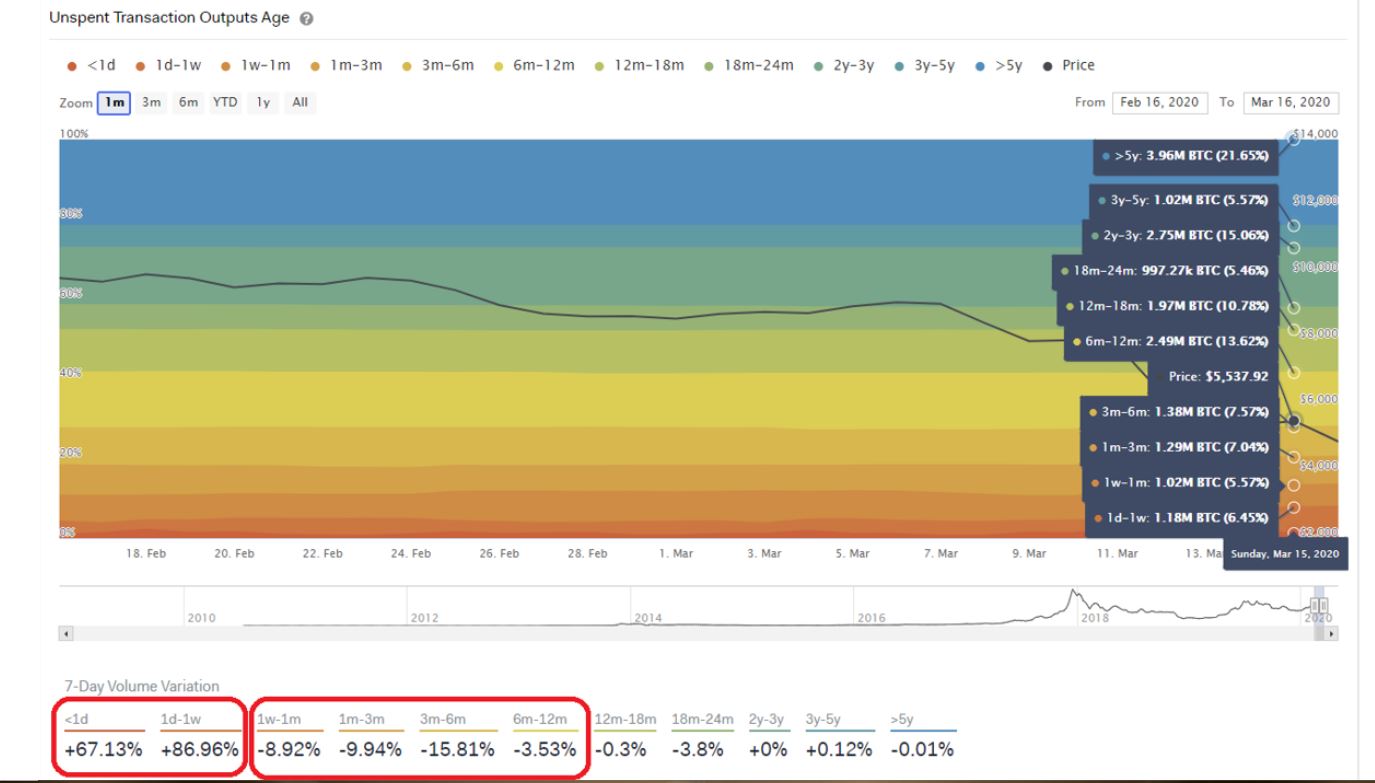

Other on-chain data support these findings.

Into the Block analysis supports the narrative that young, 1- to 12-month-old Bitcoin was sold off, while the number of new entrants soared, as judged by the number of new UTXOs.

