Curve Breaks Yearly High As Token Supply Dwindles

Only 11% of the total Curve supply is currently left in circulation.

Key Takeaways

- Curve has broken past its yearly high.

- Increased demand for the CRV token and low circulating supply are driving up the price.

- Currently, over 89% of all CRV tokens are locked up in DeFi protocols.

Share this article

Curve has broken past its April highs, fueled by increased demand for CRV tokens and a low circulating supply.

Curve Breaks Out

CRV tokens are in high demand.

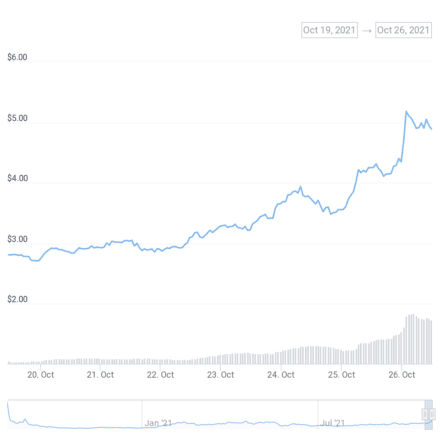

The DeFi DAO token is climbing higher, breaking past its yearly high of $4.66 achieved in April. The CRV token is currently trading at $4.91, up 75% over the past week.

Curve Finance, the issuer of CRV tokens, is a DeFi protocol specializing in like-asset swaps such as stablecoins and wrapped assets. Users can provide liquidity to Curve’s swap pools to earn CRV tokens rewards, which can then be deposited into other DeFi protocols to generate additional yield.

This year a whole sub-DeFi ecosystem has formed around yield optimization for CRV tokens. Both Yearn Finance and Convex Finance offer attractive yields to users willing to lock up their CRV tokens in vaults for up to four years.

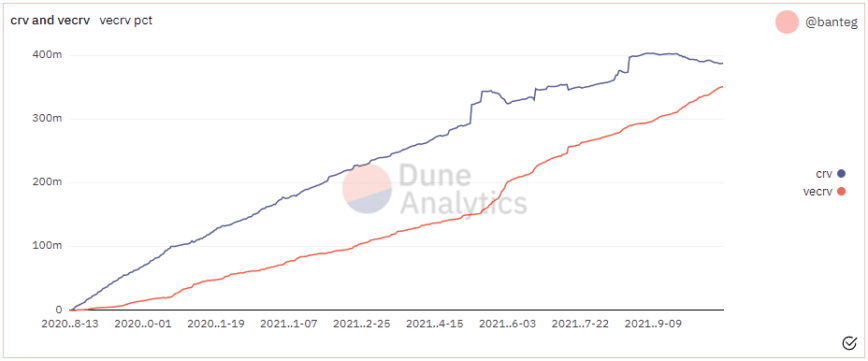

The competition between these two protocols, sometimes called “The Curve Wars,” has rapidly consumed a large portion of the total CRV token supply. Additionally, a new “DeFi 2.0” protocol, abracadabra.money, allows users to borrow its MIM stablecoin using Curve Liquidity Provider tokens as collateral, further reducing the CRV supply.

Over 89% of all CRV tokens are currently locked up in various DeFi protocols, with an average vesting time of 3.68 years. With the supply shrinking and demand staying constant, the CRV token is rapidly increasing in value. Recently, the supply of CRV tokens has become disinflationary, meaning that more tokens are being locked up than new ones distributed.

Since May’s market crash, DeFi protocol tokens have underperformed compared to the market average. While Layer 1s such as Solana and Avalanche have enjoyed significant gains, Aave and Yearn finance’s tokens have remained stagnant. Whether Curve’s current price action is the start of a DeFi revival in the market remains to be seen.

Disclaimer: At the time of writing this feature, the author owned BTC, ETH, and several other cryptocurrencies.

Share this article