DeFi Project Spotlight: Raydium, Solana's Top Automated Market Maker

Raydium has quickly become one of Solana's DeFi blue chips by offering some of the most interesting mechanics in the space.

Key Takeaways

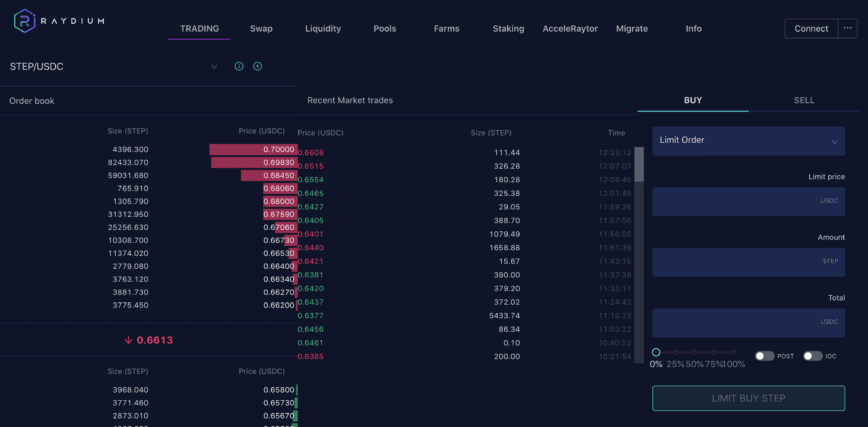

- Raydium is the biggest decentralized exchange on Solana. It aggregates liquidity from its own liquidity pools and Serum’s orderbook.

- Raydium is also the biggest market maker on Serum and one of few DeFi exchanges with a built-in limit orders option.

- In order to help grow the Solana ecosystem, Raydium built AcceleRaytor, a launchpad for new projects on Solana.

Share this article

Raydium is a decentralized exchange on Solana that functions unlike any other exchange. It uses liquidity pools but also acts as the biggest market maker on Solana’s order book-based exchange, Serum.

Raydium Explained

Raydium Protocol is Solana’s top automated market maker.

However, it works differently from other decentralized exchanges in that it acts as a market maker for Serum.

To understand why Raydium functions the way it does, it’s worth considering the project’s team. The group had worked together for several years before launching the decentralized exchange in early 2021. The team worked together in a quant trading algorithmic market-making firm on some of the top crypto exchanges.

Raydium’s story has parallels with the story of Sam Bankman-Fried, the billionaire founder of the FTX exchange and Alameda Research and a big supporter of the Solana ecosystem. Both Bankman-Fried and the Raydium team were traders, which shines through in the exchanges they build. Alpha Ray, the founder of Raydium, affirms that Bankman-Fried has been a big help to Raydium. They explain:

“Sam is a big investor in both Solana and Serum, and to make these work he needs a thriving ecosystem on Solana so he’s very helpful. He devotes a lot of his time, and FTX’s resources to help the ecosystem.”

One of the main advantages to centralized exchanges compared to their decentralized counterparts is the ability to create limit orders (although limit orders have been made possible on Uniswap V3 by following a certain technique). Orders need an order book rather than a liquidity pool. Traders prefer to specify the price at which they’d like to trade their assets, which isn’t possible with liquidity pools.

Raydium’s exchange was built on the philosophy of allowing the best of both worlds. When a user enters a trade, it will either be made using Raydium’s own liquidity pools or routed to the decentralized order book Serum depending on where the best price can be found. Alpha Ray explains:

“Serum has an order book system, and Raydium has its own liquidity pools. When users make transactions on our platform, the protocol aggregates liquidity from these two sources, a bit like 1inch on Ethereum.”

Raydium is the biggest market maker on Serum, routing trades from their own users 24/7, making them one of the only DeFi exchanges to have a built-in option for limit orders. The team also has a close relationship with Serum, which means it can quickly troubleshoot any issues that arise.