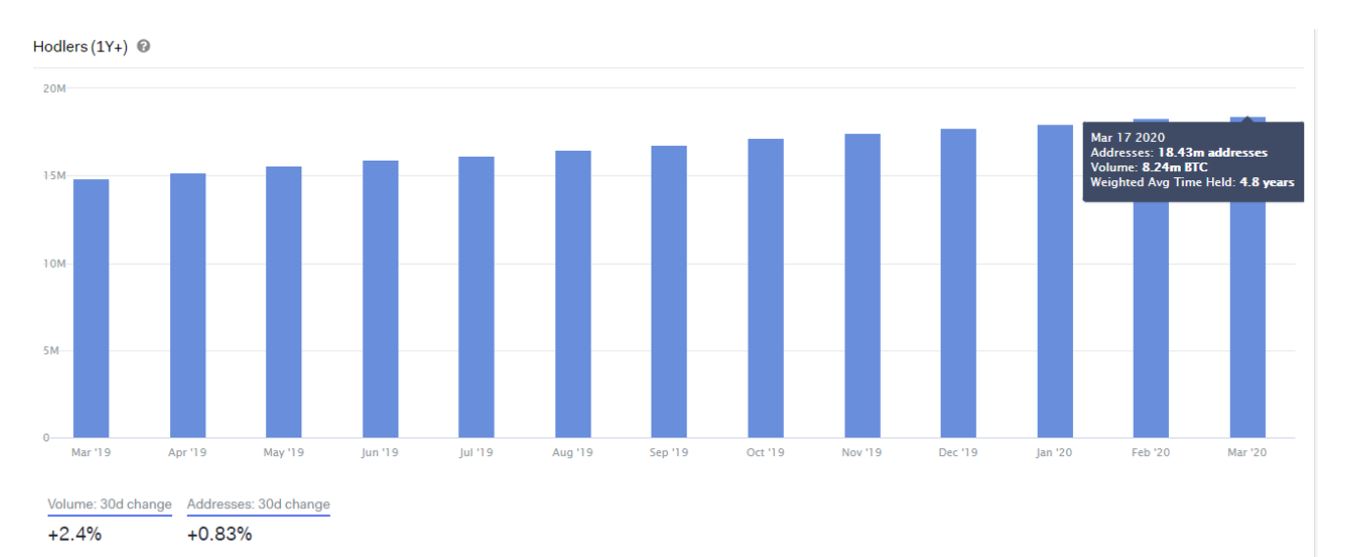

The analytics firm also found that the number of long-term Bitcoin holders had reached all-time-highs, again suggesting that short-to-medium term investors fueled the latest sell-off.

The data points to a more nuanced insight into the drivers of the sell-off.

Long-term true believers and new entrants into the market were holding and buying Bitcoin, respectively, as short-to-medium term Bitcoiners were selling.

Payments Processors Make Onboarding Easier

At the same time, online wallet providers and payments processors announced updates which would make crypto easier to buy and spend.

Wyre, a bridge between fiat currencies and cryptocurrencies, partnered with Opera to allow US users to buy Bitcoin and Ether through debit cards and Apple Pay.

Paxful and Localbitcoins already support crypto payments through Apple Pay, and Wyre’s Opera feature has already been available in Scandinavia for over a year. According to Head of Crypto at Opera, the browser company has a long-term goal of making blockchain technology about more than just speculation:

“Allowing our users to easily load cryptocurrency into their browser’s digital wallet is very powerful, as it connects the Web to a global internet-native payment network.”

Coinbase announced yesterday that its crypto-funded Visa debit card could now be added to users’ Google Pay wallets, enabling mobile payments. The service went live in over a dozen European countries.

On Mar. 16, Crypto.com announced that its Visa-backed metal debit cards, already available in Asia and the US, were set to begin shipping to Europe. Crypto Briefing reached out to CEO Kris Marszalek, who further confirmed that retail demand was rising amid the sell-off:

“We’ve seen massive retail demand during the last week’s sell-off, with platform transactions hitting an all-time-high two days in a row. It’s a clear indication that cryptocurrency users believe this asset class will rebound faster and harder than traditional markets. In fact, unlike in 2018, the confidence in the retail market is higher now than on the institutional side, which suffered steep losses on the over-leveraged derivative platforms. Long term HODLers understand that Bitcoin was made for a crisis like this one: it’s the hard money we need in times of unprecedented quantitive easing.”

With a slew of new payment developments aligning with renewed interest in crypto and the true believers holding on, the clouds hanging over the bear market may yet have a silver lining.

But Is That the Whole Picture?

There have been some unsubstantiated claims that institutional investors were behind the sell-off, with fund managers needing to liquidate their holdings.

While intuitive, there has been limited data to support this.

Crypto Briefing reached out to Zac Prince following BlockFi’s announcement that it would raise BTC and ETH Tier 1 interest rates from Apr. 1.

If institutional investors, likely representing the bulk of borrower demand on BlockFi’s platform, were liquidating, crypto deposit interest rates should be facing downward, and not upward, pressure.

Prince said that “it’s hard to say precisely, but we think that there has been a supply reduction (in the amount of assets available to be lent) more so than a demand rise (more borrowers entering the market) in the institutional crypto lending market.”

BlockFi’s insights suggest a more nuanced picture than the simple proposition that institutions are selling and retail investors are buying.

The data related to the age of the Bitcoin being traded during the latest crash reveals three insights: long-term holders continue to hold; new entrants are buying; and medium-term traders are causing the bulk (over 98%) of the selling pressure.

Some of that selling likely relates to institutional investors, but not all of it. According to Into the Block, large transactions accounted for less than $34 billion worth of volume over the past 7 days. That is the equivalent of current 24-hour volumes.

Given BlockFi’s interest rate adjustment, demand for non-stablecoin crypto remains robust, if not growing.

Concluding, Bitcoin has clearly lost the safe-haven asset argument, at least for the time being. One cannot argue that the crypto bloodbath exposed how markets currently view the number one digital asset.

There does, however, seem to be a silver lining. The evidence suggests interest in Bitcoin has seen an uptick and that it enjoys a base level of price support from long-term holders.

Time, as always, will paint the full picture.

Share this article