Shutterstock cover by Flow 37 and WindAwake (edited by Mariia Kozyr)

DeFi Project Spotlight: Frax Finance, a Sweet Spot for Stablecoins

FRAX is the first stablecoin with a dual collateral-backed and algorithmic peg mechanism.

Frax Finance is a decentralized protocol that can be thought of as a fully autonomous, on-chain central bank issuing and controlling the monetary policy of a fractional-algorithmic stablecoin called FRAX. Found in the sweet spot between fully-collateralized and uncollateralized stablecoins, FRAX is the first decentralized stablecoin that utilizes a dynamically adjusting collateral ratio to successfully maintain peg stability.

The Current Stablecoin Landscape

Frax is a decentralized, fully autonomous on-chain protocol managing a flagship fractional-algorithmic stablecoin that is backed partly by external and partly by internally-generated collateral.

To understand Frax’s value proposition and its standing among other stablecoins, it’s first necessary to summarize the current stablecoin landscape. For the uninitiated, stablecoins are crypto assets pegged, in one way or another, to a particular fiat currency—typically the U.S. dollar. More broadly, they can be classified into two types: centralized and decentralized. Centralized stablecoins represent fully-backed, fiat-collateralized digital assets issued and controlled by centralized companies or custodians. These include Tether’s USDT, Circle’s USDC, and Binance’s BUSD and occupy by far the biggest market share.

Centralized stablecoins are the simplest of the asset class. Centralized issuers mint them in exchange for dollars and redeem them to receive dollars back at an exchange ratio of one-to-one. This means the issuers must be trusted to always have an equal or greater supply of dollars or other highly liquid, low-risk assets like commercial paper or treasuries on their balance sheets to honor those redemptions. While the market generally deems them safer, centralized stablecoins nevertheless carry considerable custodial and censorship risks.

Decentralized stablecoins, on the other hand, typically fall into two categories: over-collateralized and non-collateralized. The most notable example of the former is the Maker protocol, which allows users to mint the DAI stablecoin by locking external crypto collateral in smart contracts as collateralized debt positions. The CDPs must be over-collateralized, meaning the total assets locked in Maker must always exceed the aggregate value of DAI’s circulating supply. While this makes DAI relatively safe and reliable in terms of peg resilience, it also makes it capital-inefficient and difficult to scale as it can only grow with the demand for leverage.

There have been many attempts to create more scalable and capital-efficient stablecoins, but by far the most notable is Terraform Labs’ recently collapsed UST. Before it ultimately failed, UST was briefly the third-largest stablecoin on the market, with a capitalization of around $18.6 billion at its highs. As a non-collateralized or “algorithmic” stablecoin, UST maintained price stability through an arbitrage swapping process with Terra’s native governance token, LUNA. When UST traded below $1, arbitrageurs could burn it for $1 worth of LUNA to profit on the difference. Likewise, when it traded above $1, arbitrageurs could mint it using $1 worth of LUNA and then sell it on the open market for profit, increasing its supply and eventually bringing its price back to its desired peg.

Despite its temporary success, UST eventually imploded in a catastrophic $40 billion death spiral event that brought Terra’s entire ecosystem down with it. Due to being entirely dependent on internally-generated LUNA collateral, the system proved gravely vulnerable to the risk of a bank run. Eventually, it ended up in the same graveyard as all previously tried-and-failed algorithmic stablecoin experiments.

However, between over-collateralized stablecoins like DAI and non-collateralized or fully algorithmic stablecoins like UST, there seems to be a sweet spot that leverages the strengths of both systems while minimizing their faults. Crypto Briefing connected with Frax Finance founder Sam Kazemian to learn more about the protocol, and he said that this is precisely the space FRAX has been occupying for the last 16 months since it launched in December 2020. “I think we have the best of both worlds and that a lot of people are realizing that,” he explained. “I also think that FRAX is a really big innovation; we seem to have developed a more capital efficient but just as safe stablecoin as Maker. So far, we’re the only ones left standing alongside them.”

Frax Finance Explained

Frax Finance is a permissionless, open-source, and entirely on-chain stablecoin protocol that provides and autonomously manages a highly scalable decentralized stablecoin called FRAX. The name FRAX is an abbreviation of “fractional-algorithmic,” which describes the mechanism the protocol leverages to maintain its peg to the U.S. dollar.

