Deep Analysis: Bitcoin Prospects For 2018 And Beyond

Although 2018 has not been a great year for Bitcoin, and the digital asset continues to drag in the markets, long-term prospects are bullish.

A major question dominating the 2018 bear market for cryptocurrencies has become “When will the price of bitcoin go up?” Investors who have been in the space as early as 2010 are familiar with the market cycles of bitcoin.

Bitcoin has corrected its price and had more than an 80% decline twice before in its history on the cryptocurrency market, and saw another 70% decline from December 2017 to June 2018. It’s important to note that the price of bitcoin is also up close to 50% in the last fiscal year – it’s hard to believe that it was commonplace to purchase bitcoin for under $1000 only 18 months ago. It’s never too late to buy Bitcoin, it seems.

Bitcoin has redoubled 16 times in its history if you take a $1 starting point. With that said, there are an abundance of investors who purchased bitcoin at the height of its 2017 cycle who are all asking the same question – when will I see returns? Well, bitcoin won’t be going parabolic in 2018 in my opinion.

The Case For A Bearish End To 2018

There are 8 main reasons why 2018 won’t be the year where the bull market returns:

- Historic Cycles

I have met very few people that became interested in Bitcoin or other cryptocurrencies in 2015, and I think that will be the case when we look back on 2018 as well – very few people become interest in an asset class when the price is going down. Only 2.3 million new wallets were activated in 2015 compared to more than 9 million in 2017 – about a quarter the amount. Activated wallets is a good, but imperfect, metric to look at to decipher the amount of new investors joining the space. It doesn’t automatically mean increased action on the cryptocurrency exchange.

If we use the 2014-2015 bear market as a case study, the bear market lasted approximately 19 months. The decline in price was close to 80% peak to valley. We have been in a bear market for 7-9 months depending on your definition, and I don’t see a reason why this cycle will be much different.

- Hashrate

The mining hashrate has tripled in the last 7 months. This is the number of computations per second that the bitcoin network is being secured with. According to Tuur Demeester, this is means a huge amount of new, more efficient mining rigs have come online.

If you are a miner without one of those rigs – your profitability has gone down substantially, which means you’ll need to sell more bitcoin to cover costs. We can estimate that approximately 1800 bitcoins are mined per day (12.5 per block and 144 blocks per day), so there is a lot of sell pressure coming from miners as they are forced to sell bitcoin rather than hold to cover their costs.

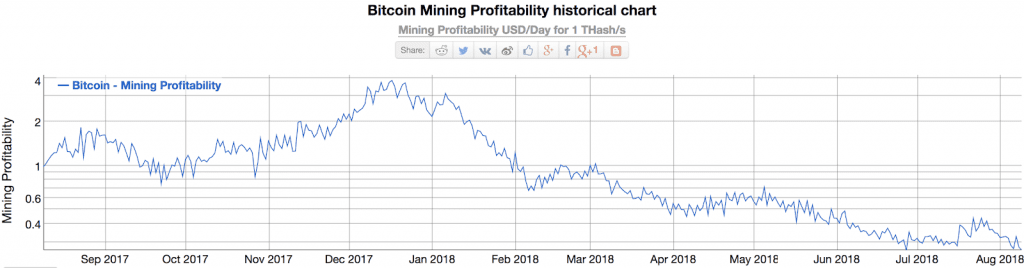

Bitcoin mining profitability in USD per day per each transaction hash has gone down 92.6% since December highs.

- ETF Delays

A popular opinion is that a regulated bitcoin ETF will bring a substantial amount of money into the asset class, which will inflate the price. This catalyst is often compared to the first gold ETF – the ETF was approved in 2004 and the price of gold rallied by 350% in the next year. The SEC delayed the decision on the ETF proposal with the highest hopes, the VanEck SolidX commodity-backed bitcoin ETF, to late September of 2018 this week.

The approval process for ETFs grants the SEC a total of 240 days after filing with the Federal Register to make a decision (including the extensions that they are allowed to make), and it makes sense that the SEC will use all the time that they have in their own favour. More time means that the more information and studies on the underlying spot market can come to light; giving the SEC the ability to make a stronger, more informed decision. The next extension is expected in late September, and the final date to make a decision on the proposal won’t be until February 18th 2019. So don’t count on an ETF decision to drive the next bull run in 2018.

When it comes, though, and it will come, a bitcoin ETF will precede a flood of investment, which will restore consumer confidence to the cryptocurrency market. For better or worse the bitcoin price drives most of the market and a massive influx of institutional investors will be good news for everybody.

