Curve Finance Finds "Product-Market Fit" Yield Farming in DeFi

Curve Finance finds product-market fit in DeFi.

Key Takeaways

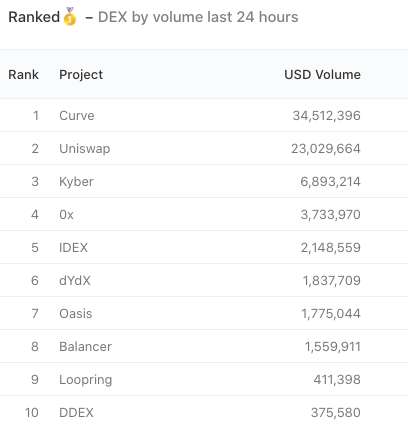

- Curve Finance is the only DEX besides Uniswap to do over $100 million in the last week.

- As Curve's volumes increase, so did its returns to liquidity providers, creating a new avenue for yield investing.

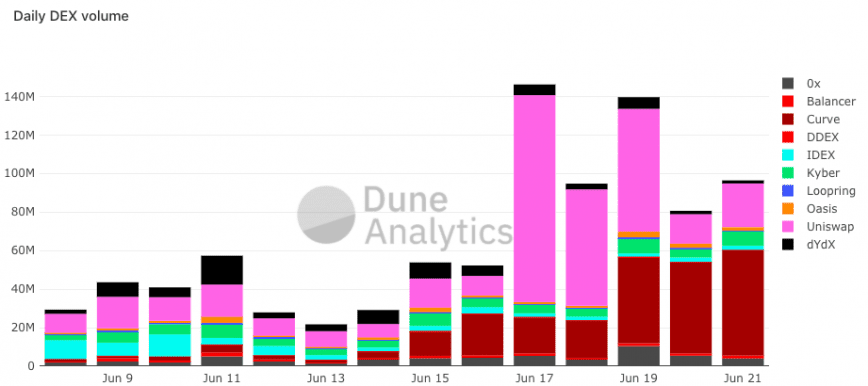

- Curve's USDC/USDT pair did more volume than Binance on June 20.

- Compound's recent growth has been vital to Curve's explosive volume.

Share this article

In the last 24 hours, Curve Finance saw more volume than any other decentralized exchange (DEX) thanks to the latest yield farming trend. As DeFi traders look to squeeze returns from across the ecosystem, Curve Finance has cemented itself as a vital service.

Yield Farming on Curve Finance

In what has been a spectacular month for the DeFi ecosystem, Curve has been an unsung leader, helping the “yield farmers” take advantage of massive returns.

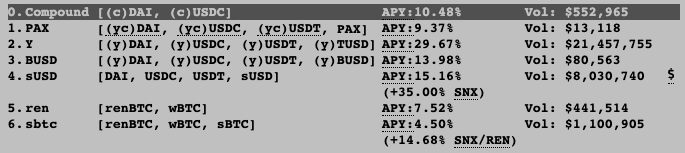

Curve is a protocol that allows users to swap one stable asset for another. A majority of its volume is in stablecoins, such as USDC, USDT, DAI, and others, but the protocol recently introduced pools that have sBTC, RenBTC, and wBTC for low slippage trade between tokens pegged to Bitcoin.

In the last week, Curve has stepped up its game by facilitating over $115 million of volume.

The protocol has facilitated more volume than Uniswap in the last 24 hours – a big feat for a DEX that only caters to specific assets.

Curve even managed to overpower Binance, the world’s leading trading platform, with more USDC-USDT volume than one of crypto’s most liquid spot exchanges.

This newfound activity caused Curve’s return to liquidity providers to soar. To understand why Curve is prospering, one must understand the current state of DeFi.

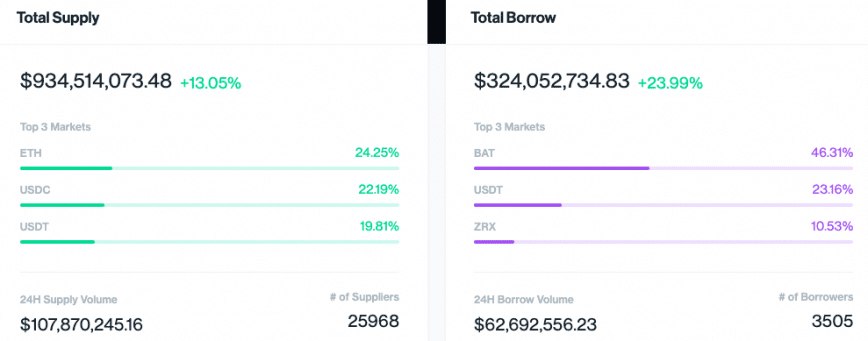

Compound has flourished in a big way, stepping over MakerDAO to become DeFi’s largest protocol by AUM.

This is a result of Compound issuing COMP, its native governance token, as an incentive to use the protocol. Lending and borrowing activity started to snowball as DeFi speculators entered the ring to milk returns.

Almost a billion dollars is currently sitting on the supply side of Compound’s money market, earning an annualized return between 4-25%.

The craze began with USDT, but this soon spilled over to other cryptoassets such as USDC, DAI, ZRX, and BAT.

As opportunities for outsized returns emerged among stablecoins, the protocol that offers the best rates for stablecoin-to-stablecoin transfers – Curve – blossomed.

Returns on Compound have simmered down, but there is still the daily issuance of COMP to consider.

As traders deploy intricate strategies to collateralize assets, lend, and borrow, there may still be explosive demand for Curve’s services. But even if this was to die down, Curve still facilitates millions of dollars of trade per day and offers liquidity providers a healthy return.

Curve Finance has found product-market fit in DeFi’s latest yield farming trend, opening the door for similar protocols to enter the ring and improve the model.

Share this article