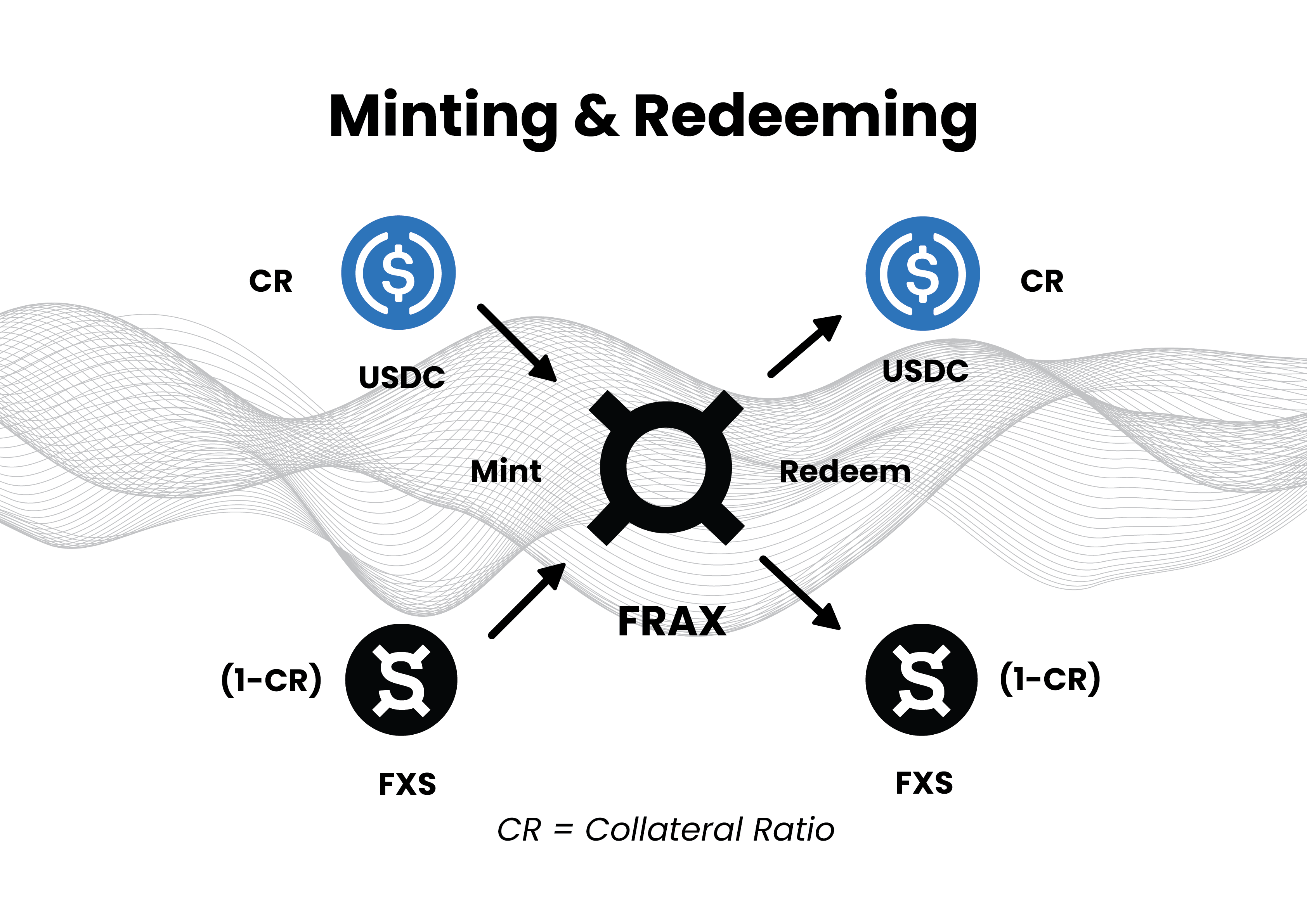

Fractional-algorithmic means that a fraction of the stablecoin is backed by external collateral—primarily USDC—and part is algorithmically backed with the protocol’s native governance token FXS, which accrues fees, seigniorage revenue, and profits from the protocol’s open market operations. The protocol decides the precise ratio between the external and internal backing using a PID controller, which adjusts the collateral ratio based on demand for the FRAX stablecoin and external market conditions. While that may sound complicated, the logic behind the mechanism is really quite simple.

