Current ICO and CRNC Token Analysis

The Current ICO and CRNC Token offer an evolution in media consumption. It represents an opportunity to recognize the value contributions provided by consumers, and to redefine the structure of value exchange between all participants in the market. Get more for watching and listening!

Current ICO Overview

The Current ICO and CRNC Token offer an evolution in media consumption. The web services we all use and take for granted have been built on the personal data and time of the consumers, without acknowledgement or reward for the value that they provide. The Current ICO is an opportunity to recognize the value contributions provided by consumers and redefine the structure of value exchange between all participants in the market.

Current ICO Value Proposition

Current is developing an aggregated digital media ecosystem that rewards all participants from creator to consumer for their role in the media consumption cycle. The project is comprised of three pillars: the platform, the protocol and the token.

The Platform provides users with a universal media search and discovery interface by aggregating disparate content sources from sites such as YouTube, Spotify and Soundcloud. As users consume media, the underlying proprietary recommendation algorithm develops a preference and identity profile based on their data.

The goal of the Current platform is to create the most comprehensive profile of an individual’s media consumption preferences possible. The platform would therefore generate higher-quality recommendations than any single media source alone, adding value to both the individual user experience and underlying data for use by third-parties.

The Protocol rewards people for their time streaming, ad impressions and personal data collected on the app. The protocol records transactions on the blockchain that reflect a user’s contribution to the network through consumption, curation or creation of content. Additionally, a smart contract distributes rewards in response to these contributions. Launching initially on the Current platform, the protocol will be open for developers and third-party providers to help expand the ecosystem.

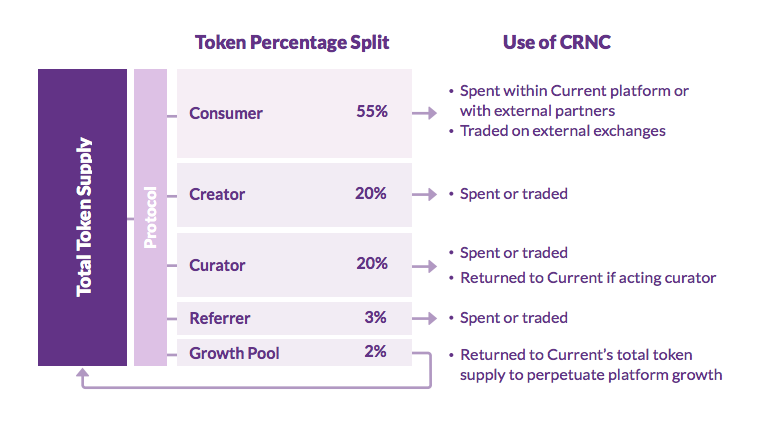

The Current Utility Token, CRNC (pronounced “currency”), serves as a multi-function ERC-20 utility token built to incentivize growth of the Current ecosystem. Current’s blockchain attribution protocol accurately and transparently compensates contributions to the recommendation algorithm and overall growth of the Current ecosystem by rewarding a portion of each token mined to all stakeholders (consumer, creator, curator, growth pool).

The CRNC token will also be used by advertisers and other third-party players to access user identity profiles to promote campaigns and create more targeted content within the app.

Current ICO Team

Dan Novaes is Co-founder and CEO of Current. His entrepreneurial experience dates back to 2012 and includes two acquisitions of digital media and mobile app startups that he founded. In addition to his successes in tech, his status as a social media influencer with 1.1 million followers on Facebook is certainly an advantage in bringing attention to the project.

Nick McEvily is CPO and also a Co-founder. He is a graduate of Cornell and served as VP of Product at MobileX Labs, one of the startups founded by Dan Novaes before they moved on to Current. He has launched previous apps that reached an active user base in the hundreds of thousands.

Kiran Panesar serves as CTO and the third Co-founder. Several of his apps have reached the top 10 in the App Store, with two having reached number 1. He co-founded Native Mobile along with Dan Novaes and was responsible for scaling the server infrastructure to handle millions of pageviews before they were acquired.

