Crypto Prime Broker TROY Trade: Institutional Investors Will Prefer DEXs

TROY Trade offers traders liquidity across exchanges.

The prospect of institutional investors makes the crypto industry go all tingly inside. Deep order books and market liquidity mean many centralized exchanges have expanded their offerings to cater to the needs and requirements of professional investors – but TROY Trade, the ‘first’ prime broker in the industry, aims to leverage decentralized exchanges for the same audience.

So far, slow and illiquid decentralized exchanges (DEXs) have sat on the sidelines. But a company claiming to be the first crypto prime broker believes it can address many of the bugbears that have held so far DEXs back, and even turning them into the preferred trading platform for institutional investors.

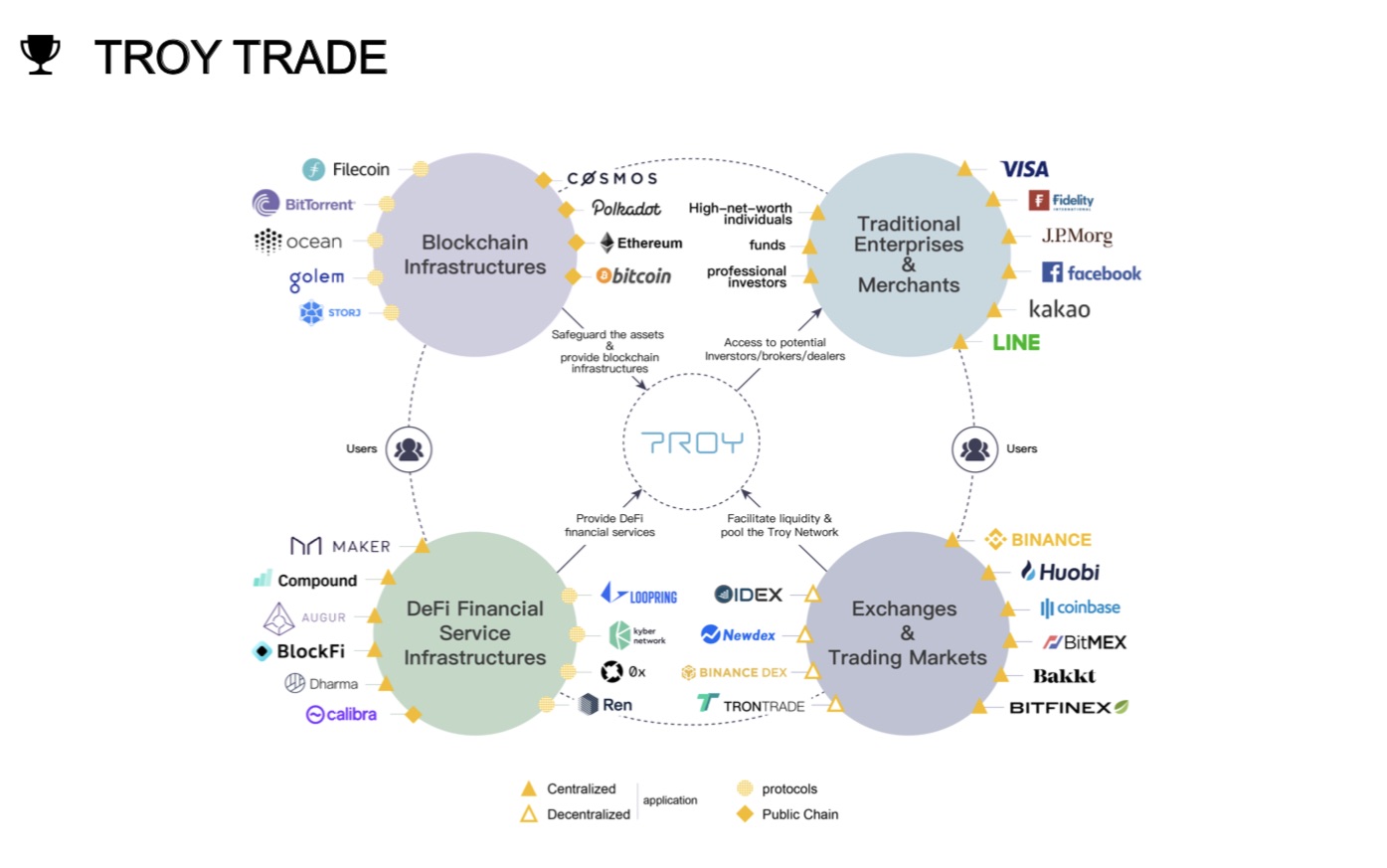

TROY Trade is a prime brokerage service providing trading and settlement services for institutional and professional investors through its non-custodial, decentralized protocol, TROY Network. As a prime broker, traders can use TROY Trade to trade with access to global liquidity, refer to multiple data points as well as create sophisticated trading strategies that can execute across different DEXs.

Although DEXs are often more secure and versatile than their centralized counterparts, many have poor UX interfaces, shallow order books, and can frequently suffer from bottlenecks. Many also lack the range of trading tools and options, like stop or limit orders, that professional traders rely on to create sophisticated trading strategies.

IDEX, which is the most popular decentralized exchange by trading volume, relies on centralized execution facilities to ensure quick trade confirmation and prevent slippage.

“[W]ith the improvement of the whole industry’s infrastructure, decentralized exchanges will certainly occupy a place in the blockchain ecosystem,” reads the TROY whitepaper.

Connecting DEXs For Increased Liquidity

Based out of Hong Kong, TROY Trade is currently connected to well over thirty trading platforms, including Binance DEX and IDEX, as well as Huobi and BitMEX, allowing users to trade across different platforms, helping to even out liquidity.

TROY tokens, which are ERC20s, can be used for trading fees as well as to quickly link up two assets that do not otherwise have active or liquid markets.

Many DEXs are built on one network, imposing limits on the types of digital assets they can support. Being built on Ethereum (ETH), IDEX users can only trade ERC20 tokens – although there are plans to expand to other blockchains. A prime brokerage service like TROY would expedite this process, giving DEX traders a greater variety of cryptocurrencies that operate on separate platforms.

Cryptocurrency is still a relatively immature market. While the entire global market cap for digital assets stands at $250bn, the size of the US banking industry alone comes in at $7.6tn.

That said, institutional investors are slowly embracing the asset-class. Investment bank JPMorgan unveiled its own patented JPM Coin settlement service earlier this year, with Intercontinental Exchange set to launch the Bakkt crypto derivatives platform later this month.

Institutional trading volumes are also increasing. Approximately 28% of active crypto traders are professional and institutional investors, but they account for more than 74% of trading volume in the ten largest exchanges.

Prime Brokerage – Crypto Maturing Fast

Prime brokerage services aren’t anything new. In traditional finance, Goldman Sachs and Fidelity offer hedge funds access to global liquidity as well as customized trading services to help grow their clients’ businesses. Earlier this year, Tagomi, a startup also looking to bring prime brokerage services to the asset raised $12M from VCs including Pantera and Multicoin Capital.

“As the market scale keeps expanding, the number of exchanges and trading markets worldwide may experience an explosive growth,” reads the TROY whitepaper. “[I]nstitutional investors and high-net-worth users will be in need of service facilities similar to the traditional stockbrokers to reduce investment costs, lower irrelevant risks and improve the efficiency of investment.”

According to TROY Trade’s roadmap, spot trading will come online sometime this month with a margin trading facility launching sometime in October. Subject to acquiring a full broker-dealer license in Q1 2020, the Troy team aims to be fully up and running by September 2020.