DAOstack ICO Review and GEN Token Analysis

The DAOstack ICO (GEN token) is creating the OS infrastructure on which they hope major decentralized projects needing governance can be based. While the blockchain use case seems valid, and the product is advanced, we have major concerns over the economics and adoption of their technology.

DAOstack ICO Overview

The DAOstack ICO and GEN Token offer an operating system for Decentralized Autonomous Organizations (DAOs) which can be used for cases such as collaboration or governance in companies, running decentralized investment funds and managing decentralized curation systems like Wikipedia.

The targets for their technology are those blockchain companies with massive numbers of members – hundreds of thousands to millions of people – which they aim to help through empowering crowd organization, management, and decision-making.

The system is powered by a technical stack and protocol for collective value management on the blockchain, including an Ethereum-based library of smart contracts for governance and a JavaScript developer environment.

DAOstack ICO Value Proposition

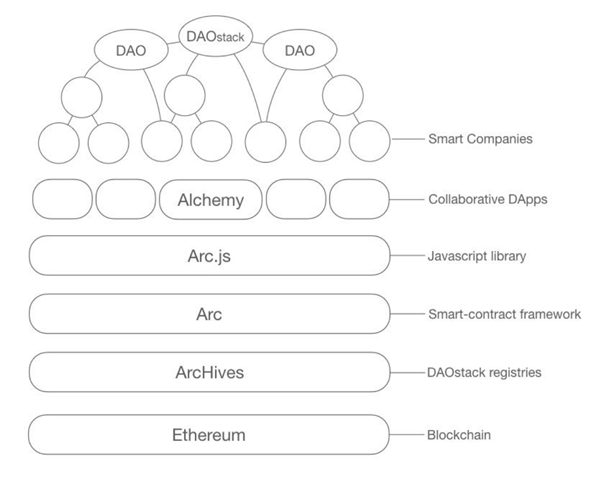

The operating system for governance which DAOstack is creating consists of 4 layers built on top of the Ethereum blockchain:

1) The ArcHives: a public set of shared registries which will allow for interoperability between DAOs and Dapps built on DAOstack

2) Arc: the base layer of the stack and smart contracts library written in Solidity which allows the creation of governance protocols for DAOs (compared to a WordPress for organizational governance by the DAOstack team)

3) Arc.js: the JavaScript frontend interface allowing developers to easily build applications and custom interfaces suitable to their organizations

4) The application layer.

To showcase the system and drive adoption, DAOstack has built the first application on the stack called Alchemy. It is a user interface for budgeting and resource allocation for decentralized organizations which allows anyone to create DAOs, participate in decision-making and talent-sharing hubs and even create an organization-specific ERC20 crypto-token if desired.

GEN is the native token of the DAOstack ecosystem and is used for promoting proposals or attracting the attention of users for a project within an organization. Proposals can be boosted by staking tokens. If the proposal is unsuccessful, tokens are either destroyed or distributed to voters. Contributors of value to the network will be rewarded with tokens which will incentivize development, promotion and early adoption of the system.

Example use-cases include Sapien using DAOstack to build a social news network, while Menlo is building a platform for decentralized funding of blockchain projects. Cultu.re is planning to use DAOstack for its worldwide peer-to-peer identity and contracts system.

The DAOstack Architecture (source: whitepaper)

DAOstack ICO Team

Matan Field (CEO): Matan has a PhD in Theoretical and Mathematical Physics from the Weizmann Institute of Science, where he conducted research on effective string theories and holographic duality. Since obtaining his PhD in 2012, he has specialized in decentralized governance and also launched La’Zooz, a collaborative transportation system and later Backfeed, an early version of DAOstack.

Adam Levi (CTO): Adam is a Blockchain technologist with a PhD in Physics from the Technion where he was researching quantum effects in black holes. He is a former radar engineer in the Israel Defence Forces and was a teaching assistant at the Technion, Israel’s highest ranked technical university, until March 2017.

Josh Zemel (Communication and Marketing): Josh designed and executed major growth initiatives for Equifax, Blue Cross Blue Shield, and Toyota as former VP at IMM, a digital agency, which he was instrumental in growing from its infancy to a team of 100 people. He is the founder of four profitable companies.

Roberto Klein (Legal and Finance): Roberto holds an M.Sc in Engineering and an MBA from the International Institute for Management Development. He was VP for Products and Business Development at Biological Signal Processing before becoming a full-time investor and entrepreneur with a focus on blockchain regulatory issues, corporate finance, IPOs, and startup financing.

Jordan Greenhall (Advisor): Co-founder and former CEO at DivX (NASDAQ: DIVX). Former SVP Strategy at MP3.com (NASDAQ: MPPP)

Yoni Assia (Advisor): Founder and CEO of eToro.com. Board Member of Meitav Dash.