On the advisory end of the team, none other than Mark Cuban is lending support to the Current ICO. Mark Cuban has provided investment in some of CEO Dan Novaes’ previous startups and has assumed an advisory role for the Current ICO. Other advisors include CEO of Couchsurfing Daniel Hoffer and Bancor Foundation Co-founder Galia Benartzi.

Current ICO Strengths and Opportunities

The challenges posed by developing and scaling digital products are enormous. People who have already succeeded in overcoming that challenge are more likely to succeed again than those who have not. The team behind Current are an experienced group of entrepreneurs from the tech world with string of successes behind them.

CEO Dan Novaes has founded previous startups with both Nick McEvily and Kiran Panesar and launched a number of digital products together. They are one of the more more seasoned teams in the space at the moment.

Current launched their app in 2017 as a strategy to attract an early user base. At this phase in product development, the Current app is offchain and solely sourcing content from third-party networks like YouTube, Spotify and Soundcloud. According to the whitepaper, 200,000 users have already engaged with the platform, though these numbers are not available for independent verification. With an app out in the market, the team have reached a product development milestone that evidences both their commitment to the project and ability to deliver.

Current ICO Weaknesses and Threats

The roadmap to converting and retaining users raises several issues. Websites like YouTube and Soundcloud aren’t simply for streaming music, but allow users to interact and form communities. This layer of engagement is a huge dimension of the user experience and holds immense value. The design of the Current platform lacks this feature, precluding the possibility for user-to-user interactions.

Scaling Current rests on the assumption that users will trade user-to-user interaction for tokenized rewards and an aggregated interface, and we don’t see the market research that backs this up.

The Current whitepaper states some of the media integrations on their platform are the result of direct partnerships, though no specific details are provided as to what that means exactly. The prospect of accessing aggregated user data of course holds immense value for media sites and would presumably help Current in forging partnerships with such players. In whatever shape or form these partnerships may exist, it’s unclear how Current plans to leverage them to add value to the ecosystem.

CRNC would hold more appreciable value, and in theory attract more users, if any media sites or third-party players announce a partnership and interest in using CRNC for accessing user data via the platform.

The Verdict on Current ICO

It’s important to remember that the goal of Current is not just launch an app, but to build and scale an ecosystem. When an investor purchases CRNC, they are placing a bet on the future of that ecosystem.

The Current ICO’s proposed model for democratizing the value of media consumption is appealing and innovative, but will only function if enough participants adopt the platform.

Our questions on Telegram were answered professionally and immediately, but the answers were directly copied and pasted from the whitepaper and left some doubt in our mind as to how many of their core platform content providers were actual partners, and how many were not. In fact, one answer strongly suggested that other networks such as the media giants mentioned previously (YouTube etc.) would *benefit* from Current’s business model, and would therefore hop on board as a matter of pure self-interest. We haven’t always seen this happen.

While we acknowledge that challenge, we also see a team leading the project who are fit for the task ahead. We’re going to place a small bet on the Current ICO.

Learn more about the Current ICO from our Telegram Community by clicking here.

Today’s Date: 2/1/2018

Project Name: Current

Token Symbol: CRNC

Website: https://current.us/

White Paper: https://cdn.current.us/whitepaper.pdf

Crowdsale Hard Cap: $36 million

Total Supply: 1,000,000,000

Token Distribution: 35% to Token Sale, 35% Mining Rewards, 12% Team, 10% Community Growth & Strategic Partners, 5% Advisors, 3% Current Foundation

Price per Token: 1 CRNC = $0.24

Maximum Market Cap (at crowdsale price): $240 million

Accepted Payments: ETH

Bonus Structure: Presale 45% bonus

Presale Terms: (TBA)

Whitelist: Presale Application

Important Dates: Public Presale – Feb 7 Crowdsale- March 14

Expected Token Release: (TBA)

ICO Review Disclaimer

The team at Crypto Briefing analyzes an initial coin offering (ICO) against ten criteria, as shown above. These criteria are not, however, weighted evenly – our proprietary rating system attributes different degrees of importance to each of the criteria, based on our experience of how directly they can lead to the success of the ICO in question, and its investors.