- Metcalfe’s Law

Metcalfe’s Law characterizes network effects in technologies. The Network Value to Metcalfe (NVM) ratio comes out of this theory. Between 2015 and 2018 the NVM ratio stated that bitcoin was undervalued comparing the price to the amount of on chain activity, but this changed in 2018 – price started to catch up to the normalized NVM ratio.

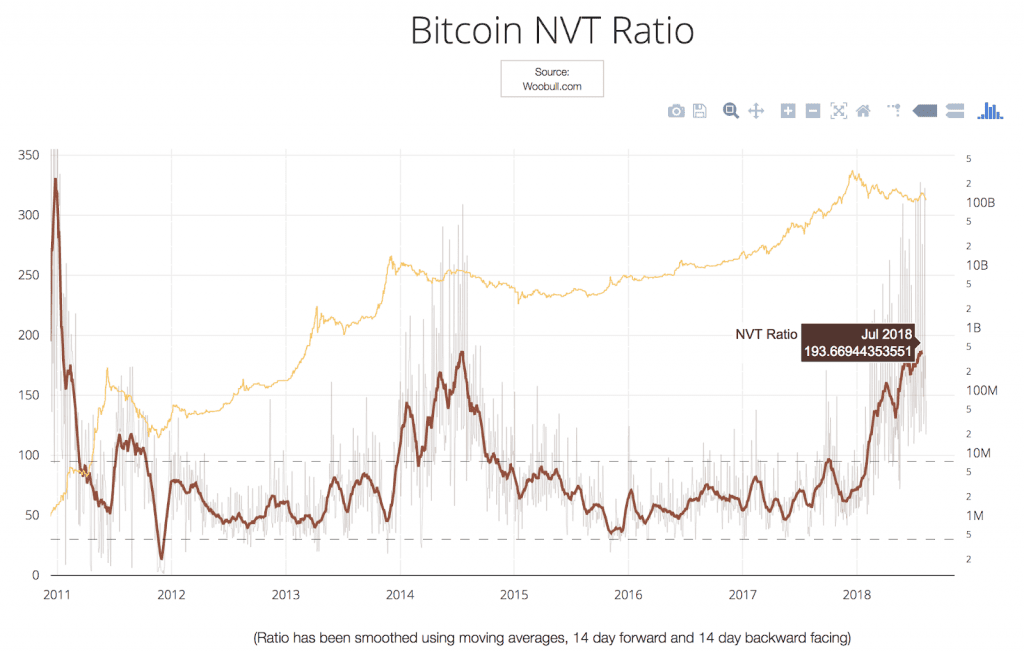

Now, the ratio suggests that bitcoin’s current market cap is too high when considering activity. A similar comparison is the Network Value to Transactions (NVT) ratio, which has been compared to the PE ratio in equity markets. This ratio is calculated by taking network value (market cap) and dividing it by daily USD volume on bitcoin, or token supply / bitcoin volume on chain. A high NVT ratio can signal high growth or an unsustainable bubble, but ultimately it just shows that the network is overvalued compared to the amount of money it’s transmitting.

The NVT ratio has climbed from 65 to 193 in 2018.

