Survey: Crypto Still Too Scary To Send Home

Share this article

Cryptocurrency is making headway in the field of cross-border remittances, but most people still find it too intimidating for regular use. A study by Clovr found that although 15% of respondents had used cryptocurrency to send cross-border remittances from the US, users are still put off by the complications and uncertainties surrounding the technology.

The study was based on a survey of 707 users on Amazon’s Mechanical Turk, a marketplace for micro tasks such as answering surveys. Secondhand data were also used from the World Bank’s studies on international remittances.

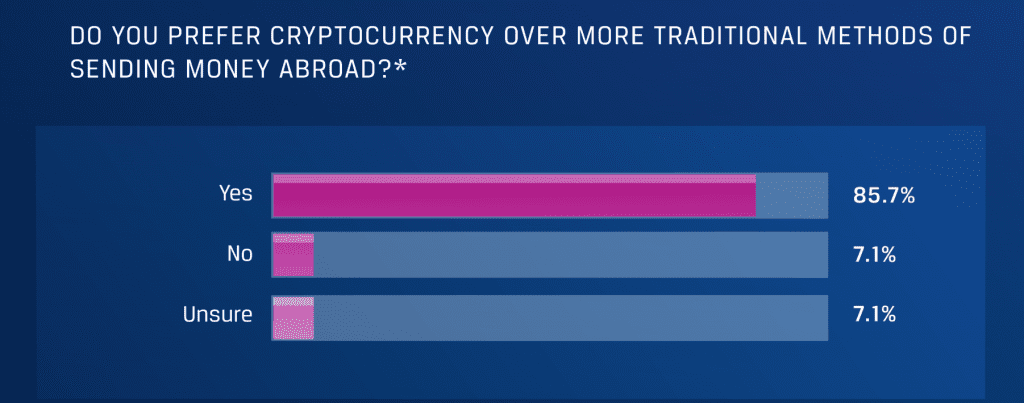

Those who did use cryptocurrencies for remittances reported satisfaction rates above 85%. The only higher measure of satisfaction was for online payments providers: 93.3%.

Cross-Border Transactions: A Lucrative Industry

International remittances are a big business, particularly in immigrant communities. Over 148 billion were sent abroad from the United States in 2017, largely to Mexico ($30.02bn), China ($16.14bn), and India ($11.72bn). Most of these funds, according to the Clovr survey, are intended for family and friends, for everyday purposes like food and household expenses.

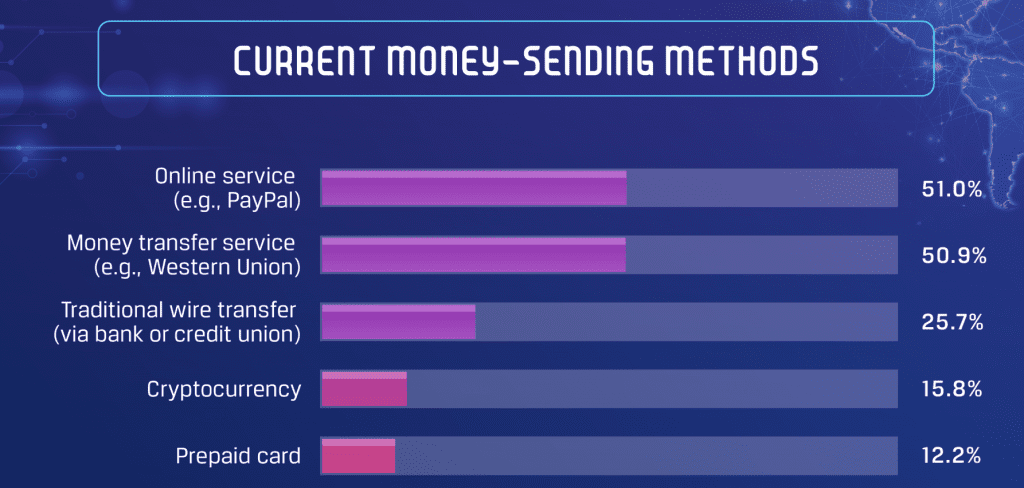

This has made the sector a target market for cryptocurrencies, which are still struggling to find market share. Based on the Clovr study, blockchain payments are still trailing behind more traditional means of cross-border transfer like online services (51%), money transfer services like Western Union (50.9%) and traditional wires (25.7%). Only 15.8% of respondents had attempted payments in crypto.

That leaves quite a bit of money on the table, considering the high fees associated with traditional transfer methods. Sending $500 abroad can incur fees ranging from $16 (mobile operators) to $52 (bank transfers), expenses which can weigh heaviest on people with low incomes. PayPal fees are not mentioned in the study, but typically range around 3%.

According to the Clovr study, the average respondent made 5.1 international transfers per year, for an annual total of $3,315; annual fees reportedly totaled $586.

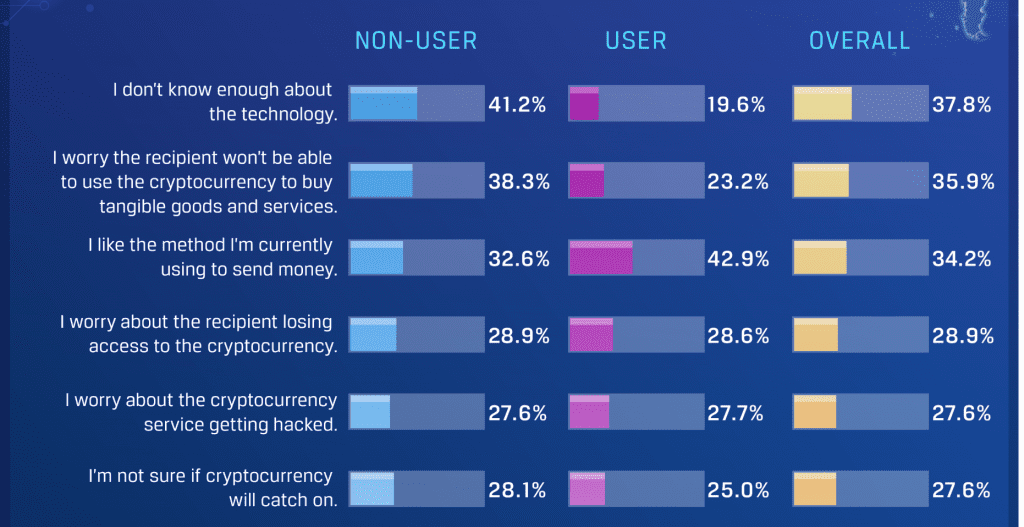

Although fees for blockchain payments are measured in pennies or even less, Clovr’s respondents were largely intimidated by the difficulty of using cryptocurrencies. 41% of non-crypto users reported that they were “Not familiar enough about the technology,” and 38% feared that the recipients would not be able to use cryptocurrency to buy tangible goods. Concerns about hacking and recipients’ losing control of funds ranged around 28% for both users and non-users of cryptocurrency.

Those hangups, it seems, are part of the reason why so many people would rather spend a few hundred on wire transfer fees than risk it all on Grandma understanding how to use her private key. Until cryptocurrency is as intuitive and reliable as Paypal, don’t expect to receive any birthday crypto from your relatives abroad.

The author is invested in digital assets.

Share this article