Crypto Briefing provides general information about cryptocurrency news, ICOs, and blockchain technology. The information on this website (including any websites or files that may be linked or otherwise accessed through this website) is provided solely as general information to the public. We do not give personalized investment advice or other financial advice.

Decentral Media LLC, the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Accordingly, nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any ICO or other transaction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media LLC makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media LLC expressly disclaims any and all responsibility from any loss or damage of any kind whatsoever arising directly or indirectly from reliance on any information on or accessed through this website, any error, omission, or inaccuracy in any such information, or any action or inaction resulting therefrom.

Cryptocurrencies and blockchain are emerging technologies that carry inherent risks of high volatility, and ICOs can be highly speculative and offer few – if any – guarantees. You should never make an investment decision on an ICO or other investment based solely on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional of your choosing if you are seeking investment advice on an ICO or other investment.

See full terms and conditions for more.

Founding Team

This category accounts for the leaders, developers, and advisors.

Poor quality, weak, or inexperienced leadership can doom a project from the outset. Advisors who serve only to pad their own resumes and who have ill-defined roles can be concerning. But great leadership, with relevant industry experience and contacts, can make the difference between a successful and profitable ICO, and a flub.

If you don’t have a team willing and able to build the thing, it won’t matter who is at the helm. Good talent is hard to find. Developer profiles should be scrutinized to ensure that they have a proven history of working in a field where they should be able to succeed.

Product

What is the technology behind this ICO, what product are they creating, and is it new, innovative, different – and needed?

The IOTA project is a spectacular example of engineers run amok. The technology described or in use must be maintainable, achievable, and realistic, otherwise the risk of it never coming into existence is incredibly high.

Token Utility

Tokens which have no actual use case are probably the worst off, although speculation can still make them have some form of value.

The best tokens we review are the ones that have a forced use case – you must have this token to play in some game that you will probably desire to play in. The very best utility tokens are the ones which put the token holder in the position of supplying tokens to businesses who would be able to effectively make use of the platforms in question.

Market

There doesn’t have to be a market in order for an ICO to score well in this category – but if it intends to create one, the argument has to be extremely compelling.

If there is an existing market, questions here involve whether it is ripe for disruption, whether the technology enables something better, cheaper, or faster (for example) than existing solutions, and whether the market is historically amenable to new ideas.

Competition

Most ideas have several implementations. If there are others in the same field, the analyst needs to ensure that the others don’t have obvious advantages over the company in question.

Moreover, this is the place where the analyst should identify any potential weaknesses in the company’s position moving forward. For instance, a fundamental weakness in the STORJ system is that the token is not required for purchasing storage.

Timing

With many ICO ideas, the timing may be too late or too early. It’s important for the analyst to consider how much demand there is for the product in question. While the IPO boom funded a lot of great ideas that eventually did come to fruition, a good analyst would recognize when an idea is too early, too late, or just right.

Progress To Date

Some of the least compelling ICO propositions are those that claim their founders will achieve some far-off goal, sometime in the future, just so long as they have your cash with which to do it.

More interesting (usually) is the ICO that seeks to further some progress along the path to success, and which has a clearly-identified roadmap with achievable and reasonable milestones along the way. Founders who are already partially-invested in their products are generally more invested in their futures.

Community Support & Hype

Having a strong community is one of the fundamental building blocks of any strong blockchain project. It is important that the project demonstrates early on that it is able to generate and build a strong and empowered support base.

The ICO marketplace is becoming more crowded and more competitive. While in the past it was enough to merely announce an offering, today’s successful ICO’s work hard to build awareness and excitement around their offering.

Price & Token Distribution

One of the biggest factors weighing any analysis is price. The lower the price the more there is to gain. But too low of a price may result in an under capitalized project. It is therefore important to evaluate price relative to the individual project, its maturity and the market it is going after.

The total supply of tokens should also be justified by the needs of the project. Issuing a billion tokens for no reason will do nobody any good.

Communication

Communication is key. The success of a project is strongly tied to the project leaders’ ability to communicate their goals and achievements.

Things don’t always go as planned but addressing issues and keeping the community and investors in the loop can make or break a project.