Using the PID Controller, the protocol autonomously adjusts the external to internal collateral ratio necessary to mint or redeem FRAX based on direct information from the market. During sustained periods of FRAX expansion, the protocol lowers the collateral ratio so that less external collateral and more FXS are needed to mint or redeem the stablecoin. The reasoning is that during expansionary periods, the market effectively signals trust in the internal collateral backing FRAX, indicating to the protocol that it should lower the collateral ratio to accommodate this belief and better facilitate growth.

More specifically, the protocol lowers the collateral ratio so that less USDC and more FXS back FRAX every time its price exceeds the targeted peg of $1. Conversely, when FRAX falls below $1, the protocol raises the collateral ratio to increase market confidence in FRAX by increasing its backing from an external or “more sound” source. To keep things transparent, the collateral ratio is always explicitly shown on Frax Finance’s front page. For instance, at press time, the collateral ratio is 89.50%, meaning that minting 100 FRAX requires depositing 89.5 USDC and burning $10.50 worth of FXS.

To paint a clearer picture, a collateral ratio of 0% would mean that the market completely trusts the internal FXS backing and has no desire to redeem FRAX for anything else. A 100% ratio would mean that the market has no faith in the internal collateral and prefers that FRAX be fully backed by sounder or more trusted collateral like USDC.

The ability to dynamically adjust the collateral ratio based on real-time market conditions gives Frax a significant advantage in scalability and capital efficiency over a protocol like Maker, which has a fixed collateralization ratio of 150% for volatile assets like Ethereum. Expanding more on this unique feature of FRAX, Kazemian brought up an interesting point about what is meant by “capital efficiency”:

“Usually, it means […] minting or acquiring the stablecoin is easier. There are more ways for it to come into existence than just overcollateralized loans. One of the main and only ways to mint DAI, other than depositing USDC, is to put a lot more Ethereum to mint it. With Frax, you can send a dollar worth of Ethereum into its protocol-controlled liquidity pool and get a dollar’s worth of FRAX.”

“In Maker,” Kazemian highlighted, “DAI is debt of the users—not the protocol.” In contrast, in a fractional reserve system like Frax, FRAX is debt of the protocol because it’s the protocol that has to honor redemptions by making sure it always has enough collateral. “In the over-collateralized model, the only way to create stablecoins is by users taking out loans or going into debt—versus the fractional model where the protocol can just print money like the Fed,” he explained.

The other essential element of Frax’s capital efficiency advantage, according to Kazemian, is that the protocol is much more profitable precisely because it can print money. Expanding on this point, he said:

“Frax has an annual revenue of about $150 million even with a $2.6 billion supply, while Maker has a significantly greater supply but has an annual revenue of about $80 million. Obviously, FRAX is riskier than DAI—that’s one of the main drawbacks when you print money. In Fed’s case, there’s inflation, whereas in our case, there’s the risk of breaking the peg, but it’s also more profitable.”

Speaking of risks to peg stability, one of the main ways stablecoin protocols generally ensure the robustness of their peg is by securing deep liquidity for their stablecoin on various decentralized exchanges across DeFi. Understanding this very early on, Frax installed several different mechanisms to help it source and secure liquidity across decentralized exchanges as efficiently as possible.

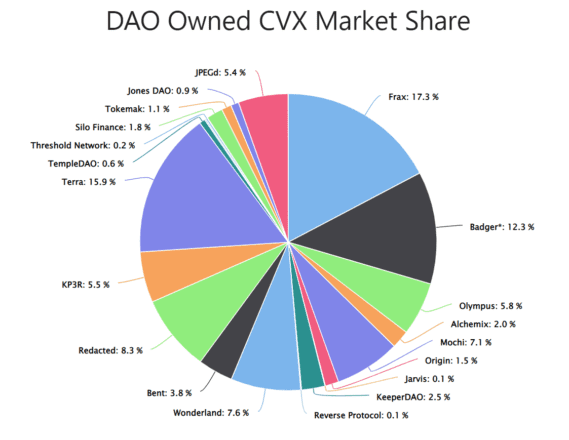

For instance, Frax is the biggest holder of Convex’s CVX governance token, holding approximately 16.7% of the token’s supply at press time. This gives it substantial governance power over Convex, which in turn is a proxy for controlling CRV rewards on the largest decentralized exchange for stablecoins, Curve. This allows Frax to inexpensively incentivize liquidity provisioning for the FRAX3CRV liquidity pool, which holds approximately $1.46 billion in liquidity, allowing highly efficient trading between FRAX and DAI, USDC, and USDT.