Martin Köppelmann (Advisor): Co-founder and CEO of Gnosis

Additional information on the rest of the team can be found on the DAOstack website.

DAOstack ICO Strengths and Opportunities

DAOstack holds impressive prospects for building decentralized organizations. If decentralization of technology, power and governance is a core value proposition of Blockchain technology, then the system needs infrastructure on which governance can take place in a trustless, transparent and effective way. DAOstack represents a potential solution for this problem. If this happened to be the case, the sky’s the limit for DAOstack.

One promising aspect of the DAOstack ICO is the advanced stage of product development the team have already reached. The main system pillars, such as Arc, are operational (as demonstrated by the functioning of Alchemy, the first Dapp built upon the system).

The GitHub is in an exemplary state and the team is credible both in terms of their technological and academic credentials but also stands out in terms of responsiveness and transparency – a truly positive example for conduct in the Blockchain space.

It is also a positive indicator that partnerships are already in place with a range of blockchain projects such as Endor, Gnosis, Sapiens and Menlo, even though no established enterprises or major market players are yet among them.

DAOstack ICO Weaknesses and Threats

One major strength of the DAOstack ICO – namely, its scope – could also prove to be the project’s Achilles heel. We have little track record for successful decentralized governance on a wider scale anywhere in the world (Wikipedia and Bitcoin come to mind).

To drive adoption for DAOstack, the team will need to win over major players both within and beyond the blockchain space. But whether decentralized governance will actually both function and flourish remains a completely open question.

Are employees of currently centralized companies willing to embrace a decentralized governance model? Will the internal tokenomics incentivize users to do the right thing for the organization? At this early stage, we simply don’t yet know.

The initial partnerships with the likes of Endor or Gnosis are not sufficient to convince us otherwise. That the core founders Matan and Adam do not have a successful history of building companies and that CEO Matan previously failed with Backfeed, a similar project to DAOstack, does not help to quell our doubts either.

The other main risk concerns the role of the token. There’s little doubt token-based economic incentivization makes sense as part of DAO infrastructure, but whether users will adapt to the system, stake tokens and potentially lose them as a result of failed governance proposals, is a major open question.

Certain practical questions also remain – for example, it’s unclear whether an organization that wants to use DAOstack would have to acquire and distribute tokens among its members for the system to work. Realistically, and not unexpectedly, without significant trial and error, it is impossible to predict how the value of the system token could evolve and if users would have sufficient incentive to hold it in the first place, especially if certain organizations decide to opt for their own versions of the system.

The Verdict on DAOstack

The DAOstack ICO is a promising and very exciting project with a credible team who’ve reached an impressive stage of product development. However, in our assessment, we must distinguish between the value proposition DAOstack holds for organizations and the value proposition for potential investors.

Potential investors without any intention of running a DAO who purchase the token are betting on the success of a highly nascent and unproven form of organization.

We are keen to watch DAOstack develop as a product and governance tool, but will pass for now on the DAOstack ICO.

Learn more about the DAOstack ICO from our Telegram Community by clicking here.

DAOSTACK ICO REVIEW SCORES

SUMMARY

The DAOstack ICO (GEN Token) aims to create an infrastructure on top of which developers can build decentralized solutions such as corporate governance, massively-scaled knowledge systems, collaboration tools and so on. While the team has clear and impressive experience (and sometimes, startup founders do better with a failed project behind them), and while we have to give them immense credit for their progress on the technology and the need, there is essentially very little to prove the economic model. It depends too much on hypothesis for us to participate in the ICO at this time.

Founding Team……………………….7.6

Product…………………………………..8.5

Token Utility…………………………..5.5

Market…………………………………..3.6

Competition…………………………..7.4

Timing……………………………………7.6

Progress To Date……………………2.8

Community Support & Hype…..7.2

Price & Token Distribution……..6.4

Communication……………………..9.1

FINAL SCORE……………………….6.5

UPSIDES

- Advanced stage of product development

- Theoretically important project for the Blockchain space

- Credible team with strong technical and academic credentials

DOWNSIDES

- Adoption will be a major challenge

- The team does not have proven and successful entrepreneurs among its core founders

- The value and ultimate use-cases of the token are difficult to determine without adoption

Today’s Date: 4/24/18

Project Name: DAOstack

Token Symbol: GEN

Website: https://daostack.io/

White Paper: DAOstack White Paper

Crowdsale Hard Cap: $30 million

Total Supply: 100,000,000

Token Distribution: 40% to crowdsale, 40% to Genesis DAO (a decentralized community fund to support ecosystem), 10% for the team and advisers, 10% reserved for future contributors

Price per Token: $1 (estimate by the team more info here)

Fully-diluted Market Cap (at crowdsale price): $75 million

Accepted Payments: ETH

Countries Excluded: US

Bonus Structure: 10% bonus for the presale

Presale Terms: Minimum contribution is at least $100,000

Whitelist: Register at https://daostack.io/whitelist

Important Dates: Presale: 4am GMT on May 1st, 2018 (will remain open for 48 hours) Main token sale begins 4am GMT on May 8th and will remain open until either the hardcap is reached or 30 days have passed.