Another Raydium team member going by the name Gamma Ray says that Raydium and Serum share their liquidity, which makes the Solana ecosystem more efficient. They explain:

“In DeFi, liquidity is often sioled between different platforms like Sushiswap and Uniswap, which is pretty inefficient. Raydium and Serum seek to share their liquidity with the entire ecosystem. It’s about growing the overall pie for the Solana ecosystem.”

Building on Solana

Solana-based projects like Raydium take advantage of the low cost of using the network. The experience of trading on order books is very different from using liquidity pools. Traders will often enter a limit order, cancel it, modify a few parameters, and reenter. In a decentralized environment, all of these actions are interactions with the blockchain that command a fee.

Solana benefits from low fees—each transaction on Serum costs less than one cent. Similar transactions could set users back $50 a time on Ethereum mainnet. Serum is currently not available on Ethereum, but the emergence of Layer 2 solutions like Arbitrum and Optimism could change that.

Solana’s cheap fees were a key factor behind Raydium’s decision to build on the network. While many DeFi projects started flocking to Ethereum in the summer of 2020, the need for extremely low gas fees forced Raydium to look for alternatives. Solana’s technical prowess managed to convince the team. Speaking of the decision to build on Solana, Alpha Ray says:

“We needed a blockchain with high transaction throughput, high speed, and low fees. When we started building on Solana there wasn’t much there. We were scared that if Solana wasn’t able to build up, it wouldn’t matter how good our platform was. Now, we’re obviously very happy to have taken that risk.”

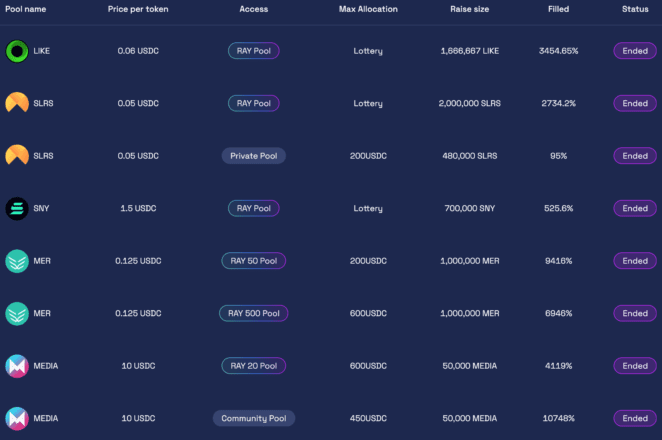

Now, one of Raydium’s key goals is to grow the Solana ecosystem by attracting more projects, talent, and users. For that, the team created AcceleRaytor, a launchpad for new projects that facilitates community investment into new Solana projects.

Many projects on AcceleRaytor are very popular. Most of them had oversubscribed launches, which resulted in random draws between all interested investors to decide who would receive a token allocation. Alpha Ray notes that Raydium identified the need to attract top-quality projects early on. He says:

“For Raydium to be big, we need a lot of tokens to exchange. We need active trading on many solid projects and a thriving ecosystem so that people will move their DeFi business to Solana. We tried to identify what we needed when we launched and give that to these projects. A solid marketing push, sufficient funding, a liquid trading market, and finally a fusion pool that distributes rewards to early investors.”

Raydium meticulously studies any project that goes through AcceleRaytor to introduce strong projects to investors and build a solid relationship built on trust.

NFTs are another big area that Raydium is monitoring, although plans for an NFT marketplace are not a priority. Improving the current product offering is currently Raydium’s main goal. Alpha Ray explains:

“NFTs are huge right now, and they bring a lot of people to Solana as well. This forces users to leave centralized exchanges, and at that point, they try Raydium. NFTs are key to bringing new users to DeFi, and Solana’s lower fees could bring even more people.”

The Risks for Raydium

While Raydium has a promising future, there are some potential risks. The team has identified three key areas that could negatively impact the project: security risks, competition, and dependency on Solana’s ecosystem growth.

