Crypto Market Weakens But Bottom Feeders May Stay Hungry

Share this article

The cryptocurrency market has opened the new trading week under pressure on Monday, with almost the entire top twenty cryptocurrencies by market capitalization trading into the red.

No clear fundamental catalyst appears to have provoked the latest crypto sell-off, although there has been speculation over bot trading; the market however appears to have succumbed to technical selling after a period of consolidation amongst the major players in the market.

Ethereum, Litecoin and Maker are amongst the worst performing cryptocurrencies, while Tether and USD Coin have managed to eke out small intraday days so far.

As always, it is always worth watching the market leaders, particularly Bitcoin, Ripple and Etherem for a better indication of whether today’s losses in the cryptocurrency market are indeed sustainable and likely to worsen or potentially just a early-week knee-jerk reaction to flush-out weaker hands before a counter move occurs.

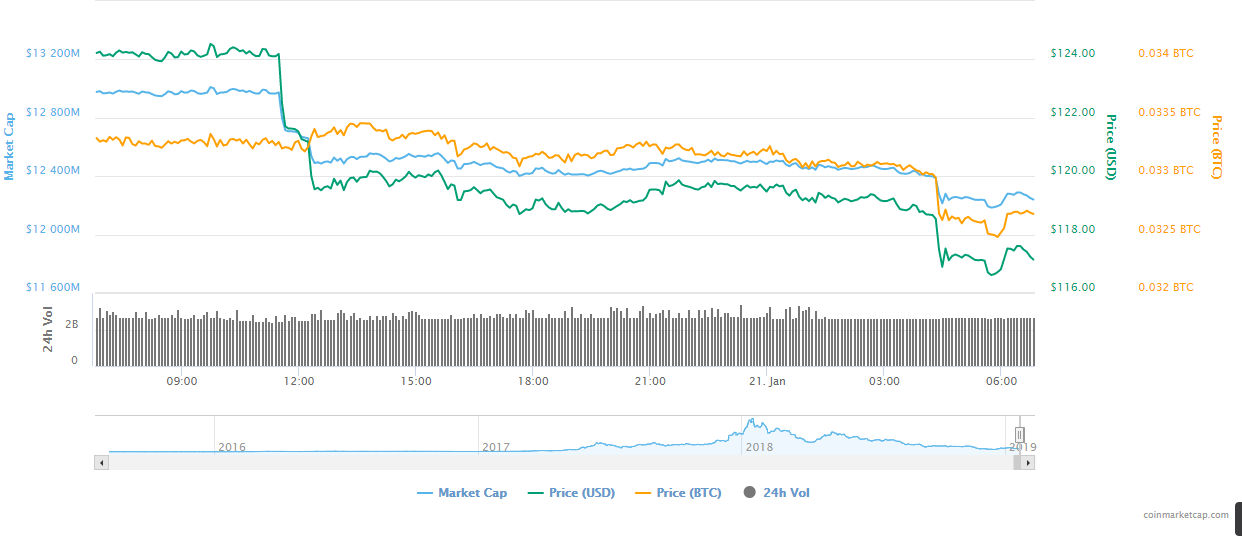

Ethereum 1-DAY Chart Source-Coinmarketcap.com

Overall, I suspect we are now seeing market participants attempting to probe towards the multi-year lows created by a number of the most popular cryptocurrencies late last year.

Technically, confirmation of a major bottom is important for traders, especially given the lack of follow through to the early month recovery seen in the crypto space.

If we do indeed see a sustained decline below the multi-year lows created in December for Bitcoin, Ethereum and Litecoin alike, this should be considered an overwhelmingly bearish sign. A further continuation of the broader downtrend in cryptocurrency market would then be the most likely and favoured scenario over the short and medium-term horizons.

On the other hand, if we see these key technical lows holding firm, I would expect cryptocurrencies to rally back towards their 2019 trading highs over the coming days and weeks, where traders would then to start to re-evaluate short and medium-term positioning.

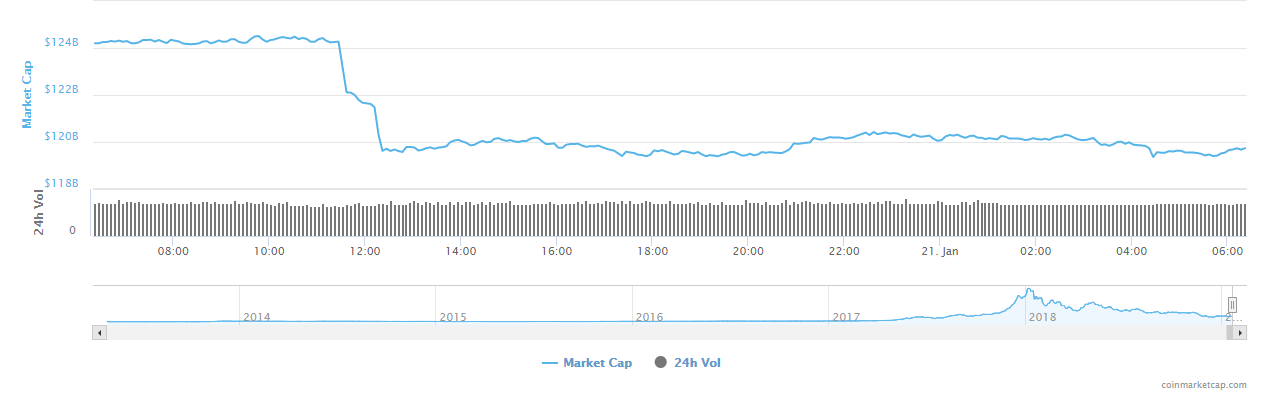

Looking at a one-day chart of the Market Capitalization of the entire cryptocurrency market, we can observe a sharp sell-off occurred, on relatively light volume it must be said, once the $124 billion support level was breached.

The $17 billion to $16.9 billion support region is the next major technical area to watch if selling continues for the entire crypto market, with the recent major low just above $10 billion, created mid-December, the foremost support area below.

Going forward, a break of $19.5 to $24 billion range is indeed worth watching, for traders and investors to get a broader gauge of the overall sentiment towards cryptocurrencies, as is a technical break of $3,100 to $3,660 price range for the number one cryptocurrency by market capitalization, Bitcoin.

Decentral Media, Inc., the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any transaction. You should never make an investment decision on an investment based solely on the information on our website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an investment.

Share this article