- Retail Interest

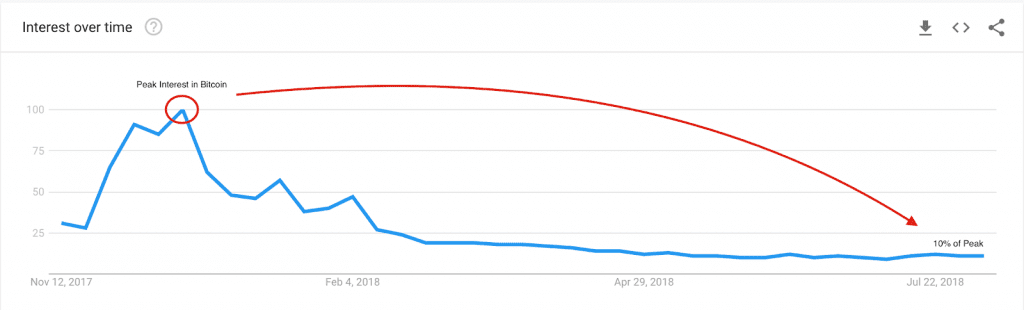

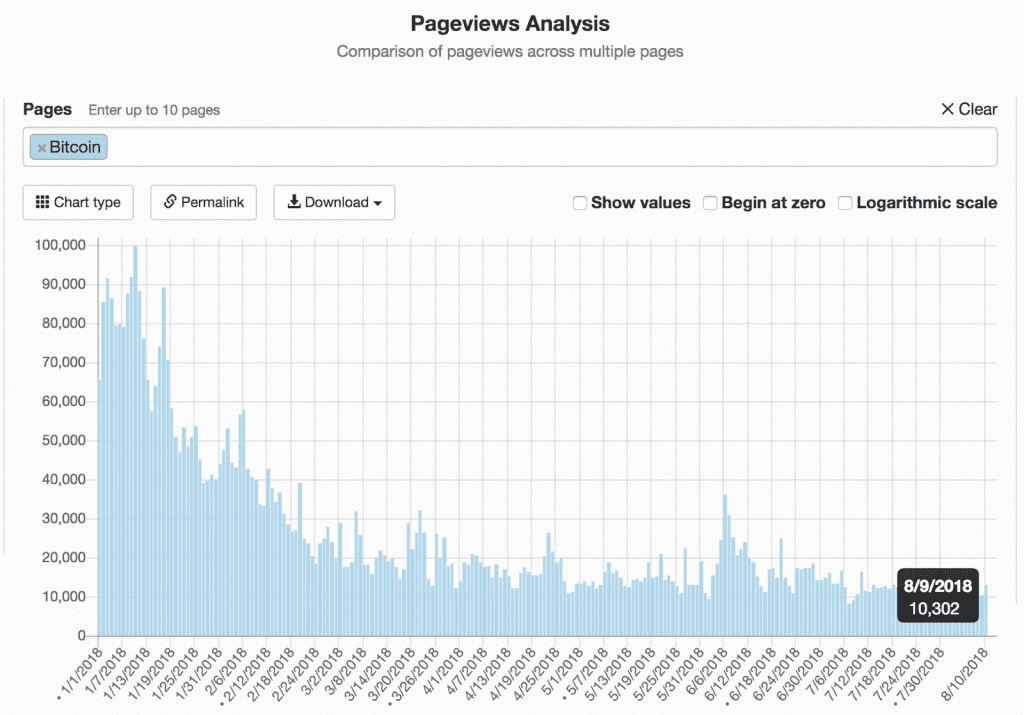

Retail interest has dwindled in 2018 as the price has plummeted. Professional analysts, including myself, were bombarded by friends asking them if bitcoin could make them rich in 2017. These retail investors feared that they were missing out on “the next big thing” and were willing to buy bitcoin at any price as it was rising exponentially to make sure they didn’t miss out on the party. This is a catalyst that kept driving the price and volatility higher and higher. Three metrics I use to measure retail interest are merchant revenue, Google searches, and Wikipedia searches. Merchants are seeing a 50% drop in bitcoin revenue compared to 2017, Google searches for “Bitcoin” have fallen to a tenth of what they were in late 2017, and daily visits to the “Bitcoin” wikipedia page have fallen from highs of almost 100k unique visitors per day to lows of close to 10k.

- Regulatory Clarity

We have had some regulatory clarity in 2018 – namely SEC’s William Hinman, outlining that Bitcoin is not a security. If the bull case for bitcoin is to become a global medium of exchange AND store of value there needs to be much more regulatory certainty on a global level; not just in the United States.

Last week when the Winklevoss ETF was denied (again) one of the main reasons was speculation that the underlying spot market for the asset was being manipulated. Global governments need to decide how bitcoin is to be treated in the long term for tax purposes and the underlying spot market needs to become more established (for certainty that there is no manipulation) for more money to flow into bitcoin. These two variables will take time.

I am still bullish on bitcoin in the long term.

The Case For A Bullish Long-Term Outlook

There are 6 longer term catalysts and theories I am watching closely that indicate positive cases for bitcoin:

- Chinese Yuan

Most analysts can agree with high conviction that the best use case for bitcoin right now is for cross border payments – more specifically, I believe it is best used for capital flight where there are restrictions in place from an authoritarian government. This has led some to believe that the price of bitcoin has been negatively correlated with the price of the CNY. The price of CNY has been declining versus USD in 2018, which may indicate a potential catalyst for capital flight into bitcoin if purchasing power continues to decline.