Expected Token Release: Tokens will be distributed immediately after the token sale

Additional Information: https://t.me/daostackcommunity

ICO Review Disclaimer

The team at Crypto Briefing analyzes an initial coin offering (ICO) against ten criteria, as shown above. These criteria are not, however, weighted evenly – our proprietary rating system attributes different degrees of importance to each of the criteria, based on our experience of how directly they can lead to the success of the ICO in question, and its investors.

Crypto Briefing provides general information about cryptocurrency news, ICOs, and blockchain technology. The information on this website (including any websites or files that may be linked or otherwise accessed through this website) is provided solely as general information to the public. We do not give personalized investment advice or other financial advice.

Decentral Media LLC, the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Accordingly, nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any ICO or other transaction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media LLC makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media LLC expressly disclaims any and all responsibility from any loss or damage of any kind whatsoever arising directly or indirectly from reliance on any information on or accessed through this website, any error, omission, or inaccuracy in any such information, or any action or inaction resulting therefrom.

Cryptocurrencies and blockchain are emerging technologies that carry inherent risks of high volatility, and ICOs can be highly speculative and offer few – if any – guarantees. You should never make an investment decision on an ICO or other investment based solely on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional of your choosing if you are seeking investment advice on an ICO or other investment.

See full terms and conditions for more.

Founding Team

This category accounts for the leaders, developers, and advisors.

Poor quality, weak, or inexperienced leadership can doom a project from the outset. Advisors who serve only to pad their own resumes and who have ill-defined roles can be concerning. But great leadership, with relevant industry experience and contacts, can make the difference between a successful and profitable ICO, and a flub.

If you don’t have a team willing and able to build the thing, it won’t matter who is at the helm. Good talent is hard to find. Developer profiles should be scrutinized to ensure that they have a proven history of working in a field where they should be able to succeed.

Product

What is the technology behind this ICO, what product are they creating, and is it new, innovative, different – and needed?

The IOTA project is a spectacular example of engineers run amok. The technology described or in use must be maintainable, achievable, and realistic, otherwise the risk of it never coming into existence is incredibly high.

Token Utility

Tokens which have no actual use case are probably the worst off, although speculation can still make them have some form of value.

The best tokens we review are the ones that have a forced use case – you must have this token to play in some game that you will probably desire to play in. The very best utility tokens are the ones which put the token holder in the position of supplying tokens to businesses who would be able to effectively make use of the platforms in question.

Market

There doesn’t have to be a market in order for an ICO to score well in this category – but if it intends to create one, the argument has to be extremely compelling.

If there is an existing market, questions here involve whether it is ripe for disruption, whether the technology enables something better, cheaper, or faster (for example) than existing solutions, and whether the market is historically amenable to new ideas.

Competition

Most ideas have several implementations. If there are others in the same field, the analyst needs to ensure that the others don’t have obvious advantages over the company in question.

Moreover, this is the place where the analyst should identify any potential weaknesses in the company’s position moving forward. For instance, a fundamental weakness in the STORJ system is that the token is not required for purchasing storage.

Timing

With many ICO ideas, the timing may be too late or too early. It’s important for the analyst to consider how much demand there is for the product in question. While the IPO boom funded a lot of great ideas that eventually did come to fruition, a good analyst would recognize when an idea is too early, too late, or just right.

Progress To Date

Some of the least compelling ICO propositions are those that claim their founders will achieve some far-off goal, sometime in the future, just so long as they have your cash with which to do it.

More interesting (usually) is the ICO that seeks to further some progress along the path to success, and which has a clearly-identified roadmap with achievable and reasonable milestones along the way. Founders who are already partially-invested in their products are generally more invested in their futures.

Community Support & Hype

Having a strong community is one of the fundamental building blocks of any strong blockchain project. It is important that the project demonstrates early on that it is able to generate and build a strong and empowered support base.

The ICO marketplace is becoming more crowded and more competitive. While in the past it was enough to merely announce an offering, today’s successful ICO’s work hard to build awareness and excitement around their offering.

Price & Token Distribution

One of the biggest factors weighing any analysis is price. The lower the price the more there is to gain. But too low of a price may result in an under capitalized project. It is therefore important to evaluate price relative to the individual project, its maturity and the market it is going after.

The total supply of tokens should also be justified by the needs of the project. Issuing a billion tokens for no reason will do nobody any good.

Communication

Communication is key. The success of a project is strongly tied to the project leaders’ ability to communicate their goals and achievements.

Things don’t always go as planned but addressing issues and keeping the community and investors in the loop can make or break a project.

Earn with Nexo

Earn with Nexo