Through partnering with OlympusDAO, Frax has also acquired and controls a portion of its liquidity, meaning it doesn’t have to pay out high incentives secured through dilution of its own governance token to rent liquidity from third-party mercenary liquidity providers. On top of that, through its so-called Liquidity AMO, Frax can put idle collateral to work by providing liquidity on Uniswap V3. It can also autonomously enter any position on Uniswap and mint FRAX against it, simultaneously securing deep liquidity and generating profits from trading fees.

Algorithmic Market Operations

In early Q4 2021, Frax expanded on the idea of becoming a decentralized central bank by launching Algorithmic Market Operations controllers. These “AMOs” represent smart contracts that algorithmically execute different open market operations to generate revenue and ensure the protocol is more secure and robust by putting its collateral to work.

Since Frax controls a significant amount of external collateral from FRAX minting, the AMOs generate substantial profit for the protocol, which eventually accrues to the FXS holders through buybacks and token burns. Each AMO, which Frax describes as a “central bank money lego,” has four properties:

- Decollateralize: actions that lower the collateral ratio

- Market Operations: actions that run in equilibrium and don’t change the collateral ratio

- Recollateralize: actions that increase the collateral ratio

- FXS1559: formalized accounting of the balance sheet of the AMO that defines exactly how much FXS can be bought and burned with profits above the targeted collateral ratio.

So far, Frax has deployed four AMOs: Investor, Curve, Lending, and Liquidity.

To generate yield, the Investor AMO deploys the protocol’s collateral to battle-tested yield aggregator protocols and money markets like Yearn, Aave, Compound, and OlympusDAO. This AMO never allocates funds to strategies or vaults that have waiting periods for withdrawals, so that it can pull the collateral at any time to honor FRAX redemptions.

The Curve AMO deploys idle USDC and newly minted FRAX into the FRAX3CRV pool on the Curve exchange. Besides earning revenues from trading, admin fees, and CRV incentives (which Frax can control through its substantial Convex holdings), this AMO also helps the protocol deepen FRAX liquidity to fortify its peg.

The Lending AMO mints FRAX directly into pools on money markets like Compound and CREAM, allowing users to acquire it through over-collateralized borrowing instead of the standard minting mechanism. Besides earning revenues through the interest payments on the loans, this AMO makes FRAX more accessible to users, who can now mint it by posting collateral as they would when minting DAI on Maker.

Finally, the Liquidity AMO puts FRAX and part of the protocol’s collateral to work by providing liquidity against other stablecoins on Uniswap V3 to earn revenue from trading fees and further deepen FRAX’s liquidity. This AMO can enter any position on the exchange and mint FRAX against it, meaning the protocol can expand its supply in a very capital efficient manner. This gives users the ability to acquire FRAX on Uniswap in exchange for Ethereum, wBTC, or other stablecoins.

Final Thoughts

While the Terra blow-up may have given all algorithmic, including fractional-algorithmic stablecoins a bad name, it’s worth noting that—despite sharing certain similarities—not all stablecoins are created equal. With this in mind, it’s worth noting that since launching over 16 months ago, FRAX’s price has remained reliably stable, with no severe deviations beyond 1% of its targeted peg. This indicates that its unique collateralization mechanism appears to be robust enough to withstand significant systemic shocks like the Terra collapse.

With that said, Frax is certainly not without its faults. Its overreliance on USDC is one: relying too much on a centralized stablecoin to mint and back a “decentralized” one is not the most desirable model for any protocol that strives to be truly decentralized and censorship-resistant.

“Frax does suffer from [overreliance on USDC,] transparently,” Kazemian admits, underscoring that no one in crypto has found a “holy grail decentralized solution with no connection to fiat coins.” Currently, Frax has about 40% exposure to USDC, while Maker has about 60%, which Kazemian admits is a lot for both. However, it’s also necessary—at least for now—to ensure sufficient stability for both stablecoins. “We’ll only diversify out of fiat coins if there’s a clear regulatory reason to do that—we won’t do it for fun and depeg like Terra,” he stressed.

All things considered, Frax employs a simple and elegant solution that seems to strike the perfect balance in stablecoin design: a protocol that’s decentralized and scalable while also being sufficiently secure and reliable.

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies.

Earn with Nexo

Earn with Nexo