- Bitcoin Dominance

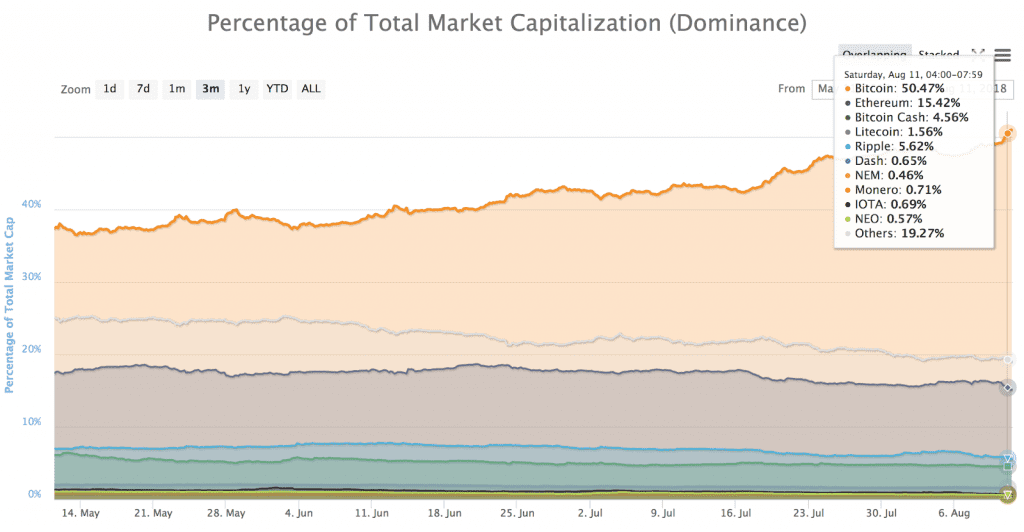

A strong opinion of mine that is loosely held is that the overvaluation of undeserving projects in the 2017 ICO craze is a contributing catalyst for the 2018 bear market, and that capital needs to bleed out of these over-capitalized projects back into bitcoin before we can realize the next bull market cycle. This means that bitcoin dominance needs to increase to a certain level, and I believe that level is well above 60%. Bitcoin dominance has been gaining ground in 2018 – climbing from lows of 33% back up to 51%.

- Block Reward Halving

In May of 2020 the block rewards for mining a bitcoin block will go from 12.5 btc per block to 6.25. There are several angles to look at this from: miners will become less profitable, or inflation will decrease.

First off, I think the block reward halving is a positive signal because of precedent – it has had a positive impact on the price of bitcoin the first two times. Secondly, I believe miners will continue to become more and more efficient by May 2020 due to Moore’s Law, and I am not as concerned about their profitability in the long term. Lastly, basic microeconomics tell us that annual inflation decreasing from 3.7% to 1.79% will positively impact the price of bitcoin.

- ETF Approval

As discussed above, I don’t think an ETF will be approved in 2018, but I do believe a bitcoin ETF will be approved eventually. When it is approved, it is an easy on ramp for institutional money to purchase bitcoin without having to do so from the unregulated spot market, and custody solutions will be in place.

Boutique investment funds investing in bitcoin is great for the market, but an ETF approval provides a framework for trillion dollar wealth funds to safely allocate the “risky” portion of their portfolio to bitcoin. Personally, I think this is a better allocation of funds than investing in things like bad debt or negative yielding bonds.

- Regulatory Clarity

I think the United States government, especially after Hester Pierce’s statements from the SEC, is open to exploring bitcoin more and fostering technological innovation. I mentioned above that regulatory certainty, such as how bitcoin is taxed globally and how citizens can safely purchase bitcoin, will take time, but I think governments are willing to provide a framework where bitcoin, fiat, and government can coexist peacefully. As bitcoin stands right now, I think governments like the idea of having a transparent blockchain where they can monitor all transactions from an Ivory tower… Remember: Bitcoin is pseudonymous – not anonymous.

- The Future Gold

The narrative that “bitcoin will one day replace all the world’s gold” may be an exaggeration, but it is one of the things that drew me down the bitcoin rabbit hole in the first place.

I believe bitcoin is a great supplement as a store of value to gold because it is superior to gold in the following ways: little storage costs, no capital control restrictions, it is divisible, there is no counterparty risk, and the supply is fixed.

A little known fact is that more and more gold is found every year and added to the world’s reserves. For simplicity’s sake, let’s say all of the gold in the world is worth $7.5 trillion USD. If just 10% of the wealth stored in gold is transferred to bitcoin that’s 750 billion USD. With a market cap of 750 billion USD, each bitcoin would be worth over $35k USD.

I also believe that type of valuation is less of a “straw hat” than others that I’ve seen that require many more assumptions.

2018 may not be the year for Bitcoin, but I continue to remain bullish in the long term.

The author holds investments in Bitcoin.