In terms of security, the team admits that there’s a possibility that someone could exploit an unforeseen vulnerability in their smart contracts, which is why protocol security is a top priority. Alpha Ray explains:

“Hacks and smart contract exploits in DeFi are happening every day now. It’s just the nature of the industry—something we must come to terms with. When you’ve got open source code custodying millions, there’ll always be someone trying to break it. Every time there’s a novel smart contract exploit in DeFi, we’re going back and reviewing our code to check whether we’re vulnerable to the same attack vector.”

The team isn’t particularly worried about competition. They say it’s “part of the game,” and when you’re the top project in your niche, there’s always someone gunning to take your spot. There’s plenty of room to grow the pie for everyone on Solana, so that’s what the team is focused on. The team says its product line is similar to Sushi, but its approach to growth is closer to Uniswap. In other words, it’s hoping to onboard as many users to the Solana ecosystem as possible without worrying too much about competition.

The only remaining worry is whether Solana succeeds in growing into a thriving, self-sustaining ecosystem, similar to Ethereum today. Every project building on newer or “alternative” smart contract blockchains faces this dilemma, especially when the Layer 1 protocol isn’t compatible with the Ethereum Virtual Machine (Solana was not EVM-compatible when Raydium started building on it, though solutions are emerging). Alpha Ray reveals that the team spent a long time considering which Layer 1 protocol to build on. He says:

“Our biggest worry at the beginning was whether we made the right choice to build on Solana. It was undoubtedly the superior protocol from a technical perspective, but in terms of the ecosystem, there was nothing much on it besides Serum. It was a hard and risky decision to make, but we made it and it now looks like it ended up in our favor.”

The success of Layer 1 protocols is heavily dependent on both network and Lindy effects, meaning the bigger they grow and the longer they survive, the higher the chance that they’ll thrive. While Solana’s success is not guaranteed, the recent ecosystem growth bodes well for Raydium’s future.

The Future for Raydium

Forthcoming plans on Raydium’s roadmap include plans for stableswap pools, which should be out by the end of August. The pools are optimized for minimal slippage, high capital efficiency, and low fees on swaps between tokens with strong price correlations, including stablecoins like USDC-USDT or different synthetics representing the same underlying asset like renBTC-wBTC.

Given that Solana offers low transaction fees, Raydium’s stableswap pools will primarily benefit users in terms of reduced price slippage for large trades using stablecoins or synthetics. The goal is to make Raydium the exchange of choice for small and big traders alike.

After that, Raydium wants to launch its advanced order routing protocol and integrate Wormhole. The order routing protocol will allow users to seamlessly swap between all assets on Solana, regardless of the available pools. For example, if a user wants to trade USDT for FTT but can’t find a pair, Raydium will find the best route between different pools to facilitate the trade at the best price for the swap.

Wormhole, meanwhile, is a decentralized bridge allowing users to port their assets between Solana and Ethereum. For example, it will let users transfer Ethereum-native Uniswap tokens to Solana to benefit from the protocol’s low cost and superior performance. Wormhole will enhance Solana’s interoperability with other blockchains and thus boost the organic growth of its ecosystem.

Raydium also has plans for governance. The team promised to decentralize and roll out governance within six months, but that has proven to be a problem so far. Alpha Ray elaborates:

“Governance has been on our mind, and it’s very important to us, but the issue is Solana currently lacks the proper infrastructure. For example, there’s no gasless DAO voting tool like Snapshot, which is critical for governance. We want to help if anyone wants to build it, but if no one steps up, we’ll have to build it ourselves.”

Raydium is an ambitious project, central to the development of the Solana ecosystem. To date, Solana has few projects that could be classified as “blue chips” that have been central to the ecosystem’s growth. From a technical point of view, Raydium’s hybrid model of trading between order books and liquidity pools is already worthy of attention.

The real kicker lies in its AcceleRaytor feature and in the protocol’s holistic approach to helping projects grow on Solana. Raising money is rarely the biggest challenge for crypto projects—gathering early users is much harder. Raydium’s help in shining the spotlight on worthy projects is one of its most positive contributions to Solana’s DeFi space, and it could help it flourish over the coming